Talking Points

- Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list: Price & Time

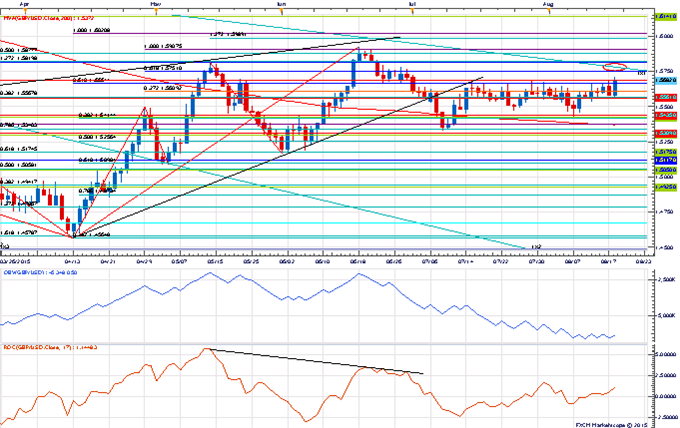

- GBP/USD nearing key Gann level

- USD/JPY consolidates below minor Fibonacci level

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

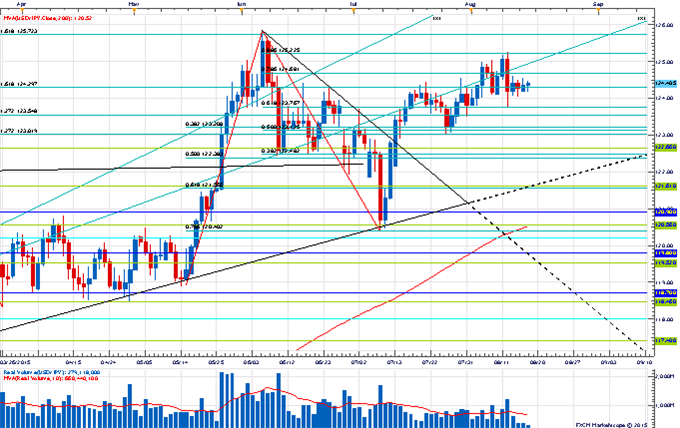

Price & Time Analysis: USD/JPY

ChartPrepared by Kristian Kerr

- USD/JPY continues to consolidate below the 88.6% retracement level of the June/July decline at 125.20

- Our near-term trend bias is higher in the exchange rate while above 124.00

- A move through 124.70 should re-instill some momentum to the rate, but traction over 125.20 is really needed to confirm the start of a more important upside push

- A very minor turn window is eyed today

- A daily close below 124.00 would turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while above 124.00 (closisng basis).

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 123.75 | *124.00 | 124.40 | 124.70 | *125.20 |

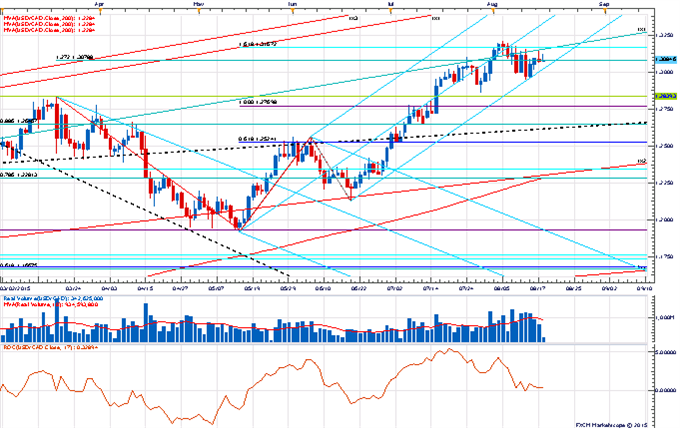

Price & Time Analysis: USD/CAD

ChartPrepared by Kristian Kerr

- USD/CAD remains in consolidation mode below Fibonacci and Gann resistance at 1.3170

- Our near-term trend bias is negative on funds while above 1.3015

- A move through 1.3170 is needed to set off the next leg higher in the rate

- A very minor turn window is eyed tomorrow

- A daily close below 1.3015 would turn us negative on the rate

USD/CAD Strategy: Square.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/CAD | *1.3015 | 1.3055 | 1.3080 | 1.3125 | *1.3170 |

Focus Chart of the Day: GBP/USD

A stronger than expected UK core CPI print has seen Cable trade above the top end of the month-long range at 1.5700. A daily close above 1.5700 would seemingly be very bullish for the exchange rate – especially given the recent contraction in volatility. However, the key level for us looks to be a little bit higher at 1.5780 as this marks the 1x1 Gann angle line of the 2014 high. The 1x1 or 45 degree line was considered the most important angle drawn by Gann on his charts as generally speaking he believed a market was in a downtrend when below it. He also believed that a 1x1 line drawn from an important high should provide major resistance for a market and when broken signals an important reversal. As such, 1.5780 should prove pivotal over coming sessions as a failure near there would confirm that the broader downtrend remains firmly intact. A daily/weekly close above the line, on the other hand, would make us seriously question the resolve of the primary downtrend and open the way for a more important advance north of 1.5900.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX