Talking Points

- EUR/USD nearing key median line

- Crude fails at important resistance zone

- NZD/USD testing important retracement

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD has come under modest pressure after failing near 1.1400 during the turn window last week

- Our near-term trend bias will turn lower on a close below 1.1175

- Last week’s closing high arund 1.1340 needs to be overcome to re-instill upside momentum into the rate

- A minor cycle turn window is seen mid-week

- A close below 1.1175 would turn us negative on the euro

EUR/USD Strategy: Like the long side while above 1.1175 (closing basis).

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | *1.0960 | 1.1075 | 1.1155 | 1.1270 | *1.1340 |

Price & Time Analysis: NZD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

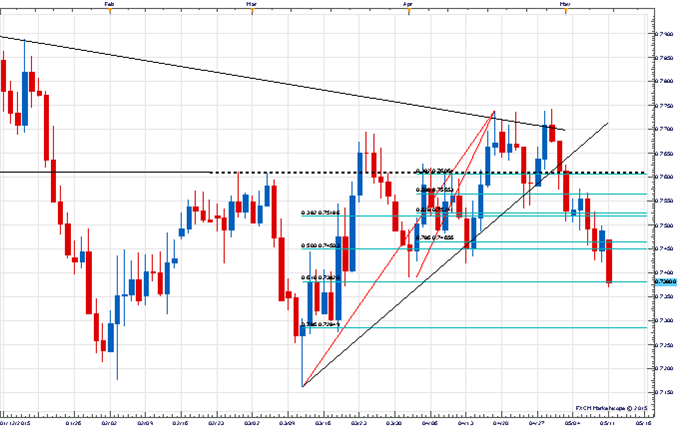

- NZD/USD has come under further pressure this morning to deal at its lowest level in almost two months

- Our near-term trend bias is lower in the Bird while below .7525

- The 61.8% retracement of the March-April range at .7380 is now an important near-term pivot

- A minor turn window is eyed here

- A daily close back over .7525 would turn us positive on the Kiwi

NZD/USD Strategy: Like the short side while below .7525

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| NZD/USD | .7285 | *.7380 | .7385 | .7465 | *.7525 |

Focus Chart of the Day: CRUDE

Crude rallied nearly 50% from the cyclical turn window we highlighted in March (Read HERE) to the high recorded last week. Our analysis of the cycles suggests the commodity reached a point last week where the broader downtrend could try to re-assert itself. The clear failure on Wednesday at median line channel resistance in the 62.00 area (drawn from the 2013 high) followed by a break and weekly close below the upward sloping trendline of the March and mid-April lows is further evidence that a turn lower of some significance is trying to unfold. Last week’s low around 58.00 is now a key pivot with traction below needed to trigger a new round of weakness. A move through 62.55 would invalidate the negative potential cyclicality here and re-focus attention higher.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX