Talking Points

Get real time FXCM volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

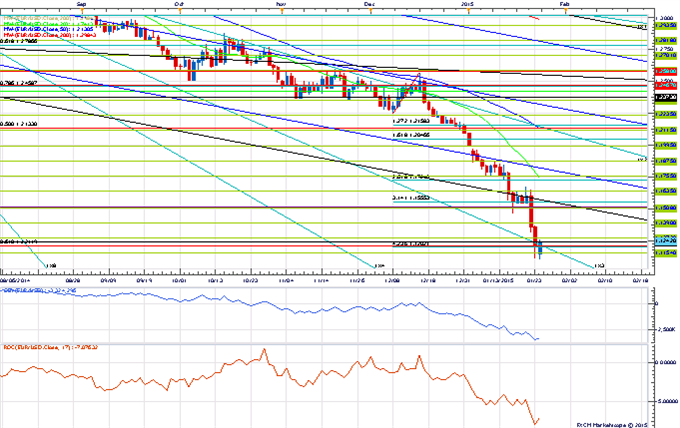

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- EUR/USD broke below the 61.8% retracement of the all-time low and all-time high at 1.1215 last week

- Our near-term trend bias is negative while below 1.1270

- A close under 1.1100 is now needed to signal that a new leg lower is unfolding

- A major cyclical turn window in the euro is seen here

- A close over 1.1270 would turn us positive on the euro

EUR/USD Strategy: Like the short side while below 1.1270

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | *1.1100 | 1.1155 | 1.1235 | 1.1240 | *1.1270 |

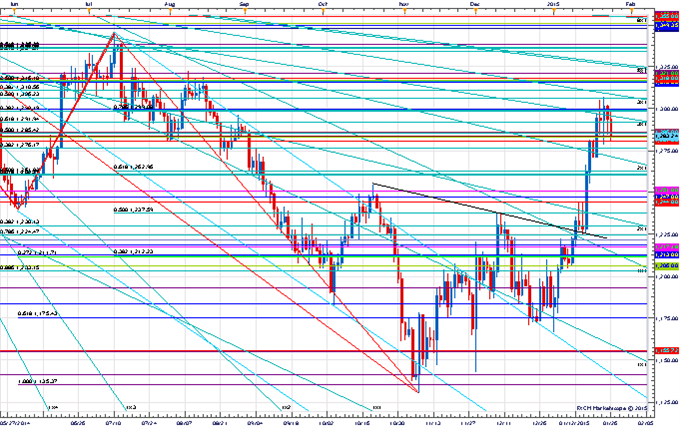

Price & Time Analysis: GOLD

Charts Created using Marketscope – Prepared by Kristian Kerr

- GOLD traded at its highest level since mid-August last week before encountering resistance near the 78.6% retracement of the July-November decline in the 1300 area

- Our near-term trend bias is positive in the metal while above 1270

- A move through 1270 is needed to confirm a resumption of the uptrend

- A minor turn window is seen over the next couple of days

- A close under 1270 would turn us negative on the metal

GOLD Strategy: Like the long side while over 1270.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| GOLD | 1263 | *1270 | 1282 | *1300 | 1318 |

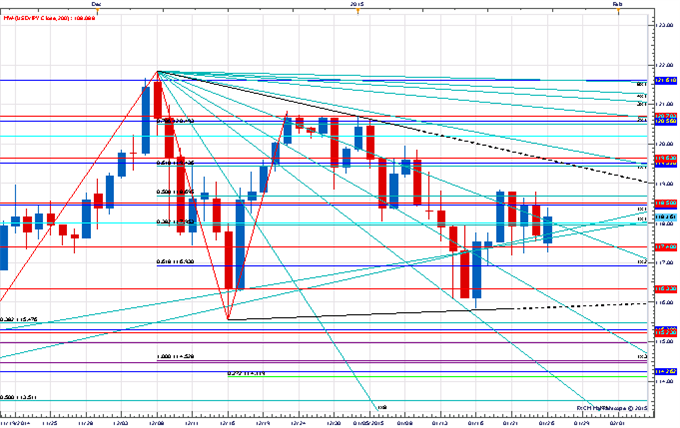

Focus Chart of the Day: USD/JPY

The next few trading days should prove key for USD/JPY. Since the reversal in the exchange rate during the key cyclical period before Christmas (Read HERE) we have been open to the idea of a “surprise” move to the downside. Initially USD/JPY complied falling to a low of 115.84 on January 16th. However, since then weakness in the pair has been rather limited. Upside attempts have been limited as well leading to a pretty clear narrowing range/triangle consolidation on the daily chart. The general rule of thumb is that consolidations that follow such strong trends usually lead to a move back into the direction of the trend. The other rule of thumb is that breakouts from such patterns tend to occur after the 5th leg of the consolidation. One could make the case that the 5th leg of the current consolidation in USD/JPY ended on Friday which brings us back to why we think the next few trading days will prove important. If a bullish break is going to occur then this is probably the time that it should materialize. Over 118.85 would be initial evidence that such a move is unfolding, but over 119.65/75 is really required to “trigger” the pattern. Failure to gain much traction over 119.75 this week would suggest that our original view is still correct and that USD/JPY is at risk of rolling over as some of the strongest directional moves often come from failed pattern breaks. Under 116.35-115.85 would turn this concern into reality.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX