GBP Analysis and Talking Points

- GBP/USD| Upside to be Capped at 1.3000 in Short Term

- EUR/GBP | Downside Momentum Stalling as RSI Confirms Bullish Divergence

See the DailyFX FX forecast to learn what will drive the currency throughout the quarter.

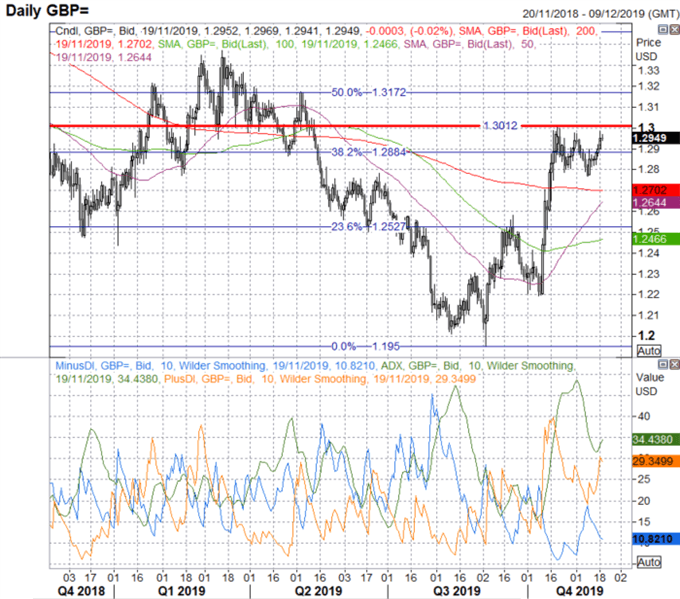

GBP/USD | Upside to be Capped at 1.3000 in Short Term

Price action in the Pound remains predominantly driven by politics. Today’s session is likely to focus on the TV debate between Boris Johnson and Jeremy Corbyn at 2000GMT with a poll to be released from 2100GMT. As it stands, overnight ATM option is pricing in an implied move of 46pips (+/-) for GBP/USD. Momentum indicators continue to tilt towards upside in the pair, however, while the trend intensity has increased, the bullish bias signalled by momentum indicators has eased slightly as GBP/USD stalls at the 1.3000 handle. Of note, over 3bln worth of vanilla options are expiring this week at 1.3000, consequently, upside may be somewhat limited to the 1.3000 handle. Alongside this, we continue to expect GBP/USD to remain rangebound in the run up to the election.

GBP/USD PRICE CHART: Daily Time Frame (Nov 2018 –Nov 2019)

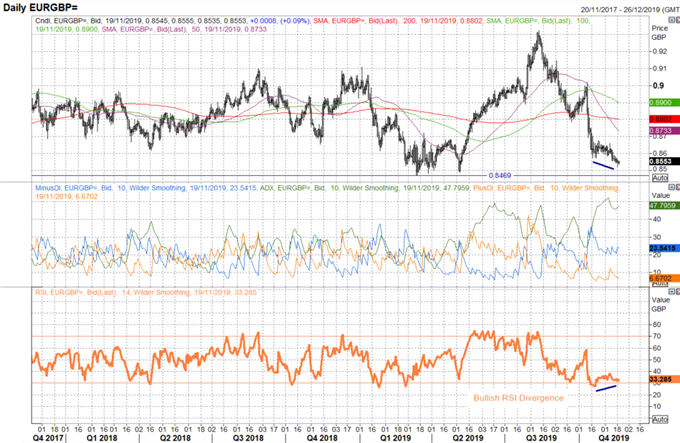

EUR/GBP | Downside Momentum Stalling as RSI Confirms Bullish Divergence

EUR/GBP has continued to head lower, reaching its lowest level since May. However, while momentum indicators remain bearish, this has eased slightly, which in turn has seen the cross begin to bottom out. Alongside this, the RSI is signalling a bullish divergence and thus raises the risk of a potential uptick in the cross. That said, Euro notable buying remains elusive, given that the Eurozone economy remains weak, as such, market participants will be looking towards the preliminary PMI figures on Friday in order to gauge whether the slowdown is starting to show signs of petering out.

EUR/GBP Price Chart: Daily-Time Frame (Nov 2017 –Nov 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX