CAD Analysis and Talking Points

- USD/CAD | Pair Tests Key Supports, Risks of Further Downside

- EUR/CAD | All Eyes on ECB as Cross Extends Losses

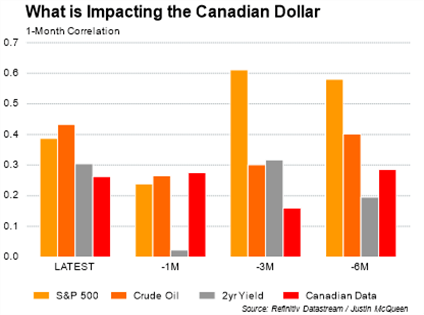

Crude Oil Dictating CAD Price Action

- US President Trump fires Iran Hawk John Bolton

- API Crude Stockpiles shows 7.2mln barrel drawdown

- DoE expect to show stockpiles declined 2.686mln barrels (released 1530BST)

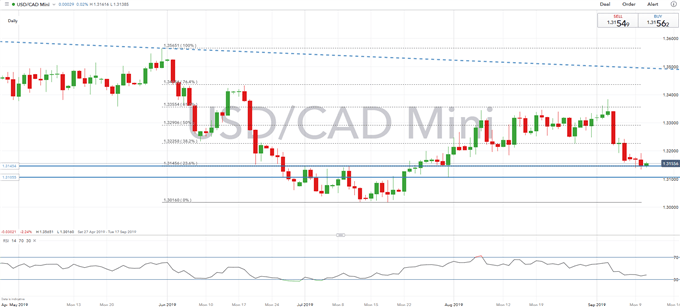

USD/CAD | Pair Tests Key Supports, Risks of Further Downside

Following yesterday’s rejection of the 1.32 handle, USD/CAD has continued to trade on the defensive with the pair testing key support at 1.3145 (represents the 23.6% Fibonacci retracement), which has held firm thus far. As short-term momentum and trend signals (using DMIs) continue to tilt to the downside, risks are for the pair to head lower in which a closing break below 1.3145 opens to door for a move towards the July 31st low situated at 1.3105.

USD/CAD Price Chart: Daily Time Frame (Apr 2019 – Sep 2019)

EUR/CAD | All Eyes on ECB as Cross Extends Losses

As highlighted in last week’s CAD technical report, the outlook remains bearish for the cross given the monetary policy divergence between the BoC and ECB. That said, EUR/CAD has extended its losses having dipped below 1.45, which in turn raises the possibility for a move towards 1.4460. However, as will be the case for many EUR-pairs, positions are likely to remain light throughout today’s session ahead of the ECB meeting. All eyes on the ECB rate decision, in which a dovish surprise could see the cross breach 1.44, although, given market expectations of a sizeable stimulus package, the bar has been set high, raising concerns of possible disappointment.

EUR/CAD Price Chart: Weekly Time Frame (Nov 2014 – Sep 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX