CAD Analysis and Talking Points

- USDCAD | Eyes on Trendline Resistance for Further Gains

- CADJPY | 200DMA Caps, Near-Term Direction Lacking

See the DailyFX FX forecast to learn what will drive the currency throughout the quarter.

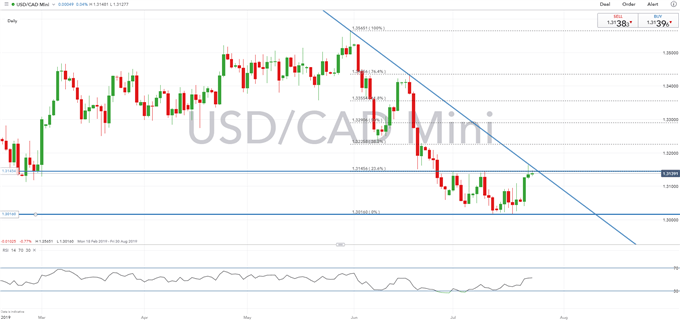

USDCAD | Eyes on Trendline Resistance for Further Gains

Since the backend of last week, the Canadian Dollar has continued to reverse its gains with USDCAD testing the top of its recent range at 1.3145-1.3150. At the same time, the daily DMIs have also flipped to a bullish bias, which in turn raises the risk of an extended reversal in USDCAD. However, for a move towards 1.32, a breach of the descending trendline from the June high would be needed, which would also raise scope for a test of 1.3225 (38.2% Fib level).

USDCAD PRICE CHART: Daily Time Frame (Feb 2019 – Jul 2019)

CADJPY | 200DMA Caps, Near-Term Direction Lacking

Having failed to break above the 200DMA, the bullish momentum in the cross has eased somewhat. Trend signals have also pulled back, suggesting a lack of near-term direction. Topside resistance is situated at 82.41 (100DMA), while on the downside, support resides at 81.85-82.00.

CADJPY PRICE CHART: Daily Time Frame (Sep 2018 – Jul 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX