CAD Analysis and Talking Points

- USDCAD | Upside Limited, Support Situated at Psychological 1.30 Level

- CADJPY | Consolidation Continues Awaiting Catalyst to Spark Breakout

See the DailyFX FX forecast to learn what will drive the currency throughout the quarter.

USDCAD | Upside Limited, Outlook Remains Bearish

Having hit fresh 2019 lows at 1.3014, the bearish momentum has eased somewhat with the USD index recouping its recent losses. However, the bounce back is likely to be shallow with resistance at 1.3090-1.3100 potentially curbing further upside. Alongside this, other levels that could prove to be hurdle for the pair is the 200WMA (1.3115), while offers are also likely to come in from 1.3145-1.3150. Longer term studies as evidenced by the weekly DMI, continues to hold a bearish bias, thus the outlook remains tilted to the downside, which in turn raises the scope for a break of the 1.3000 handle to test the 100DMA (1.2988). On the option front, USDCAD O/n ATM vols are at 7.85 = 43pip breakeven (cover CPI release).

USDCAD PRICE CHART: Daily Time Frame (Jan 2019 – Jul 2019)

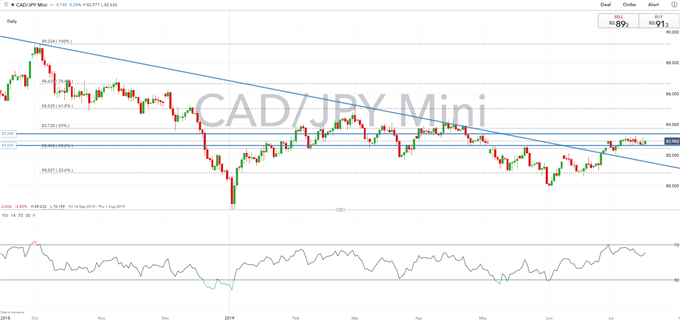

CADJPY | Consolidation Continues Awaiting Catalyst to Spark Breakout

The cross has continued to consolidate over the past week, awaiting a potential breakout. The CAD remains firmer against the JPY with the daily DMI showing a bullish bias. As such, eyes are for a test of the 200DMA at 83.25, in which a close above raises the upside risk of a test of the 50% Fib (83.72). On the downside, support is situated from 82.45-50.

CADJPY PRICE CHART: Daily Time Frame (Sep 2018 – Jul 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX