Talking Points:

- EUR/USD Traders Look to FOMC for Direction

- Short Term Technical Resistance Found Near 1.1221

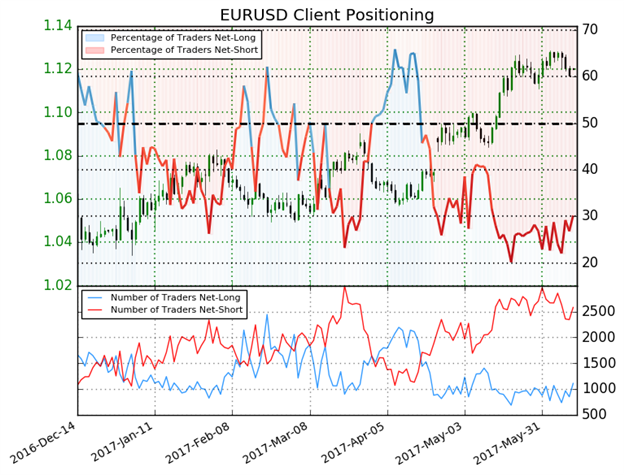

- IG Client Sentiment is Neutral at -2.40; 71% Net-Short

The EUR/USD is trading slightly higher for Monday, as traders look ahead to a loaded economic calendar for the week. First, EUR/USD traders will be looking forward to the release of German Zew Survey figures on Tuesday. Expectations are set for this event at 21.8. This will be followed by Wednesday’s FOMC rate decision. Expectations are looking for a potential increase in rates to 1.25%. Traders should note that both of these events have the ability to increase market volatility, and potentially influence the direction of currency pairs such as the EUR/USD.

Technically, the EUR/USD continues to trade off of its standing 2017 high found at 1.1285. At present, the pair may be seen graphically challenging its 10 day EMA (exponential moving average) at 1.1221. This line is currently acting as a value of short term resistance, and if the EUR/USD is set to trend higher traders should look for a price close above this value. In the event of a bearish reversal, traders should look for a turn in the market near present levels. This opens the EUR/USD to retest the previous May swing low, which is found at 1.1109.

New to the Forex market? Read our beginner trading guides here

EUR/USD Daily Chart & Averages

Why and how do we use IG Client Sentiment in trading? See our guide.

Traders should finally note that sentiment totals for the EUR/USD remain at extremes. For Monday, IG Client Sentiment reads at -2.40, with 71% of traders remaining short the currency pair. Despite this value being unchanged from last week, this sentiment reading suggests that the EUR/USD may continue to trade higher. In the event of a breakout to new highs, traders should look for IG Client Sentiment to remain net-short. However, in the event of a price reversal, traders should also look for sentiment figures to reverse back towards more neutral readings.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.