Talking Points:

- EUR/USD Trades to New Highs as NFP Misses Expectations

- Price Remains Supported Above the 10 Day EMA at 1.1197

- IG Client Sentiment Remains Extreme at -2.58; 72% Net-Long

The EUR/USD has reached new yearly highs this morning, after the release of U.S. Non-Farm Payrolls (May) missed expectations. Expectations for today’s NFP event were set initially at 180k, but were reported at an actual 138k. While today’s NFP headline number garners the most attention, traders should also note that U.S. Unemployment Rate (May) figures were released at 4.3%, which was better than the expected 4.4%.

What’s next for the Euro and US Dollar? Read our price forecast here.

EUR/USD Daily Chart & Averages

Technically this morning’s rally can be seen as a continuation of an ongoing EUR/USD uptrend. As seen in the daily chart below, the pair remains above both its 10 day EMA (exponential moving average) and 200 day MVA (simple moving average). For Friday’s trading, the 10 day EMA is currently located at 1.1197. If the EUR/USD continues to rise, traders may reference this point as a value of support in an ongoing uptrend.

In the event of a bearish reversal, traders may begin looking for prices to turn lower under today’s current high at 1.1282. Going into this week's close, traders should also continue to monitor the EUR/USD’s previous swing high at 1.1268. This value was considered a previous value of resistance for the pair. With today’s breakout however, 1.1282 may now be seen as a value of daily support.

Why and how do we use IG Client Sentiment in trading? See our guide.

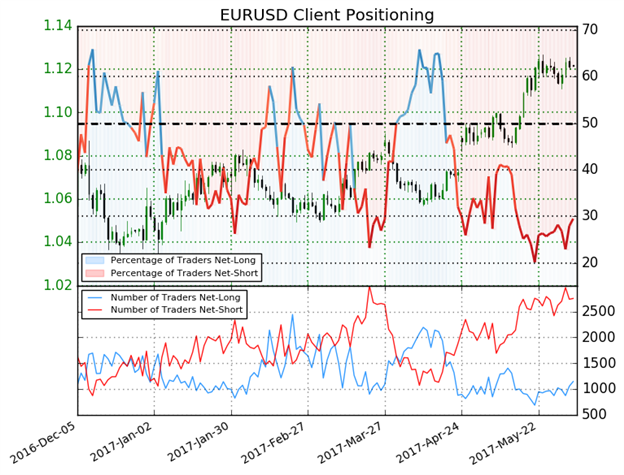

Sentiment figures for the EUR/USD are little changed for today’s session despite the pair's advance in price. IG Client Sentiment remains at negative extremes, reading at -2.58. This value indicates that 72% of traders are currently net-short the EUR/USD. When interpreted as a contrarian indicator, this negative extreme suggests that the EUR/USD may continue to trend higher. In the event that the EUR/USD closes the week off its highs, it would be expected to see these sentiment totals remain near their current values. Alternatively, if the EUR/USD begins to reverse lower, traders may look for sentiment totals to neutralize and back away from their present extremes.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.