Talking Points:

- USD/JPY Little Changed to Close Week

- Traders Look to Next Week’s News for Direction

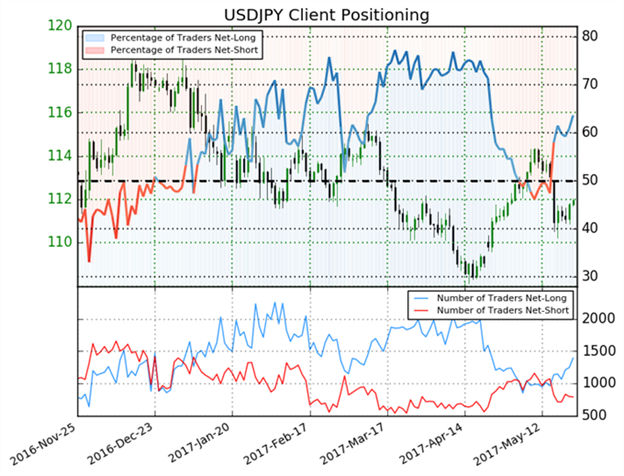

- IG Client Sentiment Reads +1.64; 62% Net-Long

The USD/JPY is set to close the week little changed, with the pair currently trading less than 15 pips away from Monday’s open price of 111.26. This pause in price action has been a stark change from the drastic decline the USD/JPY experienced earlier in the month. Traders should note that the pair has fallen as much as 414 pips from the standing May high at 114.37 to the low at 110.23.

Going into next week, traders will be looking forward to a variety of U.S. data to help provide further direction for the USD/JPY. Key high importance events for next week include U.S. ISM Manufacturing (May) and the U.S. Change in Non-farm Payrolls (May). Expectations for Thursday’s U.S. ISM Manufacturing (May) release are set at 55.2, and expectations for Friday’s Change in Non-farm Payrolls (May) are set at +178k.

USD/JPY Daily Chart & Averages

Technically the USD/JPY is consolidating in a developing ascending price channel. This cannel as depicted above, has been created by connecting a series of swing highs and lows beginning with last Thursday’s price action. In the event that the USD/JPY breaks lower, traders should first watch for the pair to breakout beneath today’s low of 110.87. Alternatively if prices reverse higher, the USD/JPY must first break above Wednesday’s high of 112.13, then test the ascending channel line near 112.25.

Why and how do we use IG Client Sentiment in trading? See our guide.

Sentiment totals for the USD/JPY are currently positive, with IG Client Sentiment reading at +1.64. This reading suggests that 62% of traders are currently net-long the pair. When sentiment is read as a contrarian indicator, this positive value suggests a bearish bias for the USD/JPY. If prices breakout lower on next week’s news, traders should watch for sentiment figures to remain negative and shift to extremes of +2.0 or greater. Alternatively if the USD/JPY rebounds higher, traders should look for sentiment figures to move back from present values towards more neutral readings.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.