Talking Points:

- GBP/USD trading above 1.32 after seeing a corrective move lower yesterday

- A break above the 1.3250 area could prove explosive on extremely short positioned market

- Yellen is in focus looking ahead, as December rate hike probability rises

The GBP/USD is trading above 1.32 at the time of writing, as the pair continues to appear supported heading into the major event risk ahead.

The Janet Yellen speech at Jackson Hole is the main event risk on the docket, with the market craving clarity on the Fed’s rate path going forward.

Against this backdrop we will form our outlook and look to find short term trading opportunities using different tools such as the Grid Sight Index (GSI) indicator.

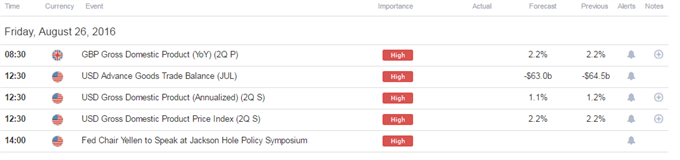

Click Here for the DailyFX Calendar

Revisions to US and UK 2Q GDP are set to hit the wires looking ahead.

The market might discard the UK figures as they represent the pre-Brexit environment.

US Dollar traders might be unlikely to commit directionally on the US GDP figures before Yellen, so unless a significant revision hits the wires, the US Dollar might show a limited response.

This puts the focus on the Janet Yellen speech in Jackson Hole, with the market likely to scrutinize the speech for hints on a potential Fed hike in September.

The probability of a rate hike before year-end implied in Fed Funds futures has increased in the last week.

If Yellen mirrors previous commentary by Dudley and Williams, the US Dollar may trade higher.

However, if Yellen disappoints, a break above the 1.3250 area could prove explosive on an extremely short positioned market.

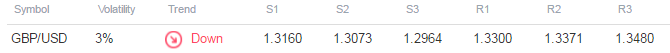

GBP/USD Technical Levels:

Click here for the DailyFX Support & Resistance tool

We use volatility measures as a way to better fit our strategy to market conditions. The GBP/USD has seeing volatility calm lately based on 20-day ATR readings, while implied volatility measures are suggesting a slight pick up down the line.

Taken together this might suggest that the pair’s volatility could remain lower in the short term, with the Yellen speech a potential game changer for this dynamic.

In turn, this may suggest that break out type trades might be appropriate ahead.

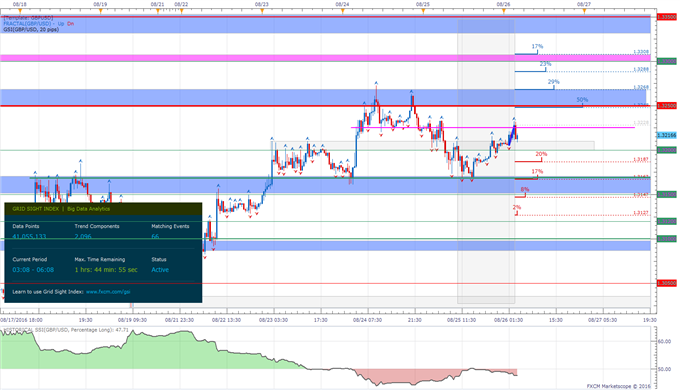

GBP/USD 30-Min Chart (With the GSI Indicator): August 26, 2016

(Click to Enlarge)

The GBP/USD is trading beneath a potential resistance level at 1.3225 at the time of writing, with GSI calculating higher percentage of past movement to the upside in the short term.

The GSI indicator above calculates the distribution of past event outcomes given certain momentum patterns. By matching events in the past, GSI describes how often the price moved in a certain direction.

You can learn more about the GSI here.

Further levels of resistance might be the area above 1.3250, 1.33, a zone below 1.3350 and 1.34.

Levels of support might be 1.32, 1.3168, 1.3120 and 1.30.

We generally want to see GSI with the historical patterns significantly shifted in one direction, which alongside a pre-determined bias and other technical tools could provide a solid trading idea that offer a proper way to define risk.

We studied over 43 million real trades and found that traders who successfully define risk were three times more likely to turn a profit.

Read more on the “Traits of Successful Traders” research.

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing that about 47.7% of traders are long the GBP/USD at the time of writing.

You can find more info about the DailyFX SSI indicator here

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com

Follow him on Twitter at @OdedShimoni