What's inside:

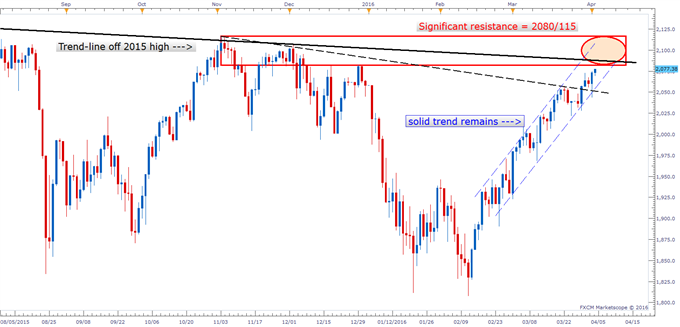

- Friday's 'gap-n-rip' pushes market closer to resistance zone

- Quick-hitter trade from short-side in the works, but

- Still respecting solid trend higher until upward structure broken

On Friday the market started out on a weak note, with pre-market futures trading lower ahead of and after the release of US jobs data. The gap down was bought modestly in the first thirty minutes of the cash session, but it was the better than expected ISM Manufacturing data which swiftly reversed the early negative sentiment. The rip on Friday sent the S&P 500 to a new swing high and inched it closer to the 2080/100+ zone of resistance we have been discussing. The Dow is in the thick of the 17775/18000 zone of resistance, while the Nasdaq 100 cleanly cleared the 4450/4500 area of resistance created late last year.

S&P 500 Daily: Aug '15 - Present

As we said on Friday, the S&P is the featured index among the three, and as such we care primarily about its price levels and when it reaches them for our macro-scale views. With that said, we still have a small amount of room before the benchmark index runs aground into stiff resistance.

The trading hasn’t been the easiest with lofty levels difficult to buy, but momentum often too strong to short. Outside of short-term hit-n-run trades there isn’t anything substantial to sink our teeth into from a swing-trade standpoint.

We continue to give the trend higher the benefit of the doubt, but as the S&P enters into a major zone of resistance we will be geared up for a reversal and material pullback to unfold.

Dialing in on the hourly time-frame, the S&P is approaching a top-side trend-line, which may be enough to cap momentum carrying over from Friday. It just so happens to coincide with the bottom of our big picture zone of resistance of 2080-100+. We will watch and see how any pullback unfolds for clues on what we will do with our trades geared towards short time horizons. At this time, it would require a break of rising trend support running back to the March 10 pivot and Friday’s low of 2043 to undermine bullish posturing, and potentially validate top-side resistance (if met prior).

Hourly: Mar - Present

The plan to start the week is to look for a quick-hitter short off the top-side trend-line/bottom of resistance zone around 2080, but bearing in mind it will require a strong break to undermine the markets psyche. On a move lower, again, as long as the lower trend-line holds the dip is likely to be bought until we see a clear break in the pattern of higher highs and lower lows.

‘Traits of Successful Traders’ – See what sets them apart from the rest.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX, or email him directly at instructor@dailyfx.com.