To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

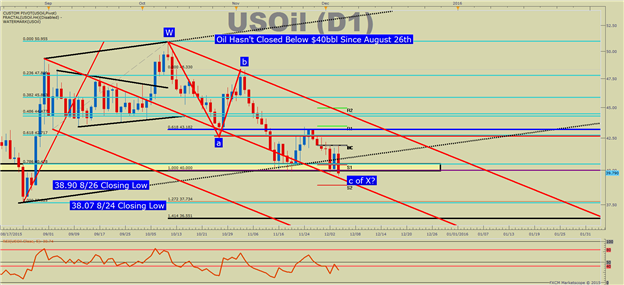

- Crude Oil Technical Strategy: Oil Pushes Lower Into August 24th Low

- Intermarket Analysis Favors Choppy Move Lower Without US Dollar Strength

- Resistance Moved Toward Weekly Pivot and Recent Highs of $42.00bbl

The OPEC meeting was looked at by many to be a potential pivot in the price after a 17 month move lower that begun in the summer of 2014. Production and Inventories, as shown by Department of Energy report continues to sit near record highs. The cure it appeared would be to cut production targets so as to balance the over-supply with the lack of demand to bring prices to a more ‘reasonable’ level. However, today, OPEC decided to lift their output target, which put further pressure on the price of Oil towards the August 24th low. What separates this move from the August move is that the August move was a momentum-based worldwide dump of risk as equity future indices went limit down (Futures trading terminology for circuit breakers getting triggered to prevent further drops in price). The current move toward presumed new lows is more fundamentally drivenby the strong dollar, weak demand, and over production/ supply continue to push price lower.

Interested In our Analyst’s Longer-Term Oil Outlook, be sure to sign up for our free oil guide here.

The new support focus is the Weekly R2 Pivot and first higherlow on the charts after the August 24th low at $38.50. Prices seem reluctant to make progress below $40, but should a clean breakdown happen $38.50 would be the first target followed $$37.73, the August 24th Black Monday low. Price continues to oscillate around the significant price level of $40.48. $40.48 comprises the 78.6% Fibonacci level of the August-October range, the high price of the 2015 extreme day on August 24th, and the closing price of November 19th where price hit a previous multi-month low.

Now that OPEC looks to raise their output target and with persistent US Dollar strength, we’ll continue to favor downside. FX Traders could look to confirmation via the inversely correlated USDCAD could make a push to new highs. Should USD/CAD be able to make a push above 1.3400 on a sustained basis, that would align equally with persistent Oil price weakness to come. Strong trends are your friends for many reasons in trading, and one reason is that they're slow to leave you. This trend lower in US Oil will remain with price staying below resistance at $41.91/$43.43bbl zone and opportunities to sell on strength appears the favorable approach until the larger environment changes. T.Y.

Would You Like To See How Other Traders Are Positioned in Key Currencies? If so, Click Here