COT Report – USD, GBP, CAD & JPY Analysis

- US Dollar Longs Rise as Euro Sentiment Deteriorates

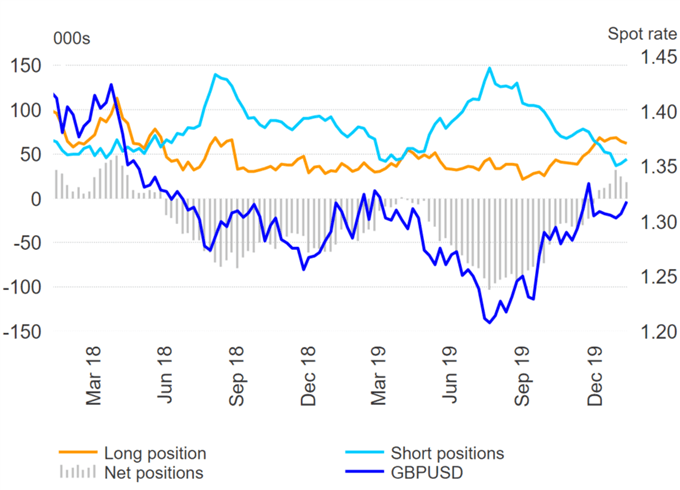

- GBP/USD Shorts Jump

- CAD Risks are Asymmetrically Tilted to the Downside

The Predictive Power of the COT Report

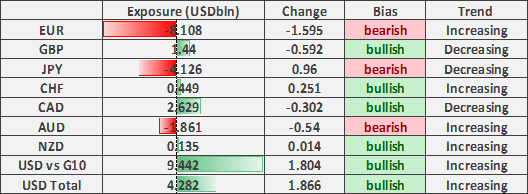

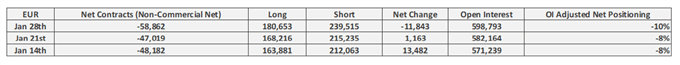

Source: CFTC, DailyFX (Covers up to January 28th, released January 31st)

US Dollar Longs Rise, GBP/USD Shorts Jump, CAD at Risk - COT Report

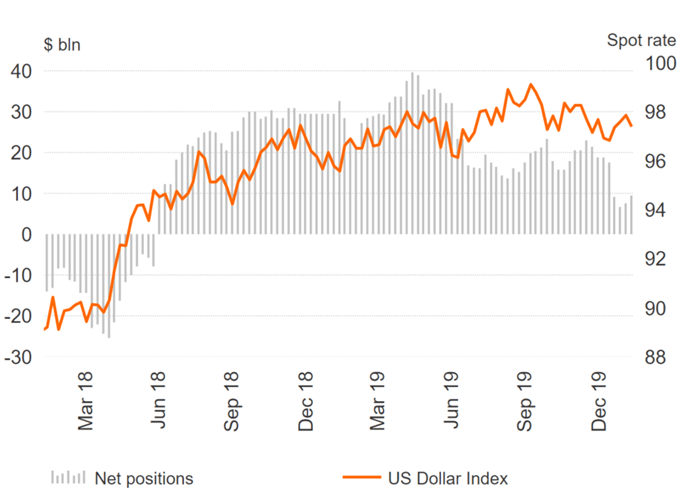

The latest CFTC report highlighted that investors had raised their bullish bets in the US Dollar by $1.8bln against G10 currencies to $9.44bln, where a large chunk of buying had been against the Euro.

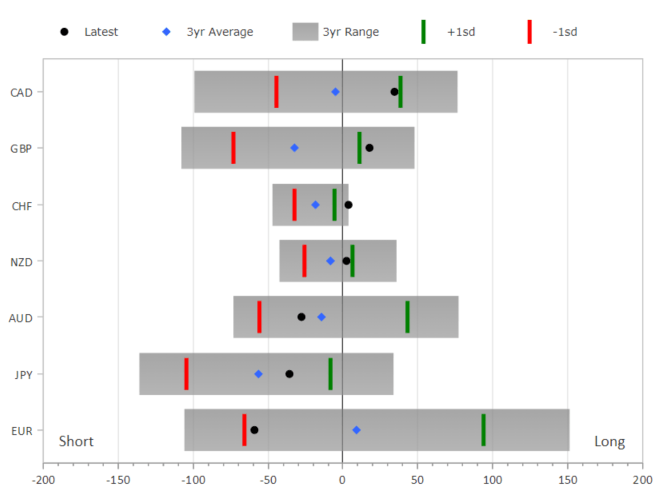

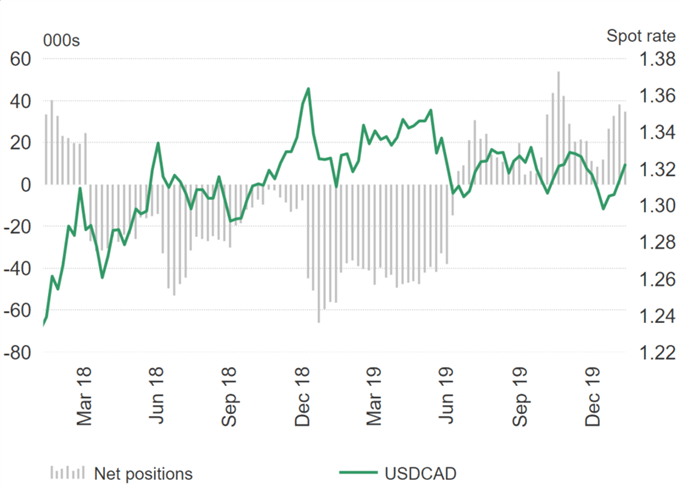

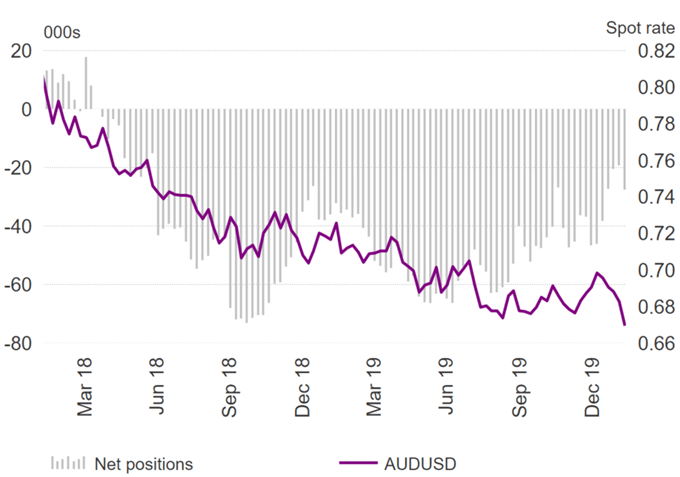

The rising uncertainty pertaining to the spread of Coronavirus saw investors reduce exposure to commodity-linked currencies. Net shorts in the Australian Dollar rose $540mln to $1.86bln, while Canadian Dollar longs had been pared slightly amid the drag from falling oil prices. That said, the Canadian Dollar remains vulnerable to weaker domestic data following the BoC’s recent dovish pivot, where current positioning in CAD suggests that downside risks are asymmetric.

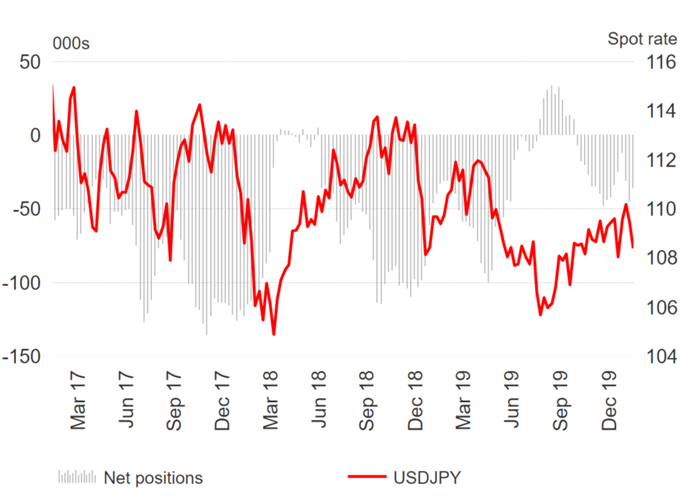

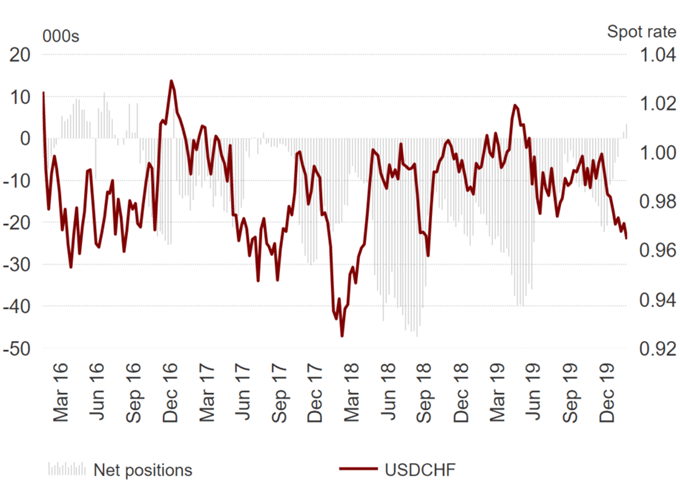

A pullback in risk sentiment saw safe-haven currencies in demand as JPY net shorts were cut by $960mln to $4.12bln amid a modest covering of outright shorts. Elsewhere, net longs continue to grow in the Swiss Franc albeit at a gradual pace, nonetheless, CHF bullish bets are at its highest since December 2016.

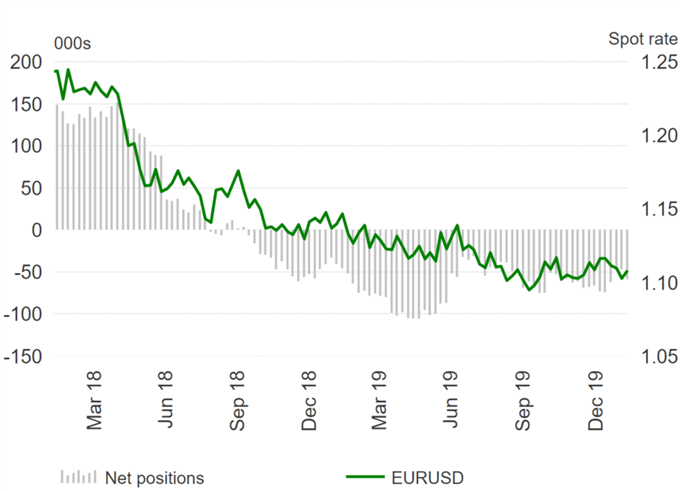

The largest positioning change had been observed in the Euro, where sentiment had deteriorated sharply as net shorts rose nearly $1.6bln, marking the first increase in net shorts since the back end of 2019. GBP net longs had eased off yet again with outright shorts continuing to pick up. With the Bank of England aside, eyes now turn towards the beginning of the EU-UK trade talks, which is set to curb upside in the currency.

US Dollar

EUR/USD

GBP/USD

USD/JPY

USD/CHF

USD/CAD

AUD/USD

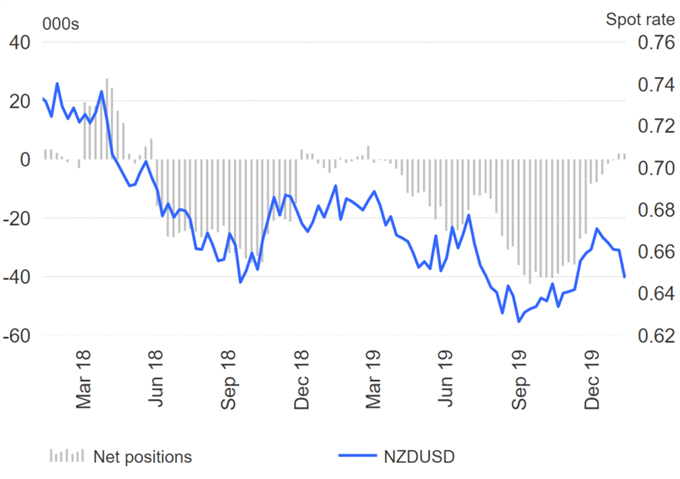

NZD/USD

For a more in-depth analysis on FX, check out the FX Forecast

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX