COT Report: Analysis and Talking Points

The Predictive Power of the CoT Report

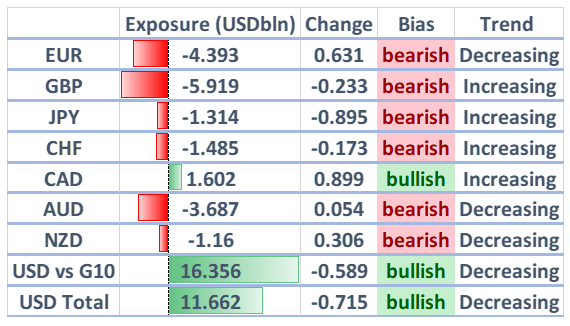

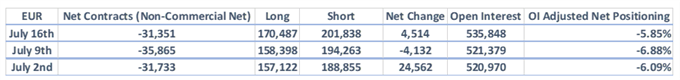

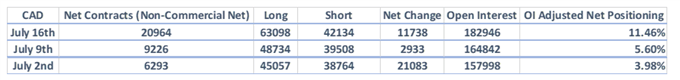

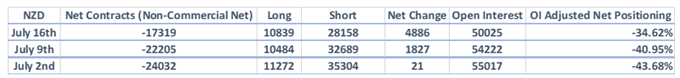

Source: CFTC, DailyFX (Covers up to July 16th, released July 19th)

CAD Longs Sharply Increase, GBP Remains Bearish, JPY Shorts Build - COT Update

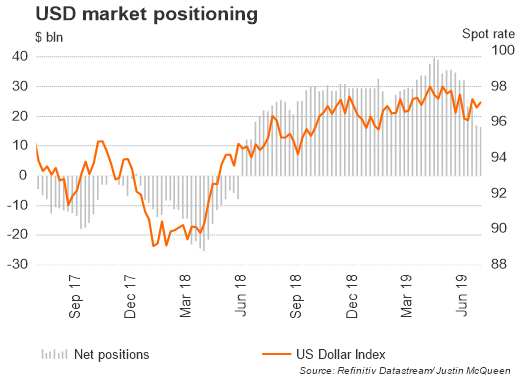

The latest CFTC positioning shows that USD selling resumed with net longs decreasing by $589mln vs G10 currencies to $16.356bln. Consequently, net long positioning against G10 currencies is at the lowest since July 2018.

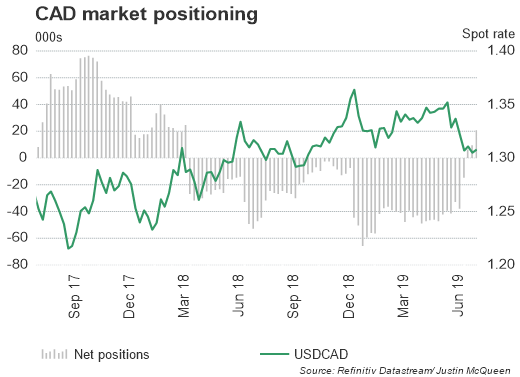

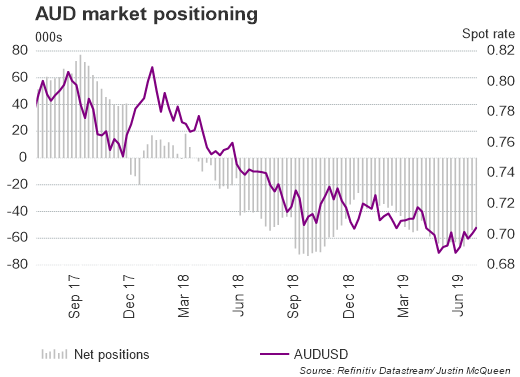

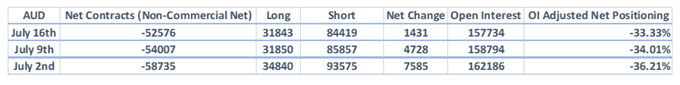

A sharp increase in CAD longs, which saw the largest singular move for the week of $899mln to $1.6bln. In turn, net long positioning remains at the highest since March 2018. Elsewhere, Australian Dollar positioning had been largely unchanged with net shorts decreasing slightly as speculators covered short positions.

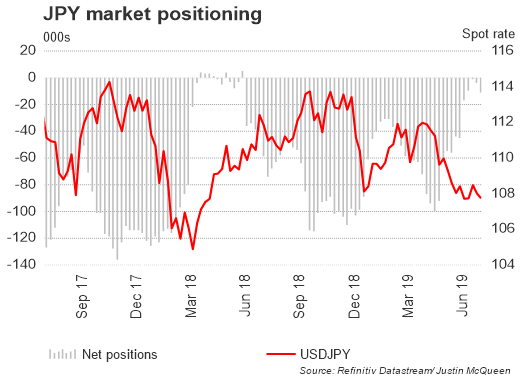

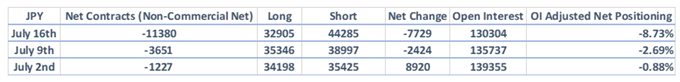

The Japanese Yen had seen the second largest weekly change with speculators raising their net short positioning in the safe-haven currency to $1.485bln following a $895mln increase.

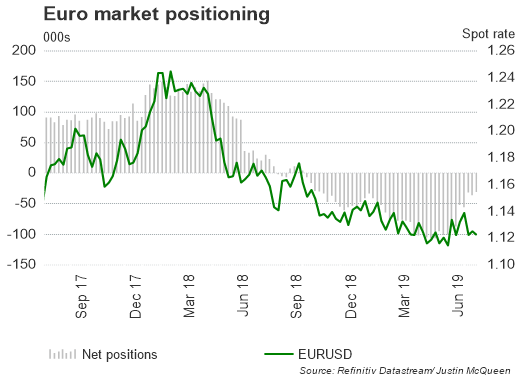

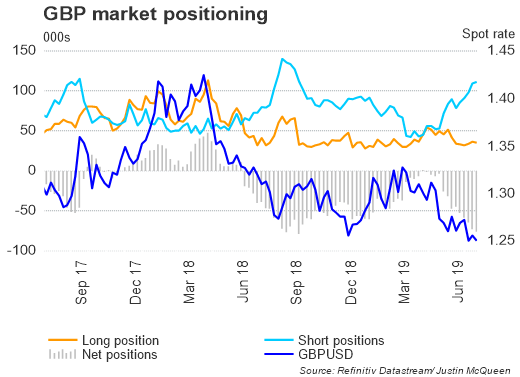

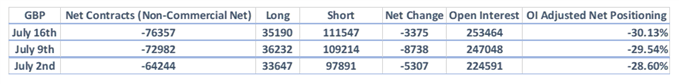

Another build in net shorts for the Pound, which increased by $233mln to $5.9bln, taking the ratio of short to long positioning to 3.16:1. GBP continues to be the largest net short across the G10 complex as Brexit uncertainty clouds the outlook.

IG CLIENT SENTIMENT (RETAIL POSITIONING): USDCAD

Data shows that 57.4% of traders are net-long with the ratio of traders long to short at 1.35 to 1. In fact, traders have remained net-long since Jun 26 when USDCAD traded near 1.32075; price has moved 1.2% lower since then. The number of traders net-long is 5.8% lower than yesterday and 16.7% lower from last week, while the number of traders net-short is 14.6% lower than yesterday and 15.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bearish contrarian trading bias.

USDCAD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX