COT Report: Analysis and Talking Points

- GBPUSD Shorts Soar on Brexit Turmoil

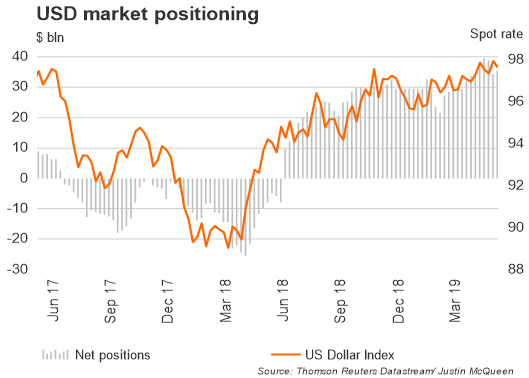

- Speculators Extend Bullish USD Positioning

- AUDUSD Gross Shorts Highest Since November 2015

The Predictive Power of the CoT Report

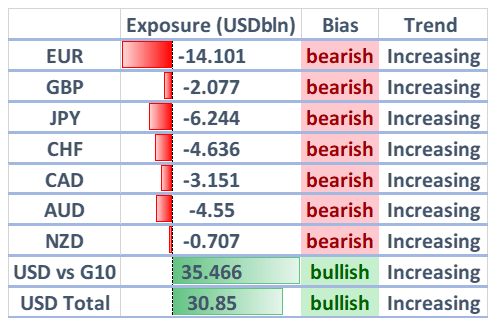

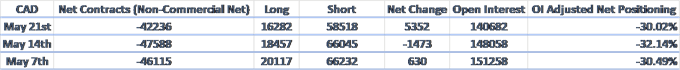

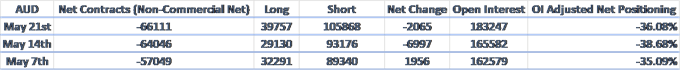

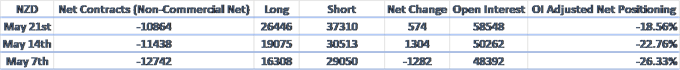

Source: CFTC, DailyFX (Covers up to May 21th, released May 24th)

GBPUSD Shorts Soar, AUD Shorts Highest Since November 2015

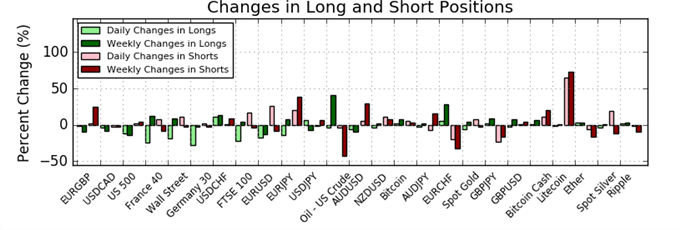

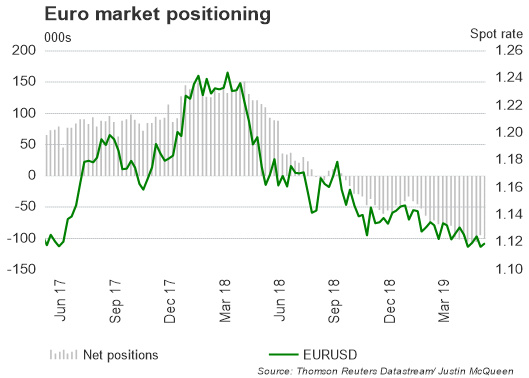

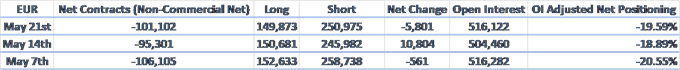

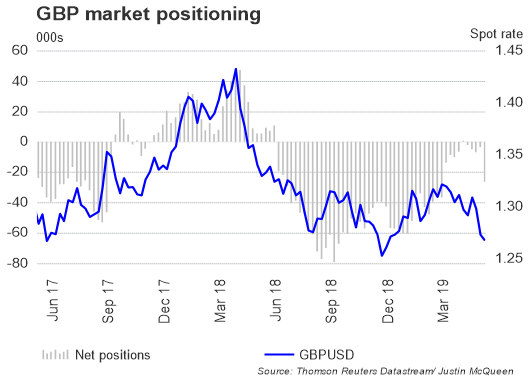

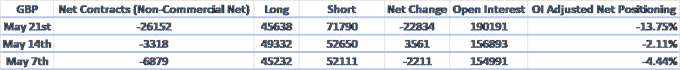

After last weeks reduction in USD long positioning, speculators had reversed course having increased their bullish bet on the greenback. This had largely been led by the $1.8bln rise in net short positioning in GBP, as investors raised their gross shorts, while also cutting back on their gross longs. The bearish sentiment on the Euro had also increased as speculators raised their net short positioning by $750mln.

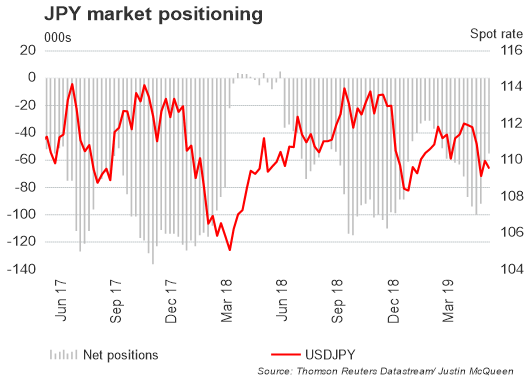

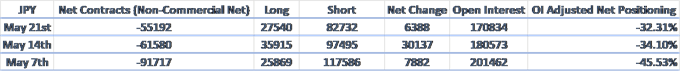

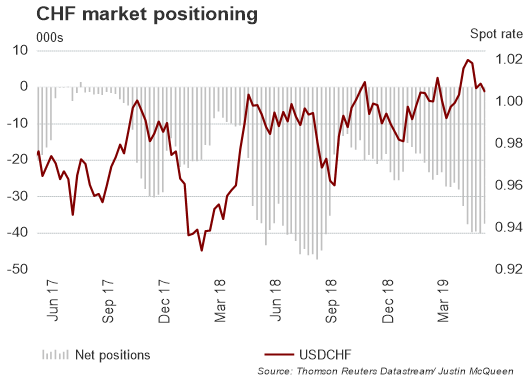

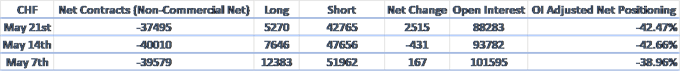

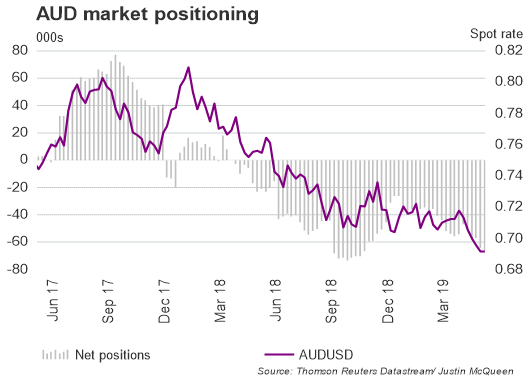

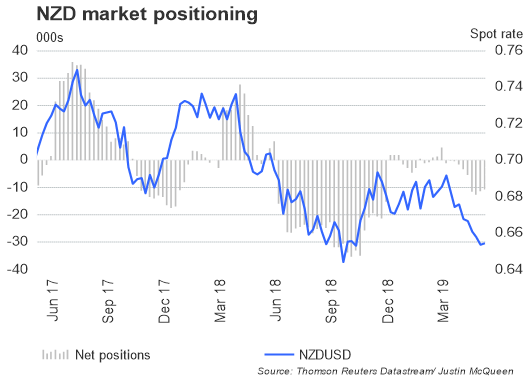

Safe-haven currencies (JPY & CHF) saw net short positions cut amid the dampened risk appetite. However, short positioning on the Swiss Franc is beginning to look stretched given that shorts outnumber longs by 8:1. Elsewhere, AUD net shorts saw a marginal increase with gross shorts now at the highest since November 2015, which in turn raises the risk of a short squeeze.

IG CLIENT POSITIONING:

IG client data shows 80.6% of traders are net-long with the ratio of traders long to short at 4.15 to 1. In fact, traders have remained net-long since May 06 when GBPUSD traded near 1.31656; price has moved 3.4% lower since then. The number of traders net-long is 2.8% lower than yesterday and 8.1% higher from last week, while the number of traders net-short is 1.1% higher than yesterday and 4.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

US Dollar

GBPUSD

AUDUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX