COT Report: Analysis and Talking Points

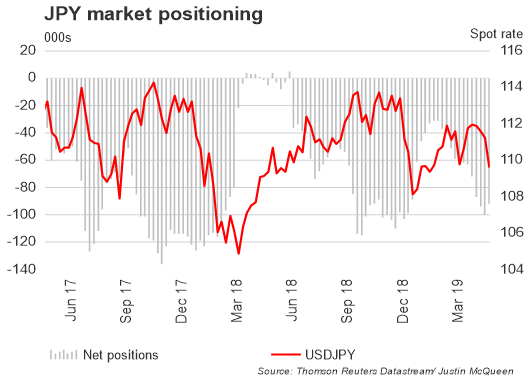

- Japanese Yen Bears Head for the Exit on Rising Trade War Tensions

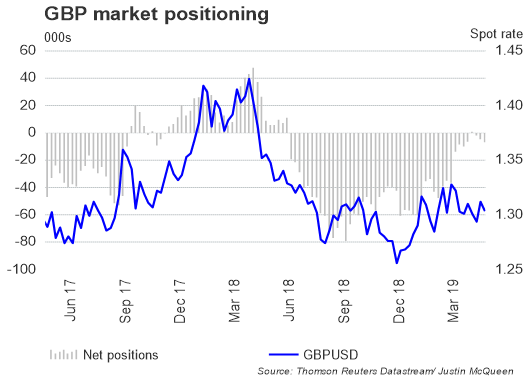

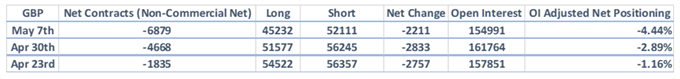

- GBP Net Shorts Continue to Pick up

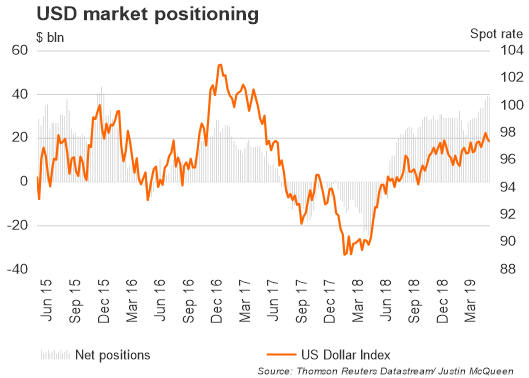

- USD Bullish Bet Reduced but Still Highest Since Over 3yrs

The Predictive Power of the CoT Report

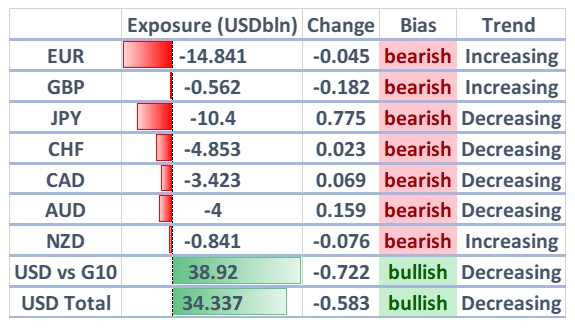

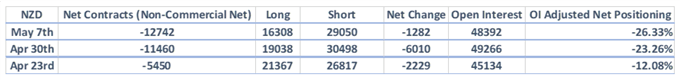

Source: CFTC, DailyFX (Covers up to May 7th, released May 10th)

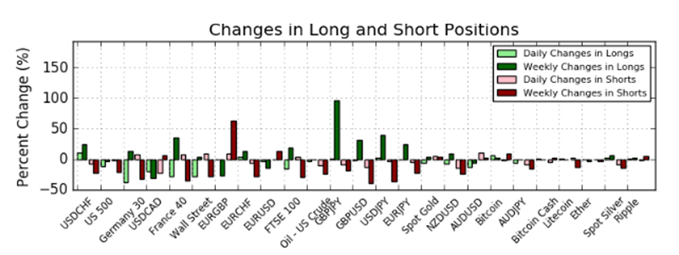

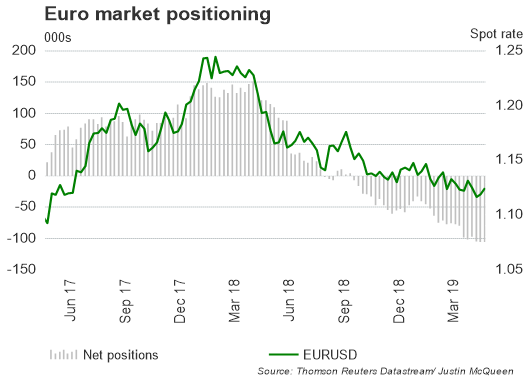

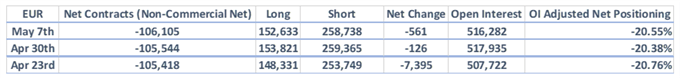

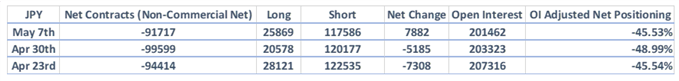

Investors slightly reduced their net long exposure in the USD index as net shorts in the Japanese Yen had been cut by 775mln to 10.4bln. However, bullish bets in the USD index remain at multi-year highs while Japanese Yen net shorts continue to remain the second largest bearish bet, although there is a risk of further short covering on increased market volatility and sell-off in equity markets. Speculative gross JPY shorts now outweigh gross longs by 4.5:1 (Prev. 5.8:1).

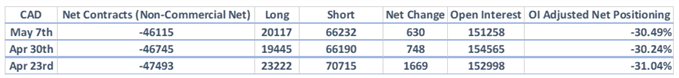

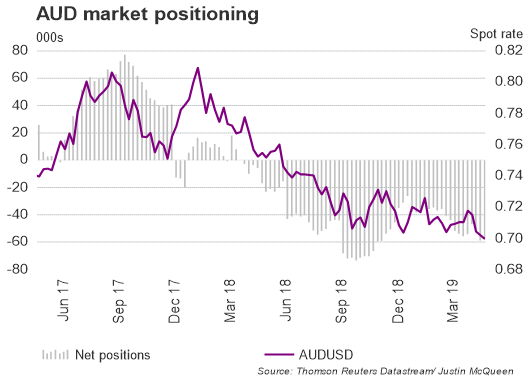

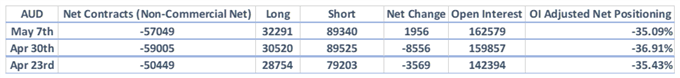

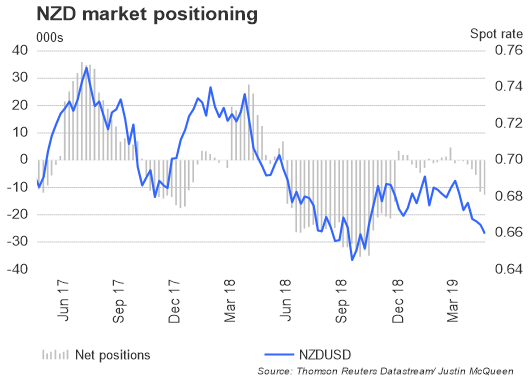

Elsewhere, positioning had been relatively muted with the exception of the Pound, which saw net shorts pick-up yet again as fragile UK politics continue to weigh on investor sentiment, while Aussie net shorts had been covered slightly having been cut by 159mln to 4bln.

IG CLIENT POSITIONING:

IG client data shows 68.9% of traders are net-long with the ratio of traders long to short at 2.22 to 1. The number of traders net-long is 1.2% higher than yesterday and 96.7% higher from last week, while the number of traders net-short is 9.1% lower than yesterday and 18.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPJPY-bearish contrarian trading bias.

US Dollar

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX