CoT Highlights:

- Gold futures bought at one-week record pace

- Euro large specs shortest since March 2017

- Large spec profiles for major FX and markets

For a timelier look at sentiment in major currencies and markets, see the IG Client Sentiment page.

The most recently released CoT report showed aggressive short-covering in gold, with a record one-week amount of contracts bought. Euro large speculators continue to hit the bid on the single-currency, pushing their net-short to a 17-month extreme.

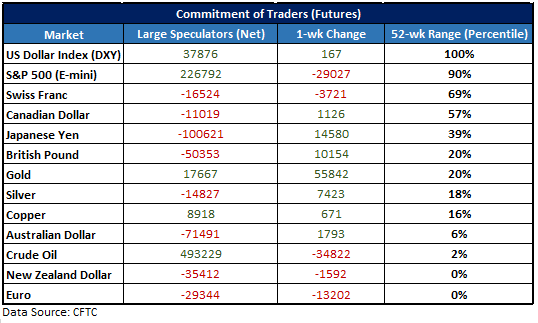

On Fridays the CFTC releases a detailed report of traders’ positioning in the futures market as reported for the week ending on Tuesday. Outlined in the table below are key stats concerning the positioning of large speculators (i.e. hedge funds, CTAs, etc.), excluding small speculators and commercial traders.

‘Large specs’ are known to typically employ trend-following strategies, and as such, they tend to add to long positions and reduce shorts in uptrends while reducing long positions and increasing shorts in downtrends. When analyzing the data, we take into consideration the direction of their position, magnitude of changes, as well as extremes.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

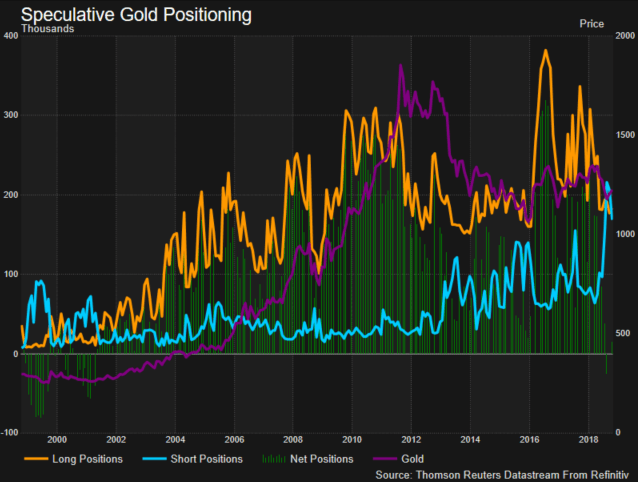

Gold futures bought at one-week record pace

Last week’s report showed large speculators scrambling for cover, as the one-week change of nearly +56k contracts was a record week. This doesn’t come as a big surprise, though, given the record short which had been built up in recent weeks and the sudden $45 rally, with most of it coming in one day.

Gold Positioning Chart

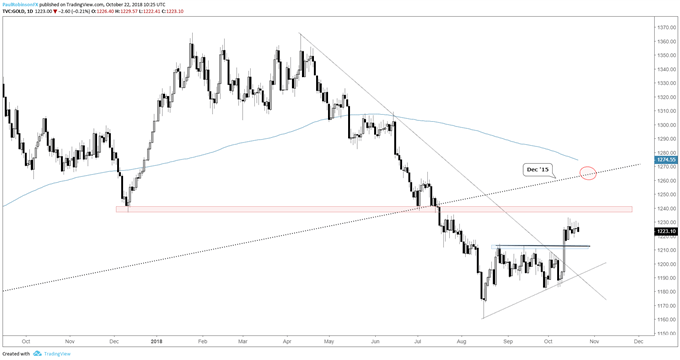

From a short-term technical perspective, gold has a little room to go before hitting resistance in the 1235/40 area, but risk/reward for fresh longs is lacking at the moment. A test of the top of the Aug/Oct range in the 1210/1214 range may offer a good spot to look for price to hold for another push higher.

Gold Daily Price Chart (1235/40 resistance, 1210/14 support)

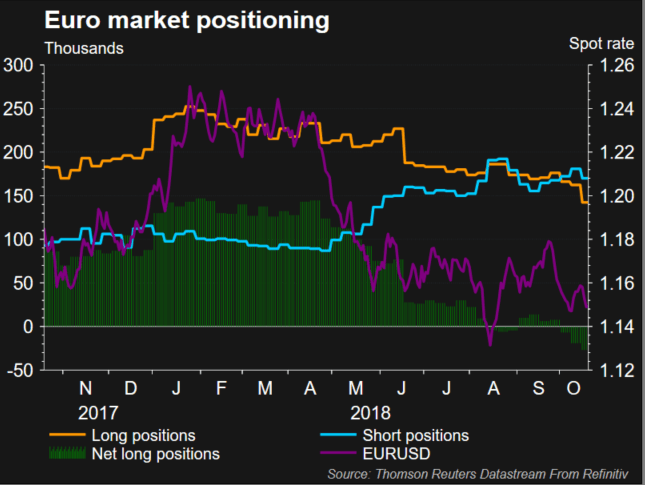

Euro large specs shortest since March 2017

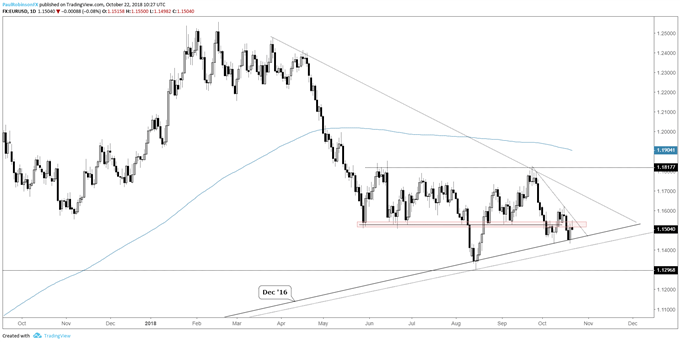

Large specs hit bids again in the Euro contract, selling another 13k to bring the total net-short to 29k. This is the shortest this group of trend-following traders has been since March of last year. The overall technical picture is murky for EUR/USD. It’s been a relatively tough handle since the end of May, and until that changes I tend to lean towards treading lightly.

Euro Positioning Chart

EUR/USD Daily Price Chart (Choppy, mixed bias)

See what fundamental and technical drivers are at work in the recently released Q4 Trading Forecasts.

Large speculator profiles for major FX & markets:

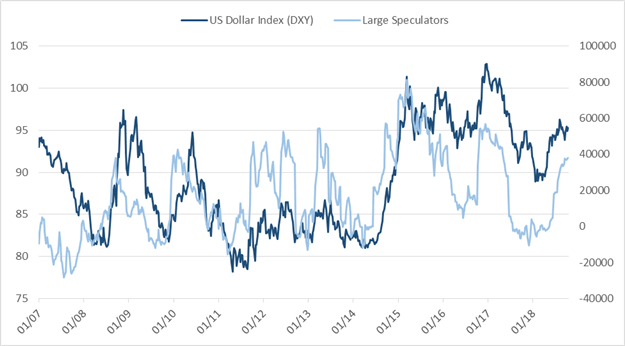

US Dollar Index (DXY)

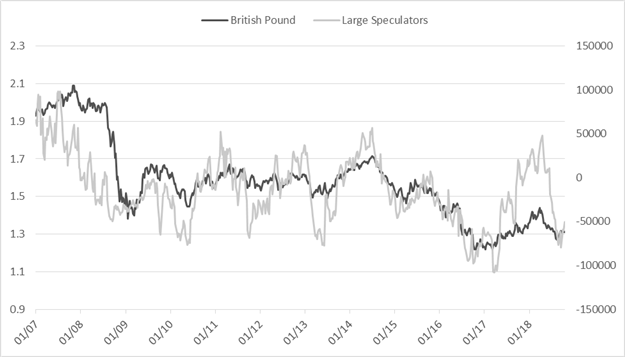

British Pound

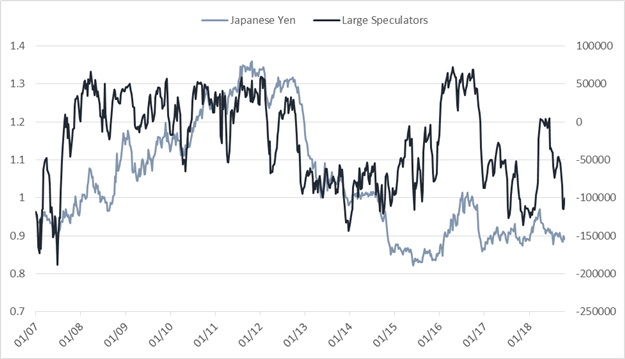

Japanese Yen

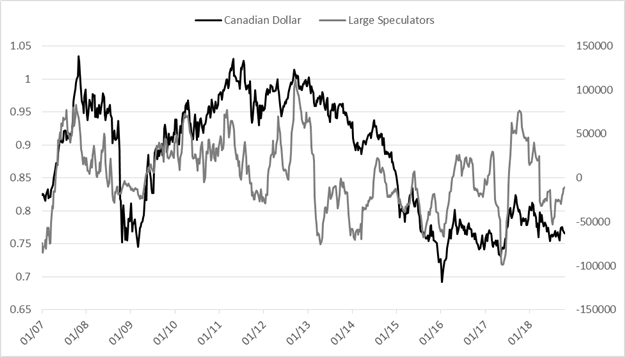

Canadian Dollar

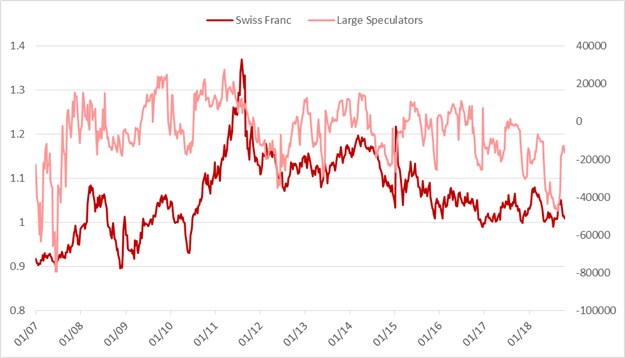

Swiss Franc

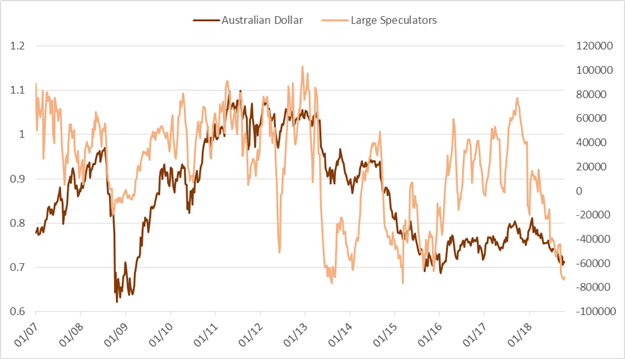

Australian Dollar

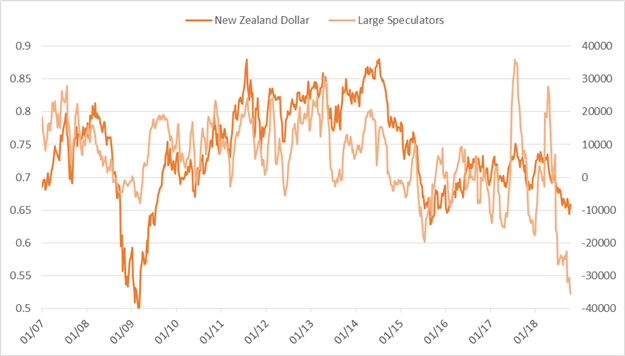

New Zealand Dollar

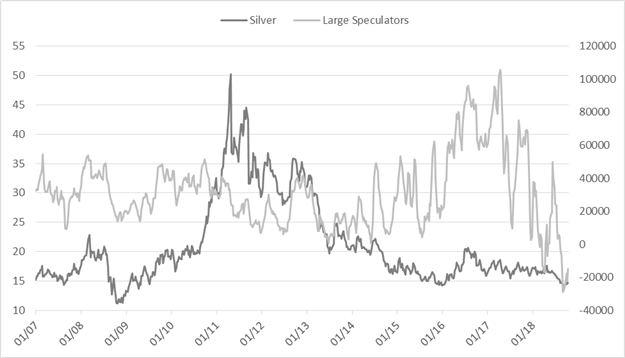

Silver

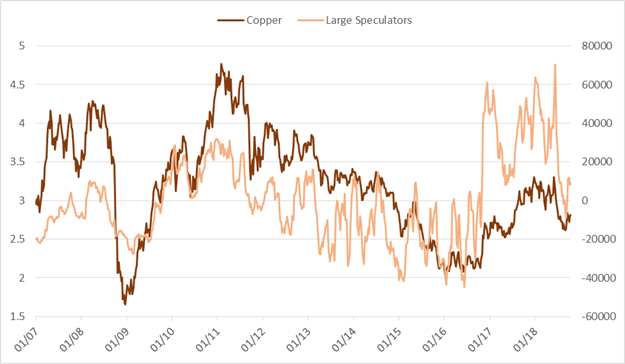

Copper

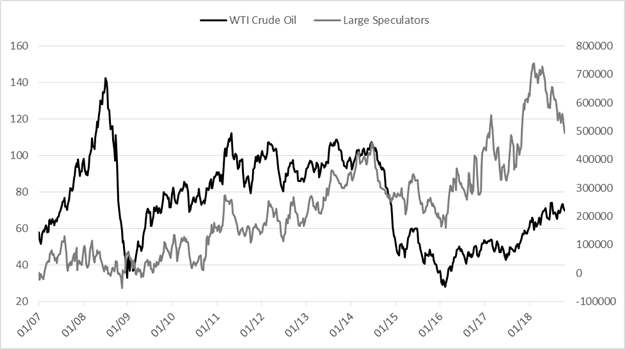

Crude Oil

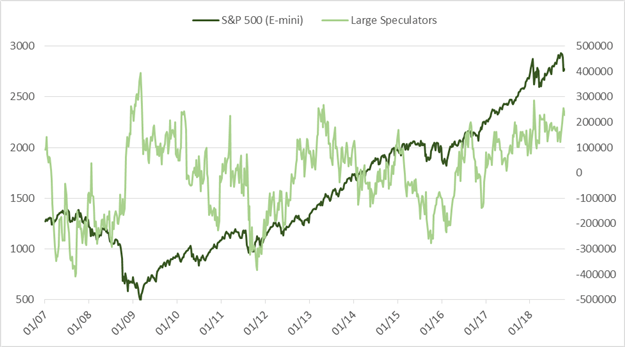

S&P 500 (E-mini)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX