CoT Highlights:

- Large spec net-long decreases for a 4th week in a row

- May or may not hold any meaning, keep an eye on price action

- Large speculative positioning profiles for major markets/currencies

For a measure of short-term sentiment readings, see the IG Client Sentiment page.

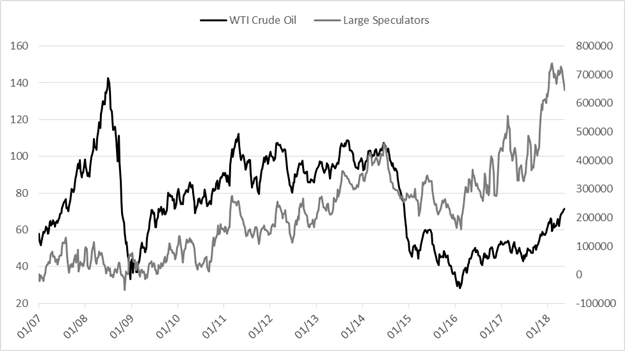

Large speculators reduced their net-long in crude oil for a fourth week in a row, what could this, if anything, be saying about the strong upward trend? Oil has certainly been in a fierce bull-phase since last year, perhaps a meaningful decline isn’t too far around the bend.

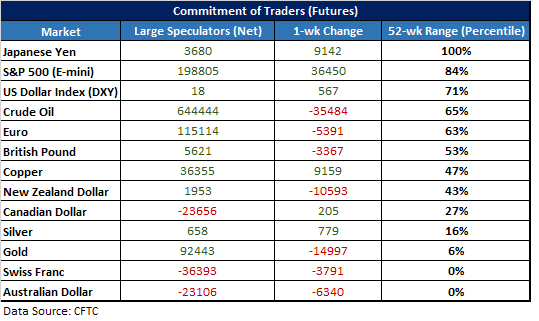

Each Friday, the CFTC releases an overview of traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below we’ve noted key statistics for net positioning among large speculators (i.e. hedge funds, CTAs, etc.). This group of traders are largely known to be trend-followers due to the trading strategies typically employed. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing what their trading activity could mean about future price fluctuations.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

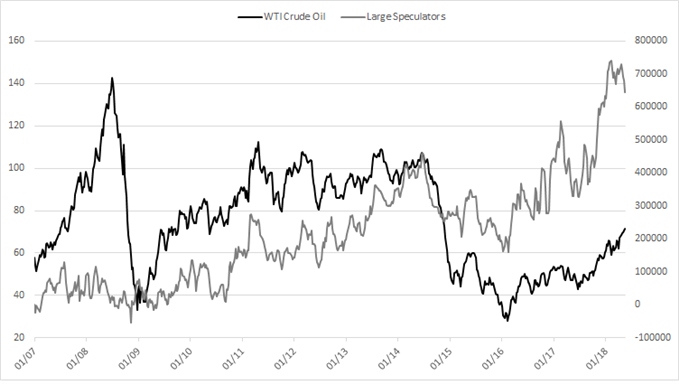

Large speculators selling as crude continues to rise

The persistent rise in crude oil since last year has sparked a massive accumulation of speculative longs, topping out at 739k contracts in February. The figure dipped a little with price during the down to flattish period in February and March, but positioning once again ramped back up to near record levels again last month.

However, in the past four weeks a somewhat curious trend has begun to emerge. Large speculators have reduced their net-long exposure each week while the price of oil continues to trade higher. The most recent report showed the trend-following group long 644k contracts, the smallest position since January.

It may not mean anything just yet, but perhaps the trend is starting to find enough skepticism that it could soon see a very long crowd of traders looking to reverse course as oil moves to fresh multi-year highs.

Keep an eye on price action for indications that oil wants to turn lower as there is plenty of resistance from current levels into the upper 70s. A sudden reversal in momentum at some point in the near future may be all it takes for a swift reduction in long positions and a sizable correction to develop.

Chart 1 – Crude Oil Positioning (Net-long Declining as price rises)

See how sentiment could tie into the Forecast for Major Currencies & Markets

Chart 2 – US Crude Oil Weekly (Watching for bearish reversal)

Large speculator profiles for major FX & markets:

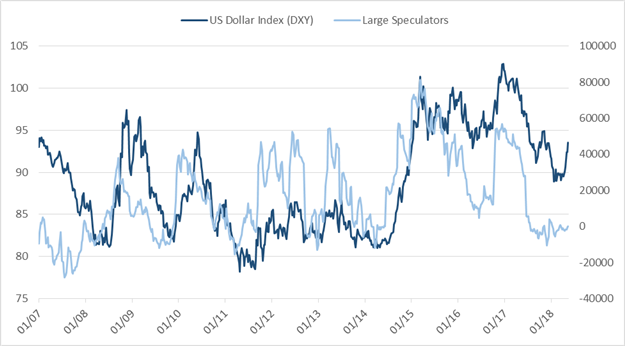

US Dollar Index (DXY)

Euro

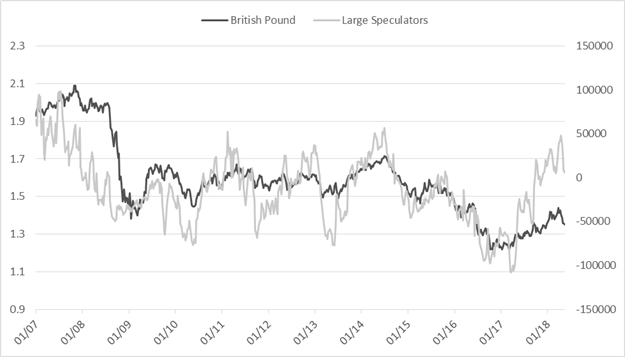

British Pound

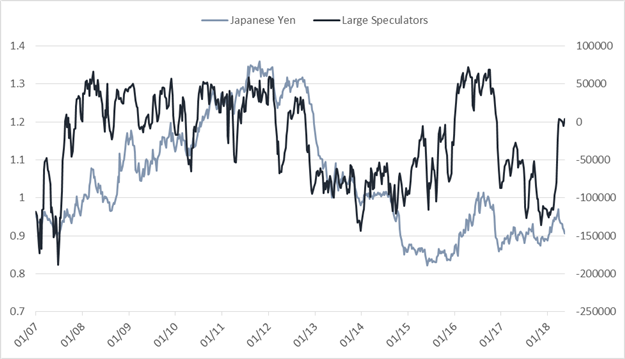

Japanese Yen

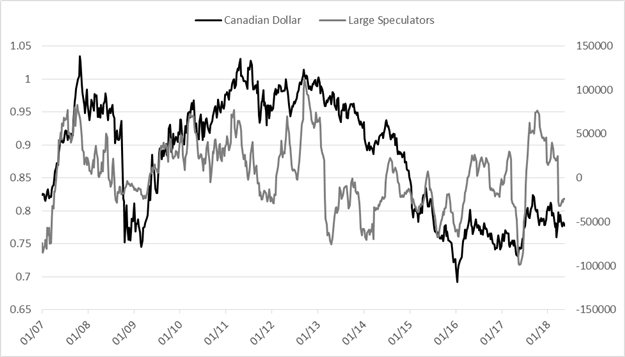

Canadian Dollar

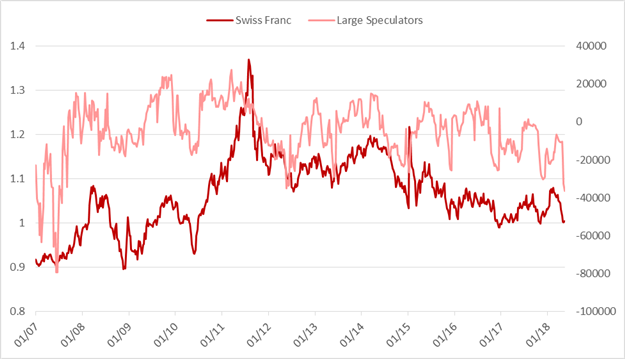

Swiss Franc

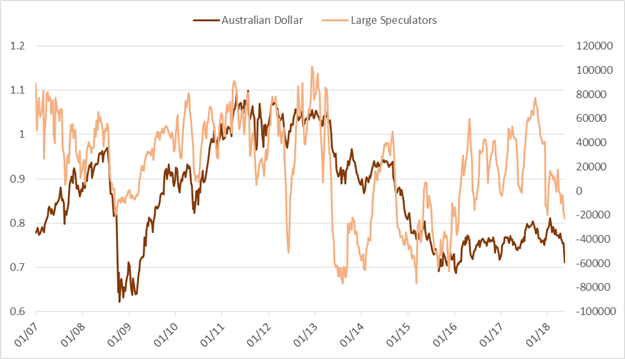

Australian Dollar

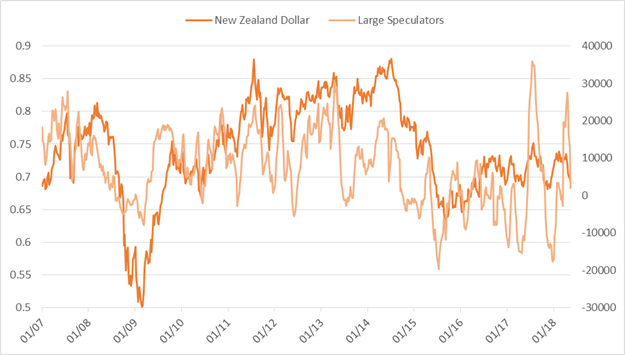

New Zealand Dollar

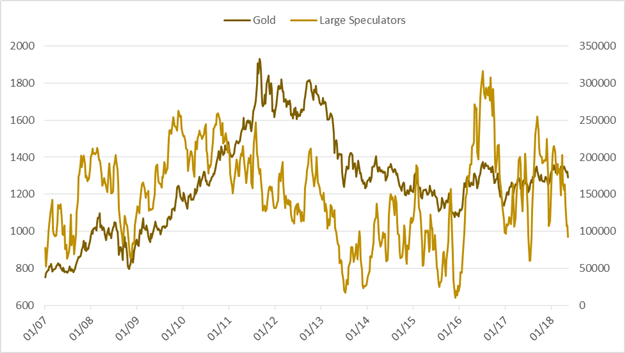

Gold

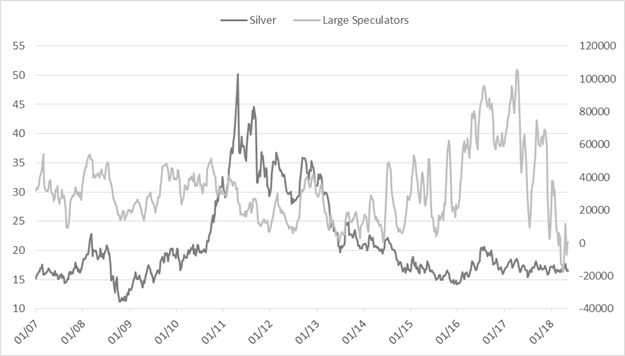

Silver

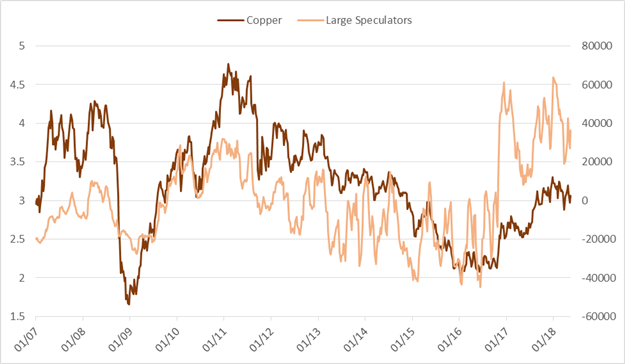

Copper

Crude Oil

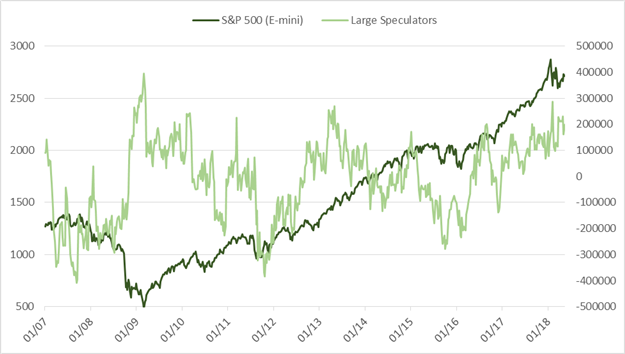

S&P 500 (E-mini)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX