US Consumer Confidence, Federal Reserve, US Dollar - Talking Points

- US JULY CONSUMER CONFIDENCE AT 95.7; EST. 97.0

- Weakening data stokes recession fears ahead of Fed

- USD higher on the day as Euro falls on Russian gas fears

US consumer confidence data for July came in weaker than expected at 95.7, lower than the consensus estimate of 97.0. The print also represents a pullback from a 98.4 reading in June. The weaking data also accompanied disappointing housing data, as recession fears loom ahead of Wednesday’s FOMC meeting. The report released by the Conference Board revealed that rising food and gas prices continue to weigh on sentiment. With higher interest rates thanks to the Fed’s policy path, intentions to purchase homes, cars and appliances all fell in July.

With the Federal Reserve’s July policy meeting underway, the FOMC is set to hike by another 75 basis points tomorrow. Tighter monetary policy comes at a time when the US economy is showing signs of slowing down, while inflation remains sticky. Markets have moved recently to price a Fed pivot in ’23, as recession fears appear to grow each day. With QT only accelerating from this point into year-end, we may continue to see risk struggle despite slowing US growth. It will be interesting to observe over the next 12 months if we are entering a new regime, one where the Fed will continue to tighten even as markets call for a policy pivot.

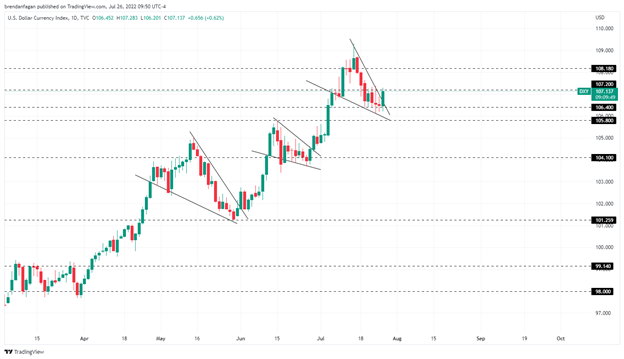

US Dollar Index (DXY) Daily Chart

Chart created with TradingView

The US Dollar has caught a bid on Tuesday thanks to broad Euro weakness as a result the gas headlines that dropped earlier this morning. It will be interesting to see if we get follow through from the break of the falling wedge formation on the daily, as this pattern has presented over the summer months. It remains to be seen if this “break” is simply a “buy the rumor, sell the news” trade into tomorrow’s key FOMC meeting. While the Fed is priced for 75 basis points, weakening economic data here in the US could continue to weigh on USD upside. If there is indeed continuation higher from this wedge, DXY could push to the 108.18 area before testing those YTD highs.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter