EUR/USD Analysis and Talking Points

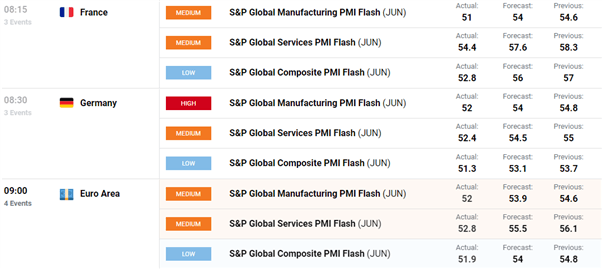

French PMI: Much weaker than expected across board with the Manufacturing sector just slightly in expansionary territory at 51 (sub 50 = contractionary territory), marking a 19 month low. Consequently, the marked slowdown at the end of the second quarter has dragged the composite figure to a 5 month low as growth falls to its weakest since the peak Omicron disruption.

German PMI: Another weak set of figures, with the latest German PMI readings also falling short of expectations and further compounding the view that the Eurozone is quickly losing momentum. What’s more with the manufacturing sector falling to a 23 month low, this raises concerns over recession risks facing the Euro Area.

DailyFX Economic Calendar

Source: DailyFX

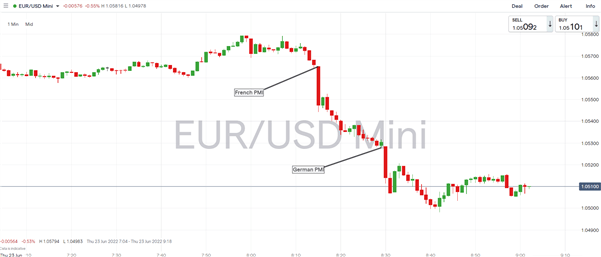

Euro Drops: In reaction to the soft set of PMI figures, the Euro is under pressure, testing the 1.05 handle on the downside, having pulled back from the high 1.05s. Meanwhile, the German 10yr bond has rallied with yields falling as much as 14bps as markets unwind ECB tightening bets.

Support: 1.05 (Round number/psychological), 1.0470 (weekly lows), 1.0350 (YTD low)

Resistance: 1.0580 (pre-CPI level), 1.06 (weekly high/round number), 1.0636 (2020 low)

| Change in | Longs | Shorts | OI |

| Daily | 1% | 1% | 1% |

| Weekly | 61% | -45% | 2% |

EUR/USD Chart: 1-Minute Timeframe

Source: IG

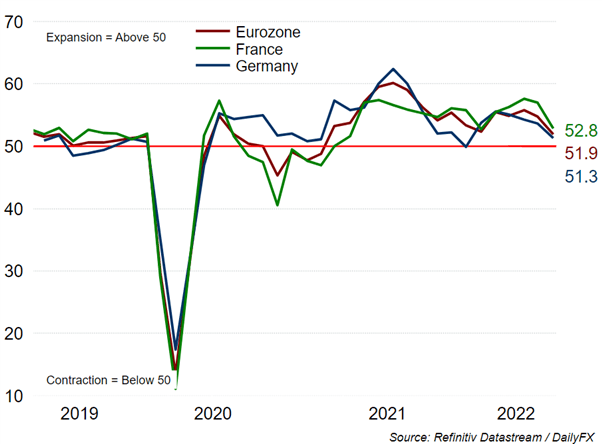

Eurozone PMI Slow to Multi-Month Lows