GBP/USD Price Analysis & News

UK Q1 GDP Recap

UK GDP April M/M: -0.3% vs Exp. 0.1% (Prior -0.1%) April 3M/3M: 0.2% vs Exp. 0.4% (Prior 0.8%)

UK GDP for April posted a surprise contraction of 0.3%, marking a second consecutive month of negative growth, in which all main sectors declined. However, the decline in growth had largely been driven by the significant reduction in test and trace activity, detracting 0.5ppt from the monthly figure. That being said, in light of today’s GDP figure, the Bank of England’s Q2 forecast of 0.1% of growth looks unlikely to be reached with risks geared toward a quarterly GDP contraction of around 0.5%.

What’s more, the cost of living squeeze further highlights the stagflation risks that the UK economy faces, particularly as consumer confidence falls to record lows. Overnight, the CBI downgraded its growth outlook to 3.7% for this year, from 5.1% and 1% (prev. 3%) in 2023, while inflation is seen rising to 8.7% in October.

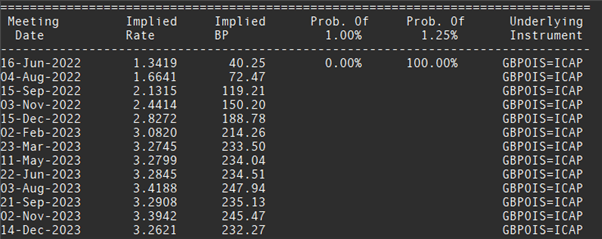

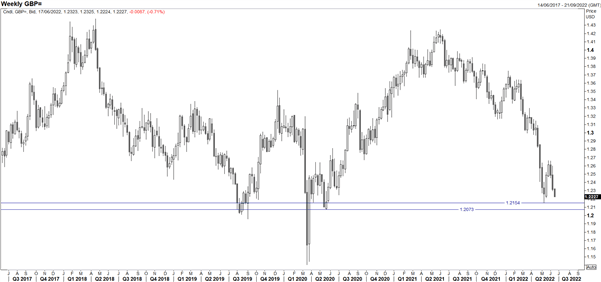

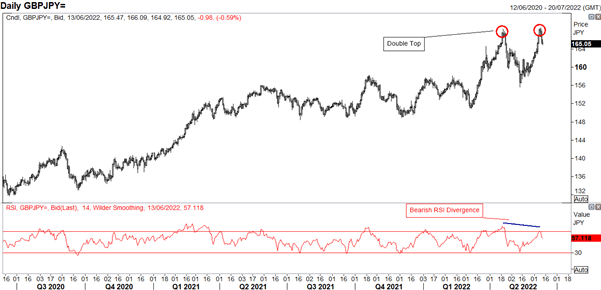

Consequently, this further complicates matters for the Bank of England. The Bank is expected to raise interest rates for a fifth consecutive meeting. Although, what is surprising is markets currently price in around 40bps of tightening at the upcoming meeting. To me this is unlikely to happen given that the BoE has been a reluctant hiker during this tightening cycle, meanwhile, they have also raised concerns over growth, which will only be exacerbated after today’s GDP report. As such, GBP downside will persist with the currency the poster child for stagflation and remains vulnerable to a dovish repricing. GBP/USD eyes a return to the YTD low, while a double top and bearish RSI divergence in GBP/JPY highlights reversal risks.

Money Markets Remain Far Too Aggressive on BoE Tightening

Source: Refinitiv

GBP/USD Chart: Weekly Time Frame

Source: Refinitiv

GBP/JPY Chart: Daily Time Frame

Source: Refinitiv