Australian Dollar, AUD/USD, Jobs, Unemployment, RBA, USD - Talking Points

- The Australian Dollar was steady after jobs data was largely inline

- Today’s data is against a backdrop of a strong domestic economic outlook

- The RBA are validated for raising rates. Will more hikes boost AUD/USD?

The Australian Dollar held its ground after the April unemployment rate came in at 3.9% as forecast and against 4.0% previously. This is the lowest Australian unemployment rate since the 1970s.

The overall change in employment for the month was 4k instead of 30k anticipated. Full time employment increased a whopping 92k, while part time jobs decreased 88k.

With uncomfortably high inflation, today’s number opens the way for the RBA to continue to hike rates and potentially accelerate the lifting cycle to rein in loose policy. However, domestic factors appear to be sidelined for the exchange rate for now.

The Aussie was pummelled overnight in a classic risk off trading environment after the reality of steep monetary tightening globally became apparent to a seemingly complacent equity market.

When it comes to growth versus inflation, central banks have erred on the side of fostering growth at the expense of living with high inflation. This is born out of the 1970-80s period of high inflation.

At that time, US Federal Reserve Chair Paul Volker got the backing of two successive administrations, from both sides of the aisle, to get inflation under control. He did so through several highly restrictive policies. One of these was a move to very high interest rates.

The cost of this policy was two severe recessions in the 1980s. The market appears to have woken up to this stark reality for the current situation. Cheap money of this era is being consigned to history at a rapid rate of knots.

With central banks focused on fighting inflation, risk assets that rely on cheap funding now have their business models questioned.

As an example, special purpose acquisition companies (SPAC), once the darlings of the recent free-money environment, are facing difficulties raising cash - if they can at all.

More concerning has been the recent disappointing reporting results from real economy companies in the US.

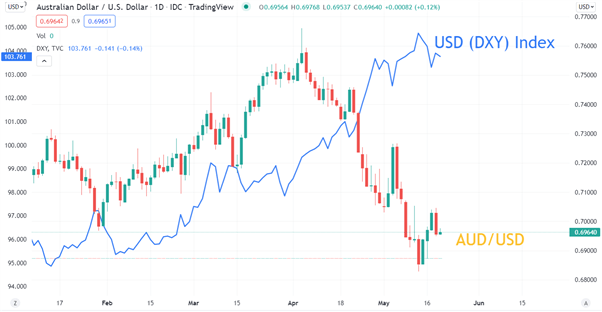

This backdrop leads to growth linked currencies like the Aussie coming under pressure, while perceived safe-haven currencies like the US Dollar, Japanese Yen and Swiss Franc attract inflows.

Movements in the USD (DXY) index seems to be driving AUD/USD for now.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter