DAX, FTSE 100 Analysis and News:

DAX Reprieve to be Short-Lived

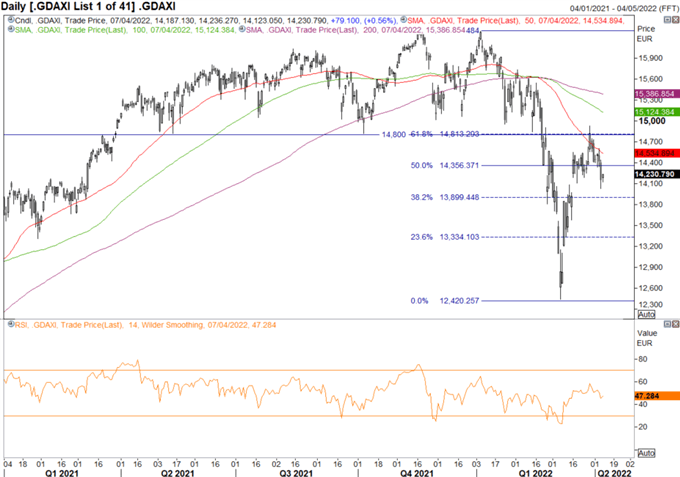

DAX: A more sanguine tone across the equity space as European bourses look to claw back yesterday’s hefty losses. However, despite the mild reprieve, risks remain geared towards the downside for risk assets. Last week’s failure at the 14800 pivot suggests that this area will continue to limit relief rallies in the index and thus will remain an area to fade. Meanwhile, a break below 14000 opens the door towards 13500-13600.

While Fed speakers will continue to be watched, little in the way new information is expected, given what has been announced in both the FOMC minutes and Fed’s Brainard’s hawkish speech. That said, as we near the May FOMC meeting risk assets are likely to come under pressure in the run-up and thus equities remain a fade on relief rallies.

DAX Chart: Daily Time Frame

Source: Refinitiv

FTSE 100 Remains Underpinned by Elevated Commodity Prices

FTSE 100: Despite a slight pullback in the index, the FTSE 100 has been the star performer among its major counterparts. The index has so far managed to eke out modest gains year to date with a rise of 2.5%, given the sizeable exposure in commodity related names. Technically speaking, the index looks to be somewhat exhausted amid the failure to hold above 7600. That said, on the downside, support sits at 7500 and 7515-30 below. However, relative to indices with high tech exposure, the FTSE 100 is not the best trade for those looking for downside, where elevated commodity prices provides a modest degree of support.

Equity Tech Levels

.

| Price | 50DMA | 100DMA | 200DMA | RSI | IG Sentiment | |

|---|---|---|---|---|---|---|

| Europe | ||||||

| FTSE 100 | 7572 | 7435 | 7391 | 7257 | 58 | Mixed |

| DAX | 14200 | 14534 | 15124 | 15386 | 46 | Bearish |

| CAC 40 | 6531 | 6677 | 6861 | 6778 | 46 | Bearish |

| US | ||||||

| S&P 500 | 4481 | 4420 | 4537 | 4490 | 51 | Bearish |

| Dow Jones | 34496 | 34361 | 35006 | 35011 | 50 | Bearish |

| Nasdaq 100 | 14498 | 14330 | 15137 | 15154 | 49 | - |

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team