NFP, Non-Farm Payrolls Talking Points:

- Today brings the release of Non-farm Payrolls data for the month of March, carrying an expectation of +490k on the heels of last month’s +678k.

- Since last month’s print, we had the first Federal Reserve rate hike since 2018 and at that meeting Chair Powell opined that a lack of slack in the labor force was a main motivator of pushing for more-hawkish policy, going along with the 40-year highs in inflation that continue to print, evidenced most recently by yesterday’s PCE deflator.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

Added 9:25 AM ET

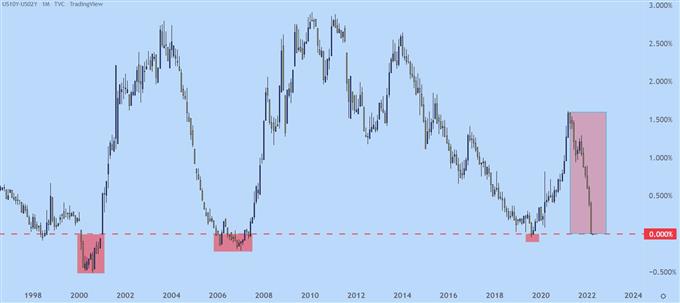

Yield Curve Inverts

In the aftermath of this morning’s report bond markets are showing a bit of distortion as the 2/10 Treasury curve has inverted. This is often approached as a sign of possible turbulence ahead, as the fact that investors are demanding a higher rate of return for shorter-term debt highlights a massive sense of distortion.

This is often attributed to the fact that investors’ pessimism drives them into what’s often considered to be safer but lower-yielding vehicles of Treasury securities. And since price and yield is inverse, with investors ducking for safe harbors at longer-terms could force yields on maturities that are further out to fall below those of shorter-dated securities.

This morning marks only the 4th time that this Treasury curve has inverted since the year 2000.

US Treasury 2/10 Yield Curve Spread

Chart prepared by James Stanley

Added 9:00 AM ET

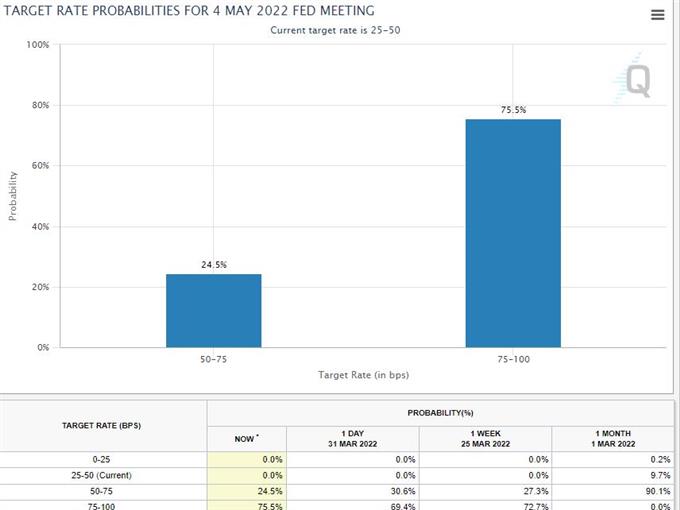

Rate hike odds have edged up a bit, with an approximate 71% chance of a 50 basis point hike in May moving up to 75.5% within the half-hour after the release of NFP.

Target Probabilities for Rates May, 2022

Chart prepared by James Stanley; data from CME Fedwatch

Added 8:47 AM ET

The initial move in U.S. equity futures appears to be negative, albeit relatively slight at this early-stage. The context here is of interest, however, as a massive rally developed on the heels of the Fed’s rate hikes that drove prices in to the end of the quarter. But, there was a heavy reaction in the final hours of yesterday’s trade as the door was closing on Q1, which could be explained by end-of-quarter window dressing or, possibly, the start of something new.

At this point with about 45 minutes until the U.S. equity open futures are pushing towards support after yesterday’s sell-off. In the S&P 500, this zone is from around 4530-4538, and since coming into play it helped to build a bear flag taking the form of a rising wedge overnight. The big question is whether sellers will take a swing around the open to help open up the first day of Q2 trade.

S&P 500 Hourly Price Chart

Chart prepared by James Stanley; S&P 500 on Tradingview

Updated After the NFP Release 8:39 AM ET

Non-farm Payrolls for the month of March has come in below expectations, printing at 431k v/s the expectation of 490k. But that was only a portion of this morning’s report as there was a massive revision to prior months’ data, with January being revised higher to +504k and February being revised up to a whopping +750k.

This will surely not help those that were hoping for the Fed to calm from the recent hawkish rhetoric.

But deeper within the report is even more positive items for the U.S. economy, as Average Hourly Earnings printed at 5.6% v/s the expected 5.5%, and the unemployment rate impressed, as well, coming in at 3.6% v/s the expected 3.7%.

So, all in all, this seems to be about as positive a report as we could hope for given a miss on the headline number. The bigger question and what remains to be answered is how market participants will price this in given the intense focus on the FOMC and the US Dollar.

At this point, just seven minutes after the release, the US Dollar is showing a muted move that’s essentially a net of flat.

US Dollar One Minute Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

Today brings the start of Q2 and this morning marks that new quarter with the release of Non-Farm Payrolls for the month of March.

The name of the game at this point is rate hikes out of the Fed but the questions is ‘how many’? The normally loose and passive Federal Reserve has been jolted into action by persistently-high inflation that, for much of 2021, they dismissed as ‘transitory.’ But, throughout the period inflation remained above target and the labor market remained red hot, and by November of last year the Fed had started the process of turning the Titanic outlay of loose fiscal policy into a more-hawkish direction.

The March FOMC rate decision marked the start of the bank’s hikes in the effort of tempering that inflation and just after the move, FOMC Chair Powell opined that one of the main motivators for the bank was just how hot the labor market had become. This morning is the first NFP report since that rate hike and this sets the stage for the next FOMC rate decision in early May, where the bank is currently expected to hike rates by 50 basis points.

Updating…

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX