Australian Dollar Analysis and Talking Points

- Australian Dollar to Find Support on Dips

- IG Client Sentiment Remains Bullish for the Aussie

Australian Dollar to Find Support on Dips

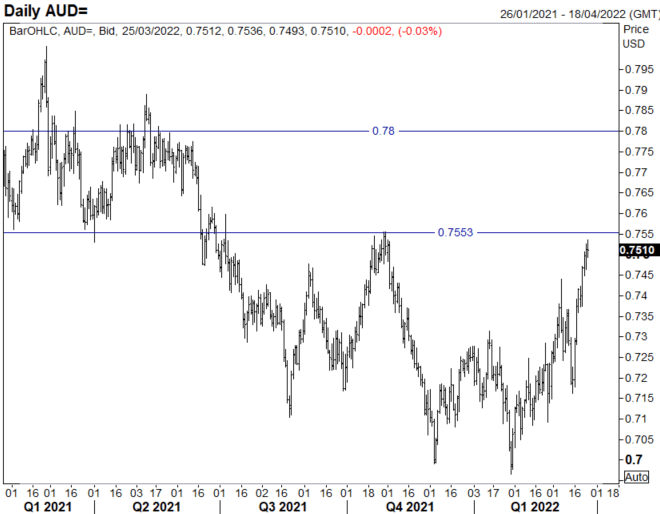

The Australian Dollar goes from strength to strength as firmer commodity prices underpins. This has somewhat shielded the currency from the recent geopolitical tensions and the increased hawkishness from the Federal Reserve. What’s more, with Australia experiencing a strong balance of payment position, supported by record trade surpluses, this further adds to support for the currency. As such, the outlook for the Aussie remains bullish where dips will likely to find support. This will be particularly the case given that the RBA appears to be further behind the curve on the inflation front relative to its counterparts. With the AUDUSD breaking above the 0.7500 handle, eyes are geared towards a test of 0.7800 in the medium term.

IG Client Sentiment: AUD/USD

Data shows 35.59% of traders are net-long with the ratio of traders short to long at 1.81 to 1. The number of traders net-long is 0.72% higher than yesterday and 15.99% lower from last week, while the number of traders net-short is 2.35% higher than yesterday and 23.90% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bullish contrarian trading bias.

AUD/USD Chart: Daily Time Frame

Source: Refinitiv