USD/CAD Analysis

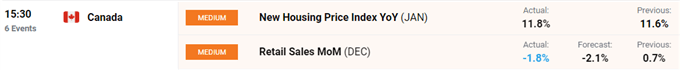

- Canada Retail Sales ACT: -1.8%, EST: -2.1%; New Housing price Index ACT: 11.8%

Retail Sales and New Housing Price Data Adds to BOC Rate Hike Expectations

Canadian retail sales beat estimates for the December period (see economic calendar below), while the new housing price index for January ticked slightly higher than previous adding to the inflationary pressure reflected in the CPI data earlier this week. Hawkish pressure on the Bank of Canada (BoC) to raise rates is mounting, giving a positive outlook for the loonie.

Source: DailyFX Economic Calendar

This being said, slumping oil prices after Iranian supply talks have minimally impacted CAD as a weaker dollar continues to prevail. Going forward, dollar weakness is likely to subside leaving CAD open to depreciation against the dollar particularly if oil prices correct lower.

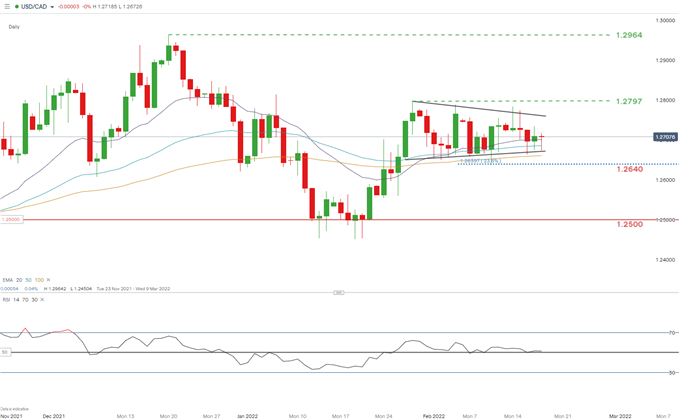

USD/CAD DAILY CHART

Chart prepared by Warren Venketas, IG

Key resistance levels:

- 1.2964

- 1.2797

Key support levels:

- 1.2640

- 1.2500

IG CLIENT SENTIMENT DATA MIXED

IGCS shows retail traders are currently prominently long on USD/CAD, with 65% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but after recent changes in longs and shorts, sentiment reveals a neutral bias.

| Change in | Longs | Shorts | OI |

| Daily | 0% | -9% | -6% |

| Weekly | 48% | -10% | 3% |

Contact and follow Warren on Twitter: @WVenketas