Federal Reserve, FOMC, Inflation, US Dollar – Talking Points

- FOMC participants behind notion that policy needs to normalize to fight inflation

- Path for balance sheet reduction not yet determined by policymakers

The FOMC meeting minutes for the Fed’s January meeting revealed that policymakers are set to move as inflation continues to run hot in the US. Most participants believe the time has come for the Fed to look to alter the Fed Funds target range, with a path yet to be determined for balance sheet reduction. Some participants stated that the conditions may be right later this year to begin reducing the balance sheet. Officials noted that inflation risks remain skewed to the upside, and that the Fed will need to remain flexible in order to make any “necessary policy adjustments.”

“Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate…” confirms the notion that the Fed could raise rates more aggressively than just 25 basis point (bps) increments. Officials also commented on the nature of net asset purchases, with most participants agreeing that the Fed should stick to the schedule outlined in December, which would see bond buying conclude in March.

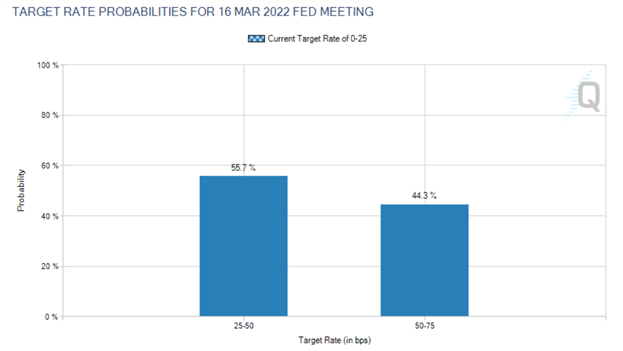

Fed Funds Probabilities

Courtesy of CME Group

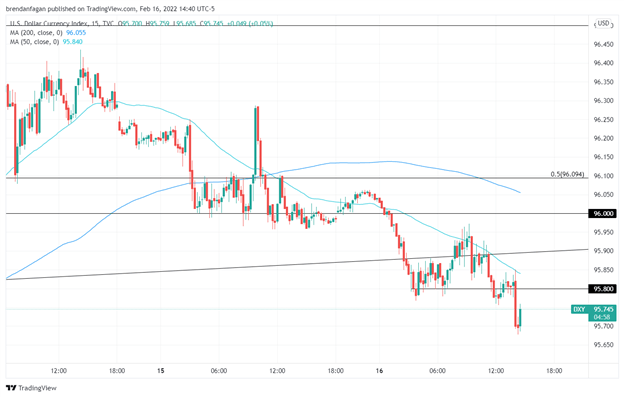

Risk assets caught a bid in the aftermath of the Fed minutes being released, as traders moved quickly to lower forecasts for a 50 bps hike at the March policy meeting. At the beginning of the week, markets were pricing in a roughly 70% chance of a 0.50% hike in March. Those odds have now fallen closer to 50/50, with market participants reverting to the original forecast of just a 25 bps hike. The US Dollar fell to session lows below 95.70 following the release of the minutes, after being under sustained pressure throughout the day.

US Dollar 15 Minute Chart

Chart created with TradingView

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter