Russia-Ukraine Latest: Multi-Asset Market Response

- Russia’s defence ministry reports partial withdrawal of troops in Southern and Western military regions

- Market response: Gold, oil, USD, JPY and EUR

Russian Defence Ministry Confirms Certain Troops to Return to Base

News that Russia is sending troops in the Southern and Western military districts back to base has filtered through to markets, providing somewhat of a pullback in ‘escalation sensitive’ assets.

After days without any signs of progress, even this relatively small development has rippled through global markets. Below is a snapshot of how gold, oil, the US dollar and USD/JPY have reacted.

Market Reaction

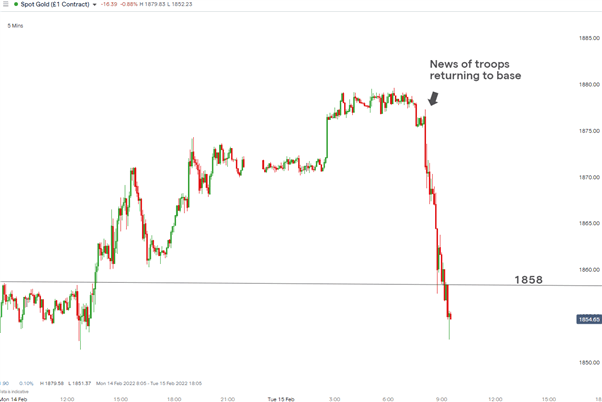

Gold

Gold price action was always going to be skewed to the upside in times of geopolitical instability/tension which saw the yellow metal shoot from the 1830/35 level to around 1877 after news last Friday that an invasion is imminent and could happen at any stage. However, the Ukrainian and Russian representatives have played down the threat of immediate invasion while Russia has actually denied any intent to invade Ukraine.

Gold has cooled slightly, dropping around $25.

Gold 5 Min Chart

Source: IG, prepared by Richard Snow

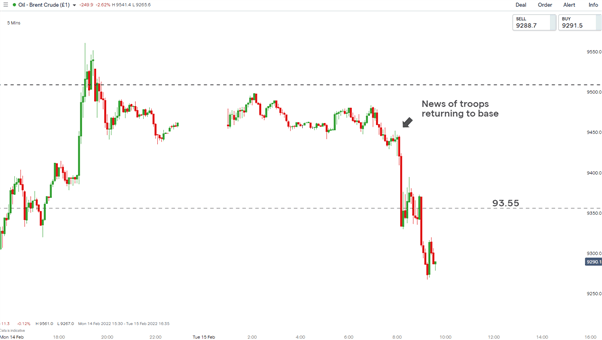

Brent Crude Oil

Oil has been elevated for months now and the fear of supply disruptions as a result of an invasion only added to the its impressive rally. Brent Crude dropped by around $1.80 but now trades around $1.40 lower since the news. The reprieve in oil prices is not expected to be very large as elevated demand and reduced supply are likely to keep oil supported.

Crude Oil 5 Min Chart

Source: IG, prepared by Richard Snow

US Dollar (DXY) - US Dollar Basket

The US dollar, viewed in the context of its proxy, the US dollar basket, declined around 25 points after the news broke and trades around 18.8 points lower currently. The dollar typically remains supported during times of geopolitical tensions and performs as a ‘safe haven’ due to its status as the worlds reserve currency.

DXY 5 Min Chart

Source: IG, prepared by Richard Snow

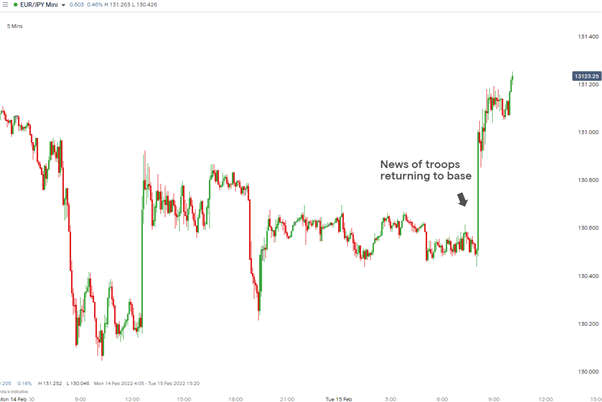

JPY

USD/JPY experienced less of a move as both currencies are considered ‘safe haven currencies’.

USD/JPY

Source: IG, prepared by Richard Snow

However, relatively big move in EUR/JPY ensued as the Eurozone’s energy situation is hugely reliant on Russia for gas.

EUR/JPY 5 Min Chart

Source: IG, prepared by Richard Snow

Similarly to the EUR/JPY move, a fairly decent rise in EUR/USD took shape too. The Euro has suffered as a result of a relatively more dovish European Central Bank (ECB) was only recently open to the idea of a rate hike in Q4 of this year despite other central banks already raising rates (BoE) or almost certain to hike rates in the upcoming meeting (Fed).

EUR/USD 5 Min Chart

Source: IG, prepared by Richard Snow

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX