EUR/USD ANALYSIS

- US Total Vehicle Sales remains weak.

- ECB doves to speak.

- All eyes on US CPI.

- Technical analysis hints to bullish EUR/USD setup.

- IG Client Sentiment points to short-term hesitancy.

EURO FUNDAMENTAL BACKDROP

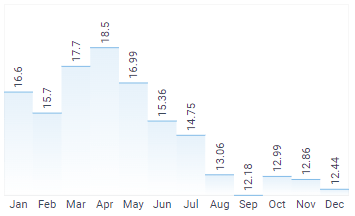

The Euro opened up slightly higher against the U.S. dollar this morning after a poor showing on the US vehicle sales front for the January period. Total sales declined for a third straight month (see graphic below). The declining nature of the data has been largely due to automotive chip shortages leading to supply constraints but nonetheless a negative for the greenback.

US TOTAL VEHICLE SALES (JAN)

Source: DailyFX Economic Calendar

Yesterday, the ECB’s Schnabel did not do much in the way of easing market expectations stating “Monetary policy, for its part, cannot afford to look through energy price increases if they pose a risk to medium-term price stability.” On the docket today, ECB board members Guindos, Lane and Villeroy are scheduled to speak. Traditionally geared towards the dovish stance, we may see some downward pressure on the Euro should they maintain their historical viewpoints.

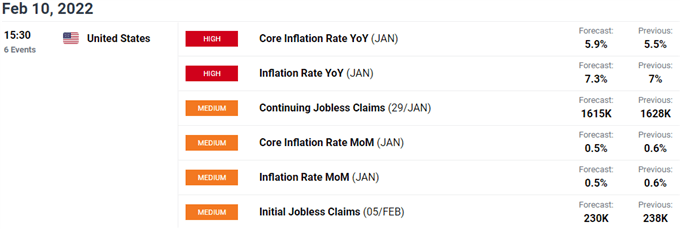

As mentioned in yesterdays’ analysis, US inflation is the focus of the day (see calendar below) and may likely overshadow the aforementioned ECB comments. A release higher than expected will likely result in a move lower on EUR/USD while a miss could see Euro bulls flood the market.

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart above may be laying the foundation for a US CPI miss later today with the bullish EMA crossover (blue) underway while price action may be revealing a breakout from the short-term falling wedge formation (black).

Resistance levels:

- 1.1500

Support levels:

- 1.1400/100-day EMA

- 50-day EMA/20-day EMA

- 1.1300

IG CLIENT SENTIMENT DATA CAUTIOUS

IGCS shows retail traders are currently short on EUR/USD, with 59% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, the recent change in long and short positioning result in a mixed bias.

| Change in | Longs | Shorts | OI |

| Daily | -10% | 6% | -5% |

| Weekly | -18% | 12% | -9% |

Contact and follow Warren on Twitter: @WVenketas