GOLD PRICE OUTLOOK:

- Gold extended a 4-day gain to $1,828 as investors mulled inflation concerns ahead of the US CPI figures

- Heightened geopolitical tensions between Russia and Ukraine lent support to the yellow metal

- Prices are eyeing $1,834 for immediate resistance, breaching which may open the door for further gains

Gold extended a four-day gain to $1,828 during Wednesday’s APAC mid-day trading session as traders mulled rising price levels and wage pressures. Traders are eyeing Thursday’s release of US CPI data, which is expected to hit 7.3% in January - a fresh four-decade high. Rapidly climbing price levels buoyed the yellow metal as it is widely perceived as a store of value and hedge against inflation. Expectations for the CPI data have likely been baked in however, rendering gold prices vulnerable to a pullback should market participants ‘sell the facts’.

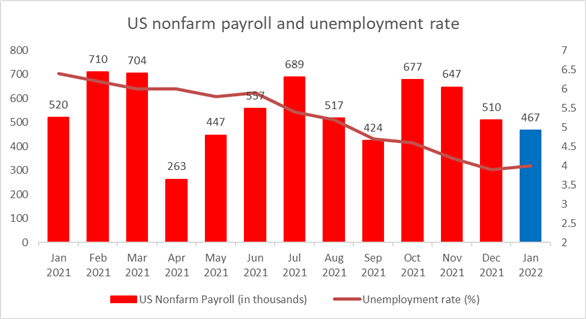

Prior to this, a much stronger-than-expected US jobs report spurred bets on Fed tightening, with more investors anticipating a 50bps rate hike in March compared to a week ago. The Bureau of Labor Statistics (BLS) showed on Friday that 467k jobs were added in January, compared to an expected 150k increase. There were also substantial upward revisions to the prior two months. Wage growth has been strong too, allowing consumers to spend more and push prices even higher. Expectations about more aggressive Fed rate hikes are limiting the upside potential for gold and other precious metals because they are non-yielding.

Gold traders have been attempting to strike a balance between rising inflation and intensified bets on Fed tightening policy recently, resulting in a tight range trading condition.

US Nonfarm Payrolls and Unemployment Rate

Source: Bloomberg, DailyFX

Meanwhile, heightened geopolitical tensions on the Russia-Ukraine border drove up demand for safety, lending support to gold prices. The yellow metal has long been perceived as a hedge against geopolitical unrest, and it may stand a good chance to leap up should the situations worsen further.

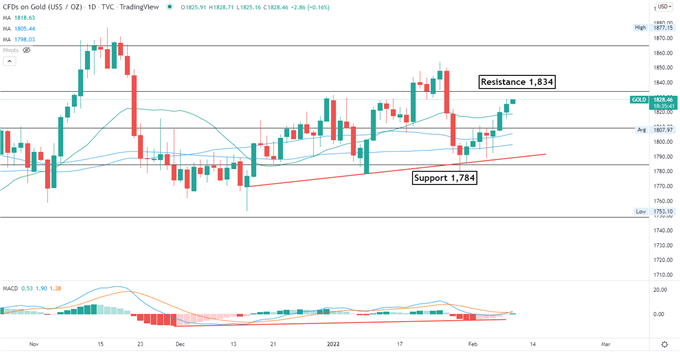

Technically, gold prices rebounded from the trendline support as highlighted on the chart below. Prices have breached above the 100-day SMA line and eyeing the next resistance level of $1,834 – the 38.2% Fibonacci retracement. The MACD indicator formed a bullish crossover above the neutral midpoint, suggesting that bullish momentum may be building.

Gold - Daily Chart

Chart created with TradingView

| Change in | Longs | Shorts | OI |

| Daily | 0% | 1% | 1% |

| Weekly | 11% | -9% | 0% |

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter