EUR/USD Analysis:

- German Bund Yield temporarily trades above zero as markets bet against ECB rate hiking timeline

- Positioning readjustment in USD after a largely bid dollar towards month end

- EUR/USD Key Technical Levels Heading into ECB Rate Decision

German Bund Yield Breaches the Zero Mark Once more

Yesterday, German 10-year Bund yields rose above zero for the third time this year after each previous breach of this psychologically important level witnessed a drop below zero. Prior to this year the Bund yield last traded above zero in April of 2019.

The recent rise in yields, alongside the latest USD drop, could help support EUR/USD into the ECB interest rate decision on Thursday.

German Bund (10 Year) Yield Chart

Source: Tradingview

Dollar Positioning Adjustment Buoys the Euro

Towards the end of January the US dollar climbed at an impressive rate. This was during the time when banks look to adjust their FX exposure, oftentimes resulting in purchases of USD. Additionally, the global equity market rebound coincided with dollar declines as investors’ appetite for risk increased across the board.

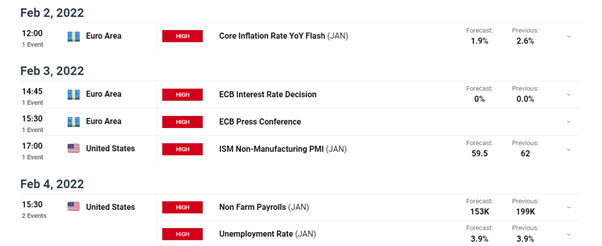

Risk Events Ahead

German unemployment data came in way better than expected with a 46k decline against a mere 6k decline resulting in an unemployment rate of 5.1%. Eurozone unemployment similarly, came in better than expected as the unemployment rate is now 7%. Tomorrow however, sees the release of Euro inflation (flash) data for January with the ECB and BoE rate decisions on Thursday, followed by NFP on Friday.

Customize and filter live economic data via our DaliyFX economic calendar

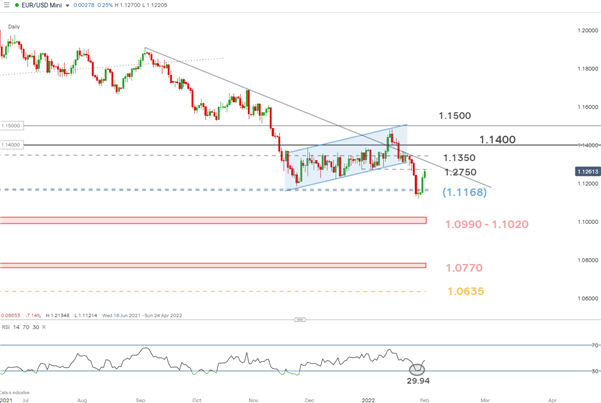

Key (EUR/USD) Technical Levels Heading into ECB Rate Decision

As mentioned before, the Euro is looking supported heading into the ECB rate decision but currently faces resistance at 1.2750, followed by 1.1350. Support comes in at 1.1168 and the recent low at 1.1121 as the RSI appeared to come out of oversold territory. The Euro support is likely to be short-lived as markets continue to ramp up hawkish expectations around the Fed’s March meeting where it is almost a certainty that we will see the first US rate hike since the start of the pandemic. Increased rate hike expectations tend to boost USD at the expense of the relatively dovish ECB.

EUR/USD Daily Chart

Source: IG, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX