USD, EUR, GBP Analysis and News

- Powell Retires Transitory View on Inflation

- Powell Signals Faster QE Taper

- USD Soars, while Month-End Rebalacing Exacerbates Market Moves

In his testimony to the Senate Banking Committee, Fed Chair Powell stated that it was a good time to retire the word ‘transitory’ for inflation, noting that transitory means not leaving permanent mark on prices. Keep in mind that in recent months, inflation has remained elevated, the most recent headline reading at 6.2% and thus the team transitory argument has been harder to support.

In turn, Powell looks to in favour of the consensus view to taper QE at a faster pace, having stated that it would be appropriate to discuss a faster taper. To add to this, with many expecting Powell to provide a slightly dovish tilt given the recent concerns pertaininty to the Omicron variant, this in itself is a hawkish surprise. A reminder, given that the Fed will be in the blackout period after Friday, this is Powell’s opportunity to send a message to the markets and curb the shock on Fed day.

Market Reaction

In reaction to the headlines, the Nasdaq 100 (most sensitive to interest rates) fell near 2% to hit session lows at 16112.

Nasdaq 100 Chart: 30-minute time frame

Source: Refinitiv

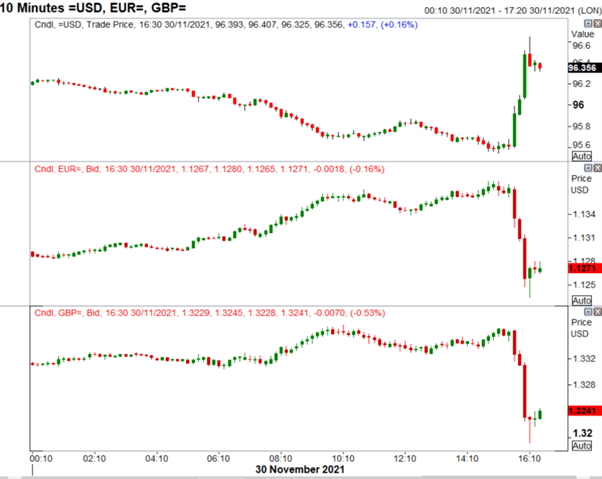

Meanwhile, the USD reversed its earlier losses to hit sessions highs of 96.64, taking both GBPUSD and EURUSD to 1.3196 and 1.1237 respectively. However, it is important to note that FX month end rebalancing likely exacerbated market moves and hence I would expect a partial retracement in the move.

To find out more on month-end rebalancing, click here

USD, EURUSD, GBPUSD Intra-day Chart

Source: Refinitiv