EUR/GBP Price, Chart, and Analysis

The Bank of England may need to hike interest rates earlier than previously expected as UK inflation runs hot, according to two members of the central bank’s rate-setting committee. Speaking to the Yorkshire Post, BoE governor Andrew Bailey said that he is concerned about the current level of inflation.

‘Unfortunately, if you look at our last forecast, it (inflation) is going to go higher I am afraid. As Bank of England governor I would prefer it not to be there’. Acknowledging that the country is going through ‘very unusual times’ governor Bailey added that they have a challenging job on their hands and that ‘ we have got to in a sense prevent the thing becoming permanently embed because that would obviously be very damaging’.

Governor Bailey was not the only MPC member to warn of higher rates over the weekend with known hawk Michael Saunders suggesting that ‘it is appropriate that the market moved to a significantly earlier path of tightening than they did previously’. Speaking to the Daily Telegraph, Saunders warned that interest rates may be raised before the end of the year to head off soaring inflation.

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

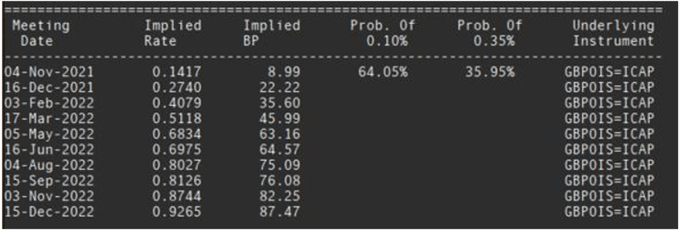

The next Bank of England meeting, with the latest Monetary Policy Report, is set for November 4 and this meeting will now take on added significance if the central bank is to pull the trigger on rate hikes this year. The market is already implying a 0.15bp rate hike in December with further hikes seen next year.

Data by Refinitiv

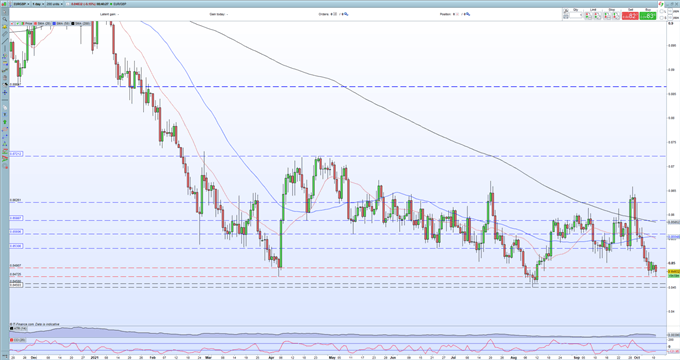

Sterling is pushing higher across the board, aided by ongoing weakness in various other currencies. GBP/JPY has jumped above 154.00 to print a new multi-week high, while Sterling is also up nearly 1/3 of a cent higher against the USD and the Euro. Looking at EUR/GBP, the pair look set to test resistance just under 0.8450. Below here EUR/GBP will be back to lows seen in February 2020. The daily chart remains bearish but oversold. This current mixed bias is confirmed by current retail positioning (see below).

EUR/GBP Daily Price Chart – October 11, 2021

Retail trader data shows 78.59% of traders are net-long with the ratio of traders long to short at 3.67 to 1.The number of traders net-long is 0.50% lower than yesterday and 56.86% higher from last week, while the number of traders net-short is 1.90% higher than yesterday and 21.82% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.