USD, NFP Price Analysis & News

- US NFP 194k vs 500k, Prior Reading Revised Higher

- Unemployment Rate Drop Overstated by Labour Force Dip

- Fed Tapering a Done Deal

NFP Mixed as Headline Misses, Revision Upgraded, While Unemployment Rate Beats

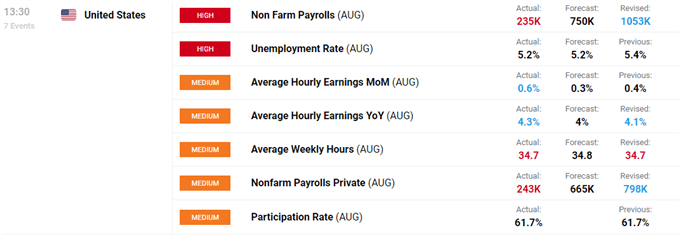

A much weaker than expected NFP headline at 194k vs 500k, while the prior reading had been revised higher to 366k from 235k. The unemployment rate fell 0.4ppts to 4.8% dropping below expectations of 5.1%. Now while the unemployment rates looks better than expectations, keep in mind the labour force participation rate fell 0.1ppt to 61.6% and thus overstates the drop in the unemployment rate, subsequently this slightly discounts what would appear to be a big positive.

Elsewhere, average hourly earnings beat expectations on the monthly reading, while the yearly rate matched estimates. However, the prior readings saw a downside revision. Once again, the ADP report proves it is not a good indicator for NFP.

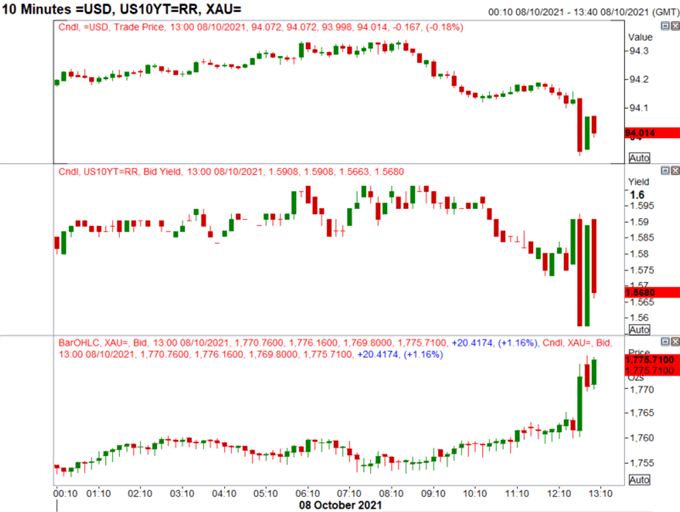

USD Drops and Gold Pops

In reaction to the headline, the USD came under immediate pressure briefly dipping below the 94.00 handle alongside yields, while the gold rose to its best levels of the day to hit a high of 1776. However, as I mentioned before, a November taper is a done deal, so this report will have not have moved the needle, particularly after Fed Chair Powell said the report needs to be reasonably good. Instead, the report has slightly cooled off rate hike bets, which in turn keeps equities on the bid.

Find Out More About Non-Farm Payrolls and How to Trade it

DATA OVERVIEW: DailyFX Economic Calendar

Source: DailyFX

USD, Gold, Rates Reaction to NFP: Intra-day Time Frame

Source: Refinitiv