CAD, USD/CAD, Analysis and Talking Points

- CAD Weakens as Risk Appetite Dips

- BoC to Stick With October Taper

CAD Weakens as Risk Appetite Dips

A modest bout of risk off sentiment sees commodity linked currencies on the backfoot with safe-havens outperforming. AUD/USD ultimately fell on the back of a dovish taper, with the initial spike higher quickly faded. As I mentioned last week, the Aussie had moved from one extreme to the next, making upside in the pair harder to come by.

USD/CAD continues to hold onto key support in the form of the 200DMA situated at 1.2527, with the current bounce now seeing the 38.2% fib of the 2021 range tested. Above this area of resistance eyes will be on for a move towards 1.2650, however, this would need to be accompanied by a more pronounced pullback in risk appetite and commodities. As it stands, trend signals are somewhat directionless and thus price action could be somewhat choppy in the week ahead.

As I said previously, key support is situated at the 200DMA, therefore a close below this level would likely confirm 1.2947 as a top and increase pressure on the downside with a move to 1.2420.

USD/CAD Chart: Daily Time Frame

Source: Refinitiv

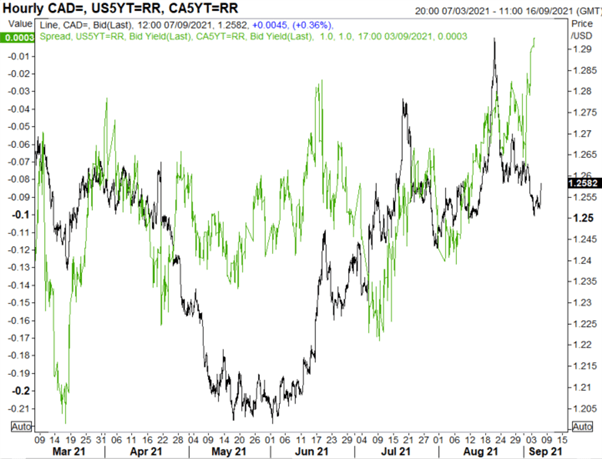

For CAD traders, aside from risk trends, focus will lie on the BoC’s monetary policy decision. Since the prior meeting, economic data has come in a touch firmer with the BoC’s CPI measure at 2.5% from 2.3%, while the unemployment rate has dropped from 7.8% to 7.5%. That said, the BoC are likely to stick with its plan to taper QE further in October. However, a factor to be aware of is the recent rise in US/CA 5Y spreads, which points to topside risks for USD/CAD.

USD/CAD vs US/CA 5YR Spreads

Source: Refinitiv

A Helpful Guide to Support and Resistance Trading

| Change in | Longs | Shorts | OI |

| Daily | 17% | -5% | 3% |

| Weekly | 66% | -14% | 6% |

IGCS: USD/CAD Outlook Mixed

Data shows 72.64% of traders are net-long with the ratio of traders long to short at 2.66 to 1. The number of traders net-long is 5.19% higher than yesterday and 5.75% higher from last week, while the number of traders net-short is 14.02% higher than yesterday and 3.60% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.