Nasdaq 100, S&P 500, Dow Jones – Talking Points

- Nasdaq 100 loses finishes down 6 points as tech stocks take a breather

- Month-end rebalancing sees Dow Jones, S&P 500 lose roughly 0.10%

- Equities post seventh straight month of gains, longest run since January 2018

US equity indices retreated slightly on Tuesday to round out August, with the S&P 500 recording its seventh consecutive month of gains. The current winning streak is the longest since January 2018 when a 10-month bull run ended. The Dow Jones Industrial Average fell 39 points or 0.11%, while the S&P 500 fell by 0.13%. The Nasdaq Composite Index outperformed both peers on the day, shedding just 0.04%. Risk-off sentiment was set by European equities, which retreated on murmurs over a discussion of tapering by ECB officials. August also represented the last trading day of the month, a day popular with buy-side money managers for rotation and reallocation.

NDX (Nasdaq 100 Index) 1 Hour Chart

Chart created with TradingView

Weighing on the Nasdaq 100 Index was Zoom Communications, which tumbled nearly 17% on the back of earnings on Monday. Despite beating revenue and earnings expectations, the company revealed slowing revenues, highlighting the impact of people returning to offices and the reopening of schools. With major economies forging ahead with vaccination programs, the need for remote communications appears to be waning. Following a 3% gain on Monday, shares of Apple retreated slightly. Shares of Amazon and Netflix rose to help offset losses throughout the broader index.

Zoom Communications Daily Chart

Chart created with TradingView

The broader market remains at elevated levels despite geopolitical tensions, fears over a Fed taper, and questions over valuations. As we enter September, historically a subdued month for equities, the S&P 500 has not had a 5% correction in 2021. The sheer ability for markets to grind higher has seen strategists across Wall Street scramble to revise year-end forecasts for the S&P 500 higher.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -4% | -2% |

| Weekly | 18% | -17% | -4% |

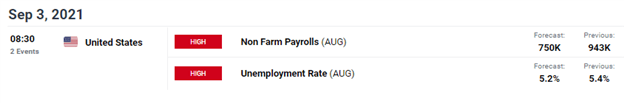

Markets will start to cast an eye on Friday’s non-farm payrolls report for August. The Federal Reserve will be following the data closely as we tick closer to the central bank’s eventual taper announcement. Chair Jerome Powell set the table for a fall taper, indicating that it will commence sometime before the end of the year, data dependent. Heading into Friday, the consensus estimate is that the US economy added 750k jobs in August, with the unemployment rate ticking lower to 5.2%.

US Economic Calendar

Courtesy of DailyFX Economic Calendar

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter