DOW JONES, HANG SENG INDEX, ASX 200 INDEX OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 indexes closed +0.31%, +0.26% and +0.03% respectively

- Cyclical sectors pulled back amid lingering viral concerns and weaker Chinese data

- Futures across the APAC markets are positioned to open modestly higher. US retail sales data in focus

Chinese Data, Crude Oil, Pandemic, US Retail Sales, Asia-Pacific at Open:

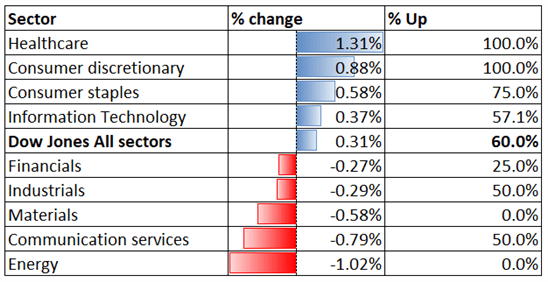

The Dow Jones Industrial Average advanced to an all-time high on Monday, lifted by defensive sectors such as healthcare and consumer staples. On the other hand, cyclically-oriented sectors such as energy, material and industrials led the decline as investors mulled rising Delta variant cases around the world and much weaker-than-expected Chinese retail sales and industrial production figures.

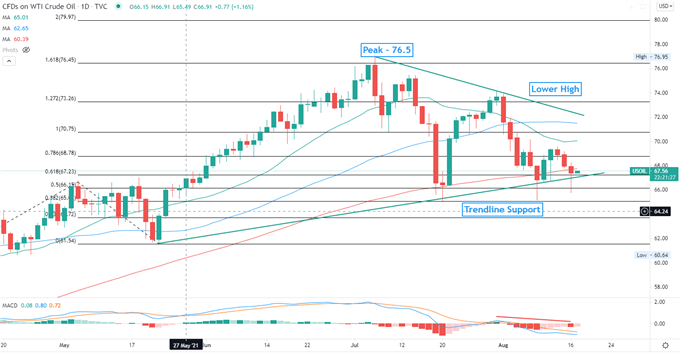

Both gauges fell short of market expectations and marked a fourth consecutive monthly decline, showing that the world’s second-largest economy is struggling to maintain growth momentum amid a viral resurgence and extreme weather conditions. As a result, WTI crude oil prices fell for a third day as the outlook for energy demand waned. The DXY US Dollar Index fell from a key level at 93.00 overnight, potentially forming a “Double Top” chart pattern.

China continued to adopt tighter travel restrictions and imposedlockdowns in areas where Covid-19 infections were found. The National Health Commission (NHC) reported only 13 new locally transmitted coronavirus cases on Monday, the lowest daily total in more than two weeks. This presented a silver lining for putting the pandemic under control, yet the authorities may continue to adopt tight measures to prevent resurgence.

WTI Crude Oil Price - Daily

Asia-Pacific markets are positioned for a positive start to the day. Futures in Japan, mainland China, Australia, Hong Kong, Singapore, India and Thailand are in the green, whereas those in South Korea, Taiwan and Malaysia are in the red.

Looking ahead, the RBA meeting minutes leads the economic docket alongside US retail sales. Find out more from the DailyFX calendar.

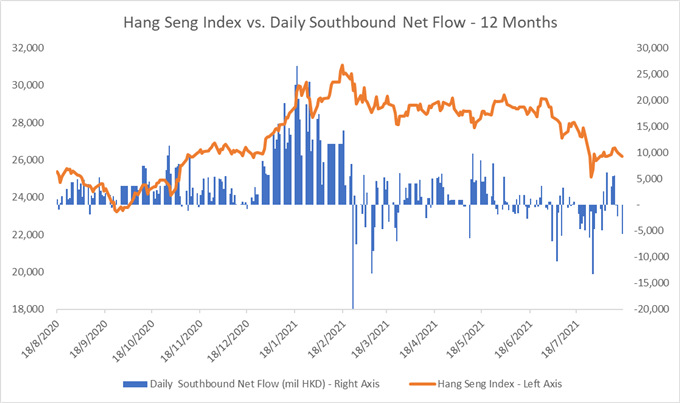

Hong Kong’s Hang Seng Index (HSI) lost 0.80% on Monday, dragged by Tencent (-3.5%) and Meituan (-5.1%). The stock connections registered HK$ 5.63 billion of net Southbound outflows (chart below), reflecting that more mainland sellers are returning to Hong Kong’s market amid fears about further regulatory clampdowns.

Source: Bloomberg, DailyFX

Looking back to Monday’s close, 4 out of 9 Dow Jones sectors ended higher, with 60% of the index’s constituents closing in the green. Healthcare (+1.31%), consumer discretionary (+0.88%) and consumer staples (+0.58%) were among the best performers, whereas energy (-1.02%) and communication services (-0.79%) trailed behind.

Dow Jones Sector Performance 17-08-2021

Source: Bloomberg, DailyFX

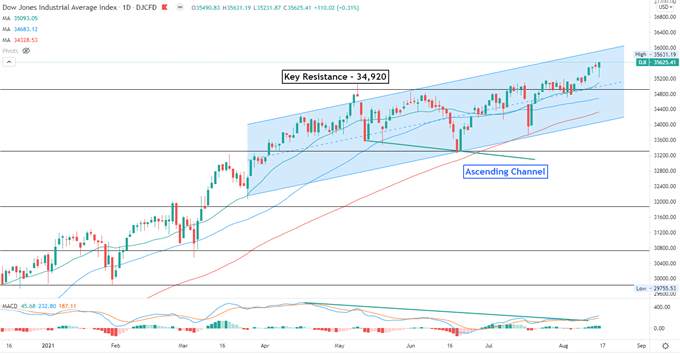

Dow Jones Index Technical Analysis

The Dow Jones index breached above a key resistance level at 34,920, thus opening the door for further gains. Prices remain in an “Ascending Channel”, as highlighted on the chart below, suggesting that the overall trend remains tilted to the upside. Bearish MACD divergence suggests that upward momentum may be weakening however.

Dow Jones Index – Daily Chart

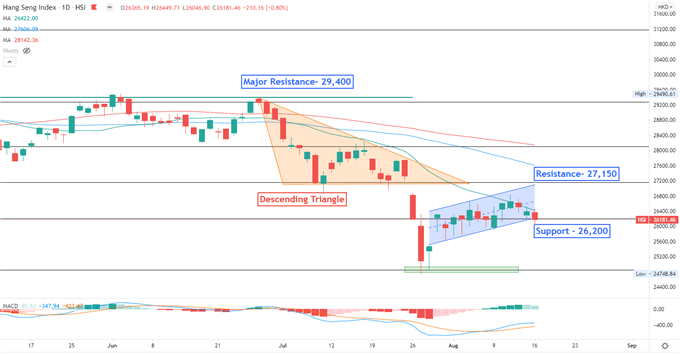

Hang Seng Index Technical Analysis:

The Hang Seng Index has likely formed an “Ascending Channel” as highlighted on the chart below. The ceiling and the floor of the channel may be viewed as immediate resistance and support levels respectively. Breaching below the 26,200 support may open the door for further losses.

Hang Seng Index – Daily Chart

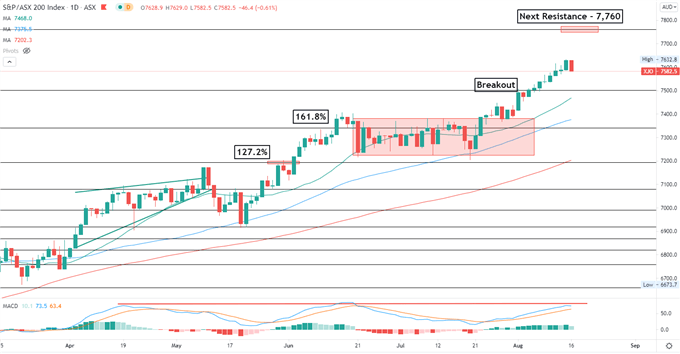

ASX 200 Index Technical Analysis:

The ASX 200 index has breached above a key resistance level at 7,500 and opened the door for further upside potential. The next key resistance level can be found at 7,760 – the 261.8% Fibonacci extension. The overall trend remains bullish-biased, as suggested by the consecutive higher highs and higher lows formed over the past few months. The MACD indicator is about to hit a trendline resistance and may see a pullback. That said, near-term momentum may be faltering.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter