RAND ANALYSIS

- Rand slips against dollar YTD.

- High impact U.S. economic data this week.

- Key levels to watch on daily chart.

ZAR FUNDAMENTAL BACKDROP

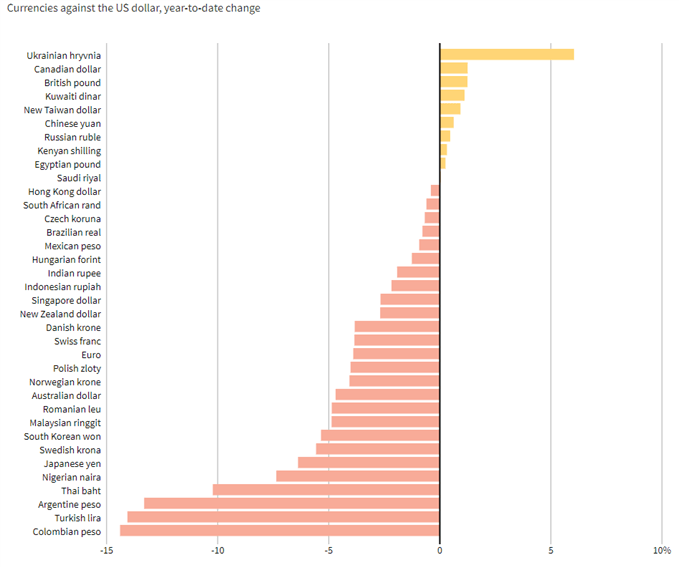

The South African rand is now trading down against the greenback year-to-date (see graphic below) after holding the title as the top performing Emerging Market (EM) currency for much of 2021. This comes after strong U.S. employment data last week along with the surprise resignation of Finance Minister Tito Mboweni during the local cabinet reshuffle announcement. Initially, the market responded critically to the news which largely lingers as South Africans await further announcements and decisions by the incumbent.

Global FX Rates vs USD 2021:

Source: Reuters

SUPPORTIVE SOUTH AFRICAN MANUFACTURING DATA, DELTA VARIANT CONCERNS & US CPI

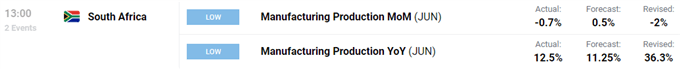

Manufacturing production MoM for June came in well below estimates at -0.7% however, the year-on-year figures reflected a positive print at 12.5% (see calendar below). The rand reacted favorably to the announcement albeit marginal as focus shifts to the U.S.

Source: DailyFX economic calendar

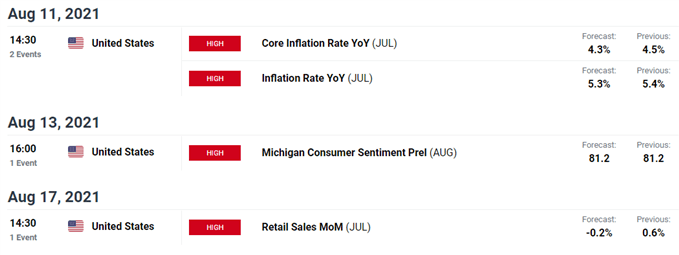

The COVID-19 delta variant is causing concern in the U.S. as well as many other countries throughout the globe triggering a lean towards a risk averse stance. In conjunction with the above, QE taper pressure is mounting and could be exacerbated by the upcoming CPI data (see calendar below). Should actual figures come in higher than expectations, the dollar could see another bullish uptick.

Source: DailyFX economic calendar

GET YOUR Q3 RAND FORECAST HERE!

TECHNICAL ANALYSIS

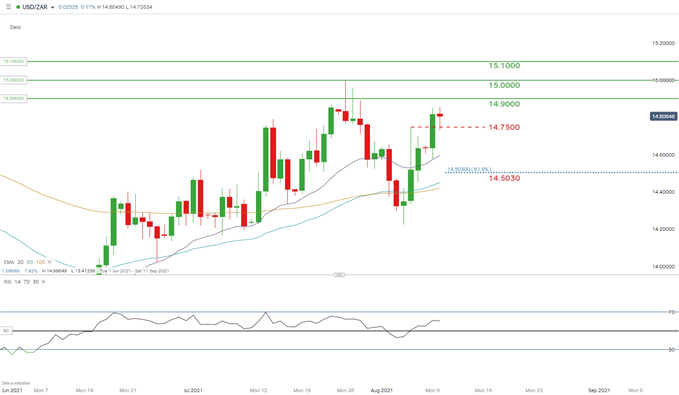

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

The daily USD/ZAR chart above illustrates the sudden rise on the EM currency pair. Today’s price action shows a slowing in upside momentum as delta variant concerns weaken. The future of the rand is heavily dependent on dollar influences and global risk sentiment however, my long-term outlook remains bullish. Short-term the rand could see small gains to the 14.7500 support handle before pushing up towards 14.9000.

Resistance levels:

- 15.0000

- 14.9000

Support levels:

- 14.7500

- 20-day EMA (purple)

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas