CANADIAN DOLLAR PRICE OUTLOOK: USD/CAD, CAD/JPY REACT TO JOBS DATA

- The Canadian Dollar is trading stronger on the session following employment data

- USD/CAD extends its slide 25-pips as CAD/JPY rises 18-pips in immediate response

- Canada’s unemployment rate dropped to 7.8% from 8.2% as 231K jobs were added

The Canadian Dollar is staging a nice rebound during early Friday trade with the Loonie stronger against most FX peers. While firmer bond yields and crude oil prices are likely helping bid up CAD price action, decent employment data just released out of Canada stands to help keep the Canadian Dollar trading on its front foot.

USD/CAD dipped lower while CAD/JPY popped higher in immediate reaction to the better-than-expected reading for the headlines jobs figure. The Canadian economy added 230.7K jobs in June, which compares to market forecast anticipating 195K and the prior reading of -68K. Looking ‘under the hood’ of the employment report, however, shows that full time employment actually decreased by -33.2K jobs. The unemployment rate declined to 7.8% from 8.2%, but it was expected to drop to 7.7%.

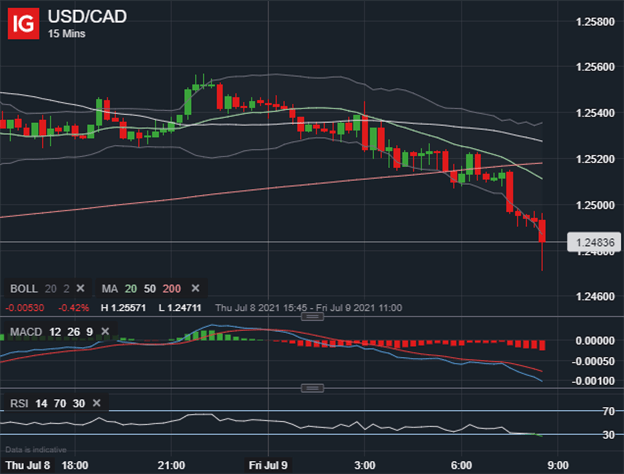

USD/CAD PRICE CHART: 15-MINUTE TIME FRAME (08 JULY TO 09 JULY 2021)

USD/CAD price action, on balance, does not seem too fazed by mixed details in the employment report. The major currency pair trades 57-pips lower on the session at the time of writing with most of the decline occurring in the run-up to the jobs data release. Again, it seems like firmer bond yields and oil prices are larger drivers of Loonie strength at the moment.

| Change in | Longs | Shorts | OI |

| Daily | 9% | -9% | -4% |

| Weekly | -1% | 1% | 1% |

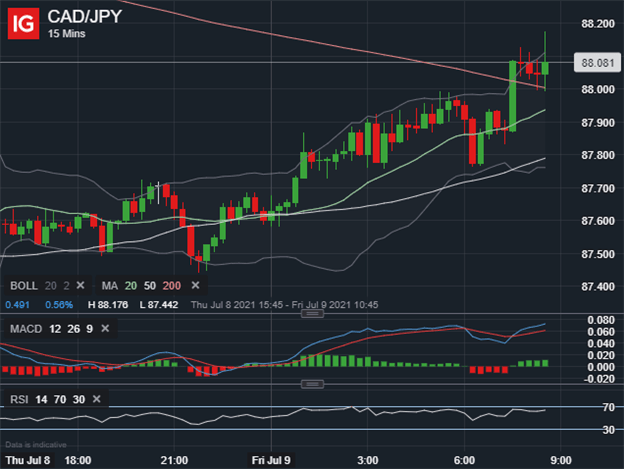

CAD/JPY PRICE CHART: 15-MINUTE TIME FRAME (08 JULY TO 09 JULY 2021)

CAD/JPY reacted similarly to the mixed yet good employment report out of Canada. The Canadian Dollar is currently trading 48-pips stronger versus the Yen on the session with CAD/JPY hovering around session highs. With the Canada jobs report unlikely to budge the current course of BoC policy, I would continue to keep close tabs on the strong positive relationship CAD/JPY typically maintains with interest rate differentials and the direction of crude oil.

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight