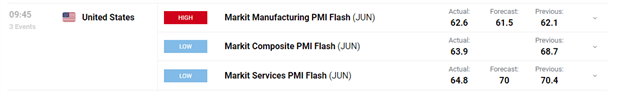

PMI SURVEYS KEY POINTS:

- June Manufacturing PMI surges and climbs to a record high of 62.6 from 62.1 in May

- Meanwhile, Services PMI decelerates and drops to 64.8 from a historic high of 70.4. Despite the slowdown, this is the second fastest expansion recorded in the report

- Both surveys suggest economic recovery continues to move forward

Most read: Nasdaq Record High Doesn't Speak for Risk, Dollar Pairs Look to PMIs

Financial information provider IHS Markit published this morning its June Purchasing Managers’ Index surveys. According to the data, Manufacturing PMI continued to gain momentum and climbed from 62.1 to 62.6, a new record high, supported by robust expansions in output and new orders. Consensus expectations called for a decline to 61.5. With the spectacular result, manufacturing activity managed to grow for the 12th consecutive month, a sign that recovery is in full-swing following the worst economic crisis since the great depression.

Elsewhere, Services PMI data showed a slight cooling, with the June reading sliding to 64.8 from a record of 70.4, disappointing forecasts of a 70 print. Despite the small deceleration, services expanded at the second-sharpest pace since data collection started in 2009 as the economy reopened due lower COVID-19 cases, and pent-up demand from healthy consumers fueled spending. In the United States, the services sector is the main engine of the economy, accounting for approximately 70% of total output. For this very reason, market participants tend to follow this and other similar surveys very closely.

The table below from the DailyFX Calendar summarizes all the results of this morning's PMI data

All in all, the PMI results suggest the economic recovery is humming as we head into the summer season and mobility rises significantly. This strong economic picture, however, did not provoke any major moves in the US dollar, but appeared to have reinforced the negative DXY bias in the early morning trade, likely because of slowdown in services.

Check out DailyFX Education to learn more about fundamental analysis

USD (DXY) INDEX 5 MINUTE CHART

In summary and with a longer-term view, a healthy manufacturing and services sector is likely to boost the labor marker as firms ramp up hiring to satisfy consumer demand. As the employment outlook improves, the debate about monetary policy tightening is likely to grow louder, prompting the Fed to start discussing comprehensively “how and when to begin tapering its bond-buying program”. The prospect of stimulus withdrawal could temporarily provoke risk aversion and volatility, but it is unlikely to cause major market disruption in the long run, especially if the economic recovery does not falter.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download our beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take our quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

- Subscribe to the DailyFX Newsletter for weekly market updates and insightful analysis

---Written by Diego Colman, DailyFX Market Strategist

Follow me on Twitter: @DColmanFX