S&P 500, NIKKEI 225, ASX 200 INDEX OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 closed +0.03%, +0.19%, and +0.33% respectively

- Key US economic data will likely set the tone for trading. Small and mid-cap stocks surged.

- The Nikkei 225 and ASX 200 indexes look set to open steadily following a positive US lead

Wall Street, US data, Inflation, Gold, Asia-Pacific at Open:

US stocks rebounded slightly on Wednesday as investors attempted to strike a balance between robust economic momentum versus rising price levels. Federal Reserve officials reiterated that inflationary pressures might be ‘transitory’, cooling expectations about tapering Fed stimulus. Both the Dow Jones and S&P 500 indexes are trading slightly below their all-time highs, while the Nasdaq 100 index continued its rebound after a “double bottom” chart pattern was formed during May.

Small and mid-cap stocks outperformed as another wave of short squeezes sent AMC Entertainment (19.2%) and GameStop (15.88%) surging. The Russell 2000 index climbed nearly 2%.

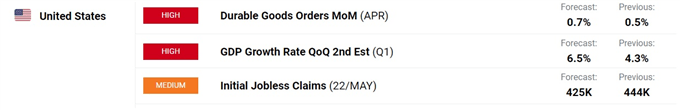

Traders will keep an eye on today’s US Q1 GDP (2nd estimate), April’s durable goods orders as well as weekly jobless claims figures to gauge the strength of an economic rebound. Jobless claims are expected to drop further to a pandemic-low of 425k as the labor market recovered from lockdowns. Stronger-than-expected readings may buoy risk appetite and strengthen the US Dollar.

Source: DailyFX

Asia-Pacific markets are positioned to open slightly higher following a positive lead from Wall Street. Futures in Japan, Hong Kong, mainland China, Australia, Taiwan, Singapore and India are in the green, whereas those in South Korea are in the red. Singapore market resumes trading following the Vesak Day holiday.

Japan’s Nikkei 225 index looks set to extend higher after snapping a five-day winning streak. A weakening Japanese Yen may lend further support to Japanese equities, due to its favorable impact on exports. The Japanese government decided on Wednesday to extend the state of emergency in Tokyo and several other major areas into June, as the number of Covid-19 cases stayed persistently high. This will also help the country to better prepare for the open of summer Olympic scheduled on July 23rd. Market reaction may be muted as the extension has beenwidely anticipated.

Australia’s ASX 200 index is attempting to reclaim its all-time high as investors shrugged off inflation concerns this week. A fresh lockdown may be imposed on the Victoria state today however, due to growing number of coronavirus cases. This may weigh on risk sentiment and traders will closely monitor the development of the pandemic situation. An overnight pullback in gold prices could exert downward pressure on gold minors, while stabilizing iron ore and copper prices may lend some support to other mining stocks.

Looking ahead, German GfK consumer confidence data dominate the economic docket alongside US GDP and durable goods orders. Find out more from the DailyFX calendar.

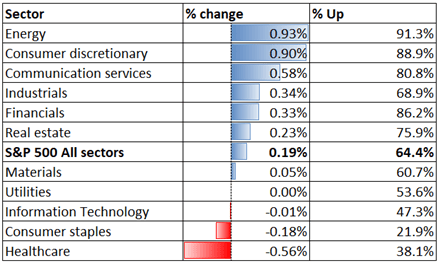

Looking back to Wednesday’s close, 8 out of 11 S&P 500 sectors ended higher, with 64.4% of the index’s constituents closing in the green. Energy (+0.93%), consumer discretionary (+0.90%) and communication services (+0.58%) were among the best performers, whereas healthcare (-0.56%) trailed behind.

S&P 500 Sector Performance 18-05-2021

Source: Bloomberg, DailyFX

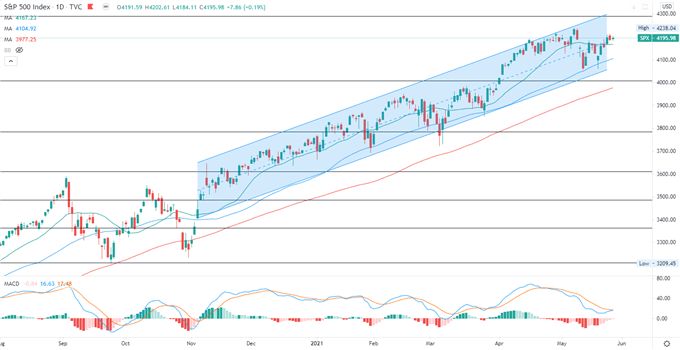

S&P 500 Index Technical Analysis

The S&P 500 index trended higher within an “Ascending Channel” formed since November, suggesting that the overall trend remains bullish-biased. A “Double Bottom” chart pattern hints that a minor technical correction may be ending, and the index may continue to trend higher towards a major resistance level of 4,290 – the 127.2% Fibonacci extension. The MACD indicator is about to form a bullish crossover, suggesting that upward momentum is strengthening.

S&P 500 Index – Daily Chart

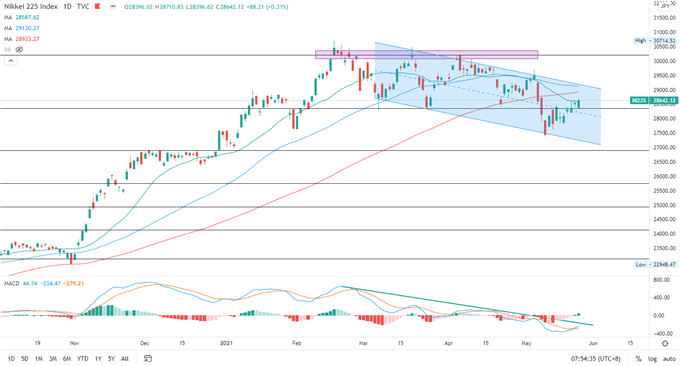

Nikkei 225 Index Technical Analysis:

The Nikkei 225 index formed a “Descending Channel” after price breached below a key support level at 28,357 – the 100% Fibonacci extension. The 20- and 50-day SMA lines are about to cross below the 100-day line, potentially forming a “Death Cross”. The MACD indicator is trending lower beneath the neutral midpoint, suggesting that further consolidation is likely.

Nikkei 225 Index – Daily Chart

Chart by TradingView

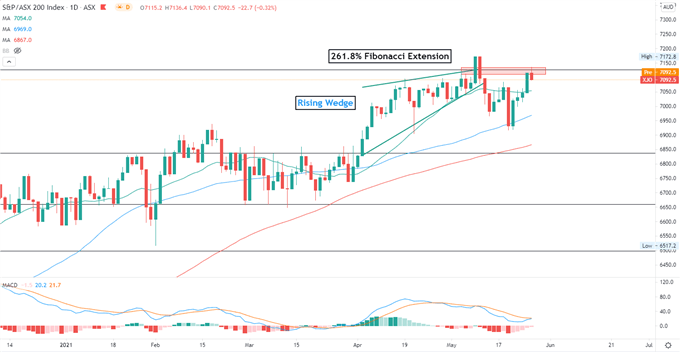

ASX 200 Index Technical Analysis:

The ASX 200 index is facing a key resistance level at 7,126 (261.8% Fibonacci extension). Breaking this level will likely intensify near-term buying pressure and open the door for further upside potential toward 7,200. The MACD indicator is about to form a bullish crossover, suggesting that bullish momentum is building.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter