Bitcoin (BTC/USD) Price Outlook:

- Bitcoin appears vulnerable to further losses after massive losses broke key technical support

- BTC/USD will look to recoup lost ground and hold above crucial support at $30,000

- How to Trade in a Bear Market: A Short Seller’s Guide

Bitcoin Price May Be in Peril After Losses Reshape Technical Landscape

Bitcoin may be vulnerable to further losses and volatility as risk appetite waned and cryptocurrency sentiment soured throughout the week. Price action has seen BTC/USD crater beneath multiple levels of support as corporations walked back their adoption plans and major exchanges had outages. The series of fundamental headwinds highlight the relatively young state of the cryptocurrency market and the immense volatility that can follow in times of uncertainty.

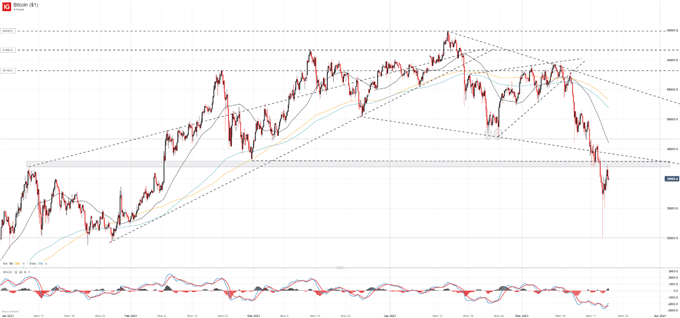

While Bitcoin is no stranger to volatility, months of gains have seen much of that volatility limited to the upside. Crypto bulls faced a rude awakening this week, however, as Bitcoin pierced major support around the $46,750 and $43,000 levels. The rout gained steam with each break beneath support and BTC/USD plummeted to a lifeline at $30,000 before leveling off and retracing higher.

Bitcoin (BTC/USD) Price Chart: 4 - Hour Time Frame (January 2021 – May 2021)

While a successful bounce off the $30,000 mark might be encouraging in the grander scheme of things, Bitcoin will have to avoid deeper declines to curtail the continuation of lower-lows and lower-highs – a trend that began in mid-April.

Prior support will likely act as resistance going forward, meaning bulls will have to negotiate a plethora of barriers if they are to recapture lost ground. Initial resistance resides along the zone at $43,000 and has already stalled the recovery effort. Secondary resistance rests at $46,750.

Given the developing series of lower-lows and lower-highs, it is difficult to make a convincing bullish argument at this stage and Bitcoin may need to regain its luster before resistance can be taken out. Further still, support is relatively sparse until $30,000 which could see the coin plummet quickly if bearishness returns. That said, a break beneath $30,000 would mark another significant downgrade in the technical outlook and would open the door to deeper losses.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX