Australian Dollar Analysis and Talking Points

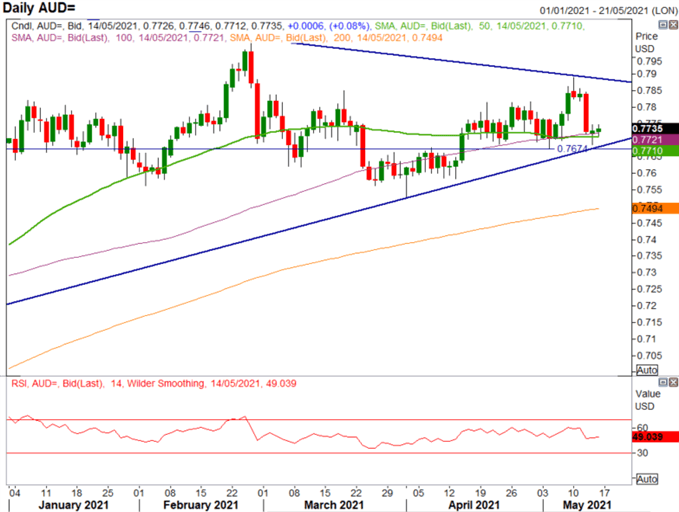

Cluster of Moving Averages Stems AUD/USD Declines

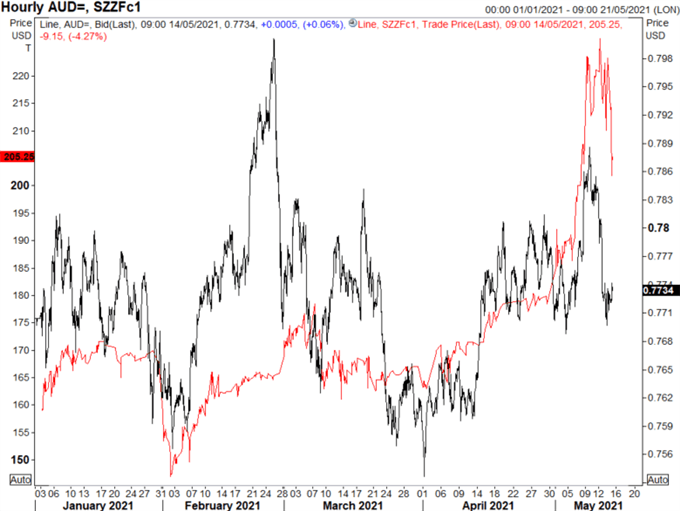

The midweek selloff in the Aussie has been stemmed by a cluster of DMAs situated at 0.7710 (50DMA) and 0.7721 (100DMA). However, with the rollover in iron ore prices, AUD/USD has stopped short of making a modest recovery. For now, sideways price action is likely to take hold, particularly as risk sentiment remains choppy, while momentum indicators signal a period of indecision. That said, the key level to look at on the downside is 0.7675-85, which coincides with the monthly low and 6-month trendline. Should the pair break below, this opens the door towards a test of 0.7600. While on the topside, 0.7850 remains in focus, with a close above needed to renew attempts for 0.8000.

Moving Average (MA) Explained for Traders

IG Client Sentiment is Bearish AUD/USD

Taking a look at IG client sentiment, retail traders have bought this latest dip with the number of net longs 6% higher than the prior day, showing the total number of traders net-long at 54.94%. Given that we usually take a contrarian view to crowd sentiment and the fact that traders are net-long suggests AUD/USD may continue to fall. Alongside this, recent positioning changes provide us with a strong bearish contrarian bias.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 2% | 2% |

| Weekly | -23% | 52% | -7% |

AUD/USD Chart: Daily Time Frame

Source: Refinitiv

AUD/USD vs Iron Ore

Source: Refinitiv