BRITISH POUND, UK GDP, US CPI, GBP/USD - TALKING POINTS:

- British Pound largely unimpressed with slightly better UK GDP data

- Tepid response probably reflects limited implications for BOE policy

- GBP/USD might turn lower if US CPI figures surpass expectations

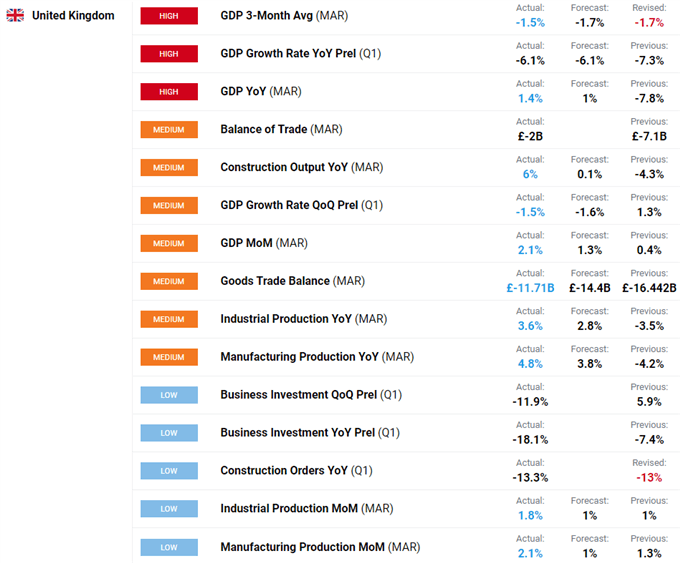

The British Pound was not especially impressed with first-quarter UK GDP data showing output shed 1.5 percent, a slightly smaller downturn than the 1.6 percent decline penciled in by economists ahead of the release. Larger-than-expected losses were recorded for consumption and investment.

The external sector offered a bit of silver lining on net, but only because imports plunged more than exports. True to Covid-era trends for most major economies, an outsized rise in government spending was a notable bright spot. Expenditures rose 2.6 percent, dwarfing forecasts of a 0.6 percent rise.

See the full DailyFX Economic Calendar here

Sterling’s tepid response to the release may speak to its limited implications for Bank of England monetary policy. The outcomes on offer did not seem to deviate enough from baseline expectations to encourage a repricing of the timeline for stimulus withdrawal.

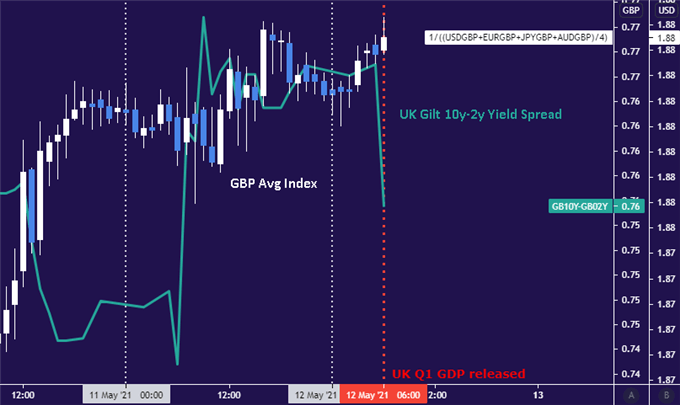

Indeed, while the slightly better-than-expected headline reading was greeted with a bit of a pop upward, the move seemed to struggle for follow-through. Meanwhile, the passing of event risk seemed to encourage a correction in yesterday’s steepening of the UK yield curve, with the 10y-2y yield spread narrowing.

Chart created with TradingView

Looking ahead, the spotlight is likely to turn to US CPI data. It is expected to show that headline inflation jumped to 3.6 percent on-year in April from 2.6 percent in the prior month. That is widely seen as reflecting base effects, owing to comparisons with the dramatic disinflation of April 2020 amid Covid’s onset.

Realized US inflation readings have increasingly outperformed relative to baseline forecasts in recent months – with last week’s dramatic pop in wage inflation shown in April’s jobs report being just the latest example. That opens the door for an upside surprise that might stoke Fed stimulus withdrawal bets.

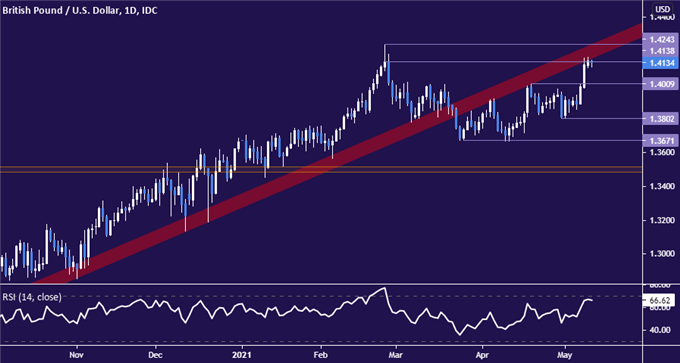

Such an outcome seems likely to boost the US Dollar at the expense of most of its major counterparts, including the UK unit. GBP/USD is testing resistance in the 1.4138-1.4243 zone, with early signs of negative RSI divergence hinting that momentum is fading. That may precede a downturn.

Initial support is at the 1.40 figure, with a daily close below that opening the door for a test of the 1.38 handle. Alternatively, a daily close above 1.4243 would critically establish a new 2021 high as well as neutralize the break of rising trend support recorded in late March, setting the stage for upside extension.

Chart created with TradingView

British Pound TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter