GOLD PRICE OUTLOOK:

- Gold prices may rebound after Treasury Secretary Janet Yellen clarified her interest rate comments

- Market remains jittery about rising inflation and worsening pandemic situations in some emerging markets, buoying demand for gold

- Gold prices may aim to breach US$ 1,800 – an important psychological resistance level

Gold prices rose slightly during Wednesday’s APAC trading session after falling nearly 0.8% a day ago. US Treasury Secretary Janet Yellen clarified that she wasn’t trying to predict interest rate hikes to rein in inflation pressure following a hawkish-biased comment on Tuesday. Markets have perhaps over-reacted on her earlier words, underscoring the fragility of risk assets amid fears about tapering Fed stimulus. A stronger US Dollar index pulled gold prices lower on Tuesday before giving up some gains. This could provide a basis for gold to recover some lost ground and move higher.

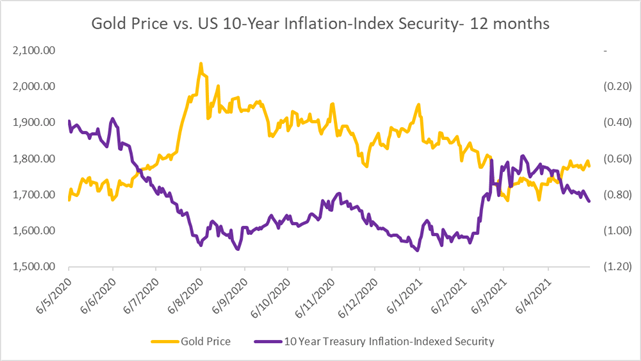

The recent rise in base metal, energy and agriculture prices has led to higher inflation expectations, which may boost the appeal of gold as a perceived inflation hedge. Signs of quickening price growth have pulled real yields (nominal yield – inflation) lower this week. The rate of the 10-year inflation-indexed security fell 6bps to -0.84% from -0.78% seen last Friday. Lower real yields may serve as a positive catalyst for gold prices, as the opportunity cost of holding the non-interest-bearing metal decreases.

Although recent robust US economic data pointed to a stronger-than-expected recovery, the outlook remains clouded by a third viral wave that hit many other parts of the world. This could lead to weaker overseas demand, delays in economic reopening and supply chain disruptions. Against this backdrop, the Federal Reserve may continue to adopt accommodative monetary policy until its long-term inflation and employment targets are met. The central bank’s dovish stance is backed by Fed Chair Jerome Powell and President of the New York Fed John Williams, both of whom said it is still far to consider tightening.

Gold Prices vs. US 10-Year Inflation-Index Security

Source: Bloomberg, DailyFX

Looking ahead, the US ADP private payrolls report will be closely eyed alongside several speeches from Fed official today. Thursday’s BoE interest rate decision and Friday’s US nonfarm payrolls print will also be watched by gold traders for clues about inflation and the strength of the US Dollar. Higher-than-expected job creation may strengthen yields and the US Dollar, potentially weighing on precious metal prices. The reverse may be true if the numbers disappoint. Find out more from the DailyFX calendar.

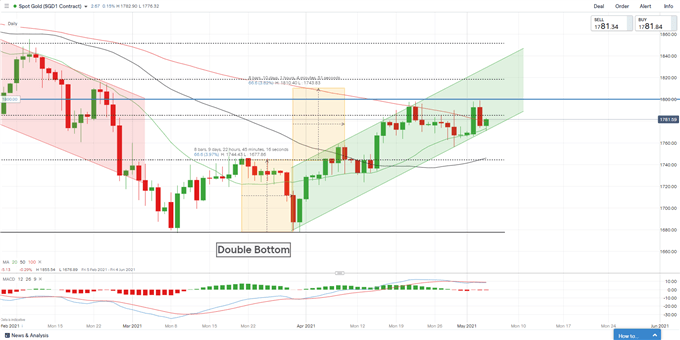

Technically, gold has likely entered an “Ascending Channel” as highlighted on the chart below. An upward channel is formed by consecutive higher highs and higher lows and can be easily recognizable as a trending market. The ceiling and the floor of the channel can be viewed as immediate resistance and support levels respectively.

On the gold chart, the “Ascending Channel” is part of a larger “Double Bottom” pattern, which hints at further upside potential. A key resistance level can be found at US$ 1,800, breaking above which would likely intensify near-term buying pressure and carve a path for price to challenge US$ 1,818 – the 5

0% Fibonacci retracement.

Gold Price – Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | -2% | -2% | -2% |

| Weekly | 7% | -14% | -4% |

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter