Key Talking Points:

- DAX 30 unable to break above its recent range

- EUR/USD at risk of falling below 1.20 as rising yields underpin the US Dollar

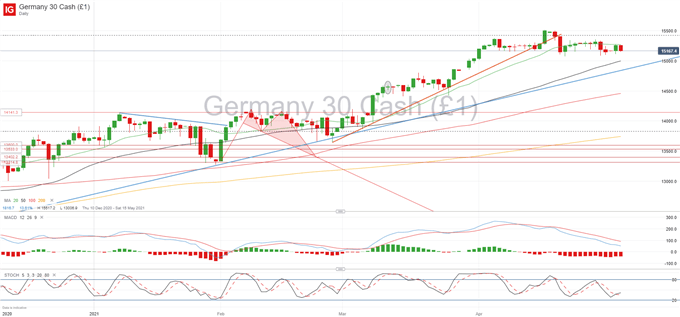

DAX 30 Levels

The German DAX managed to regain some bullish momentum in yesterday’s session. The selloff at the end of last week saw the index back at its current support as buyers are struggling to remain in control. The latest retail sales data for Germany helped the DAX 30 push higher in yesterday’s session as the monthly figure came in at 7.7%, beating expectations of just 3% after the country started to unwind some of its lockdown measures.

But the index is still trapped in the range it has traded in for most of April, with momentum stalling around the 15,300 mark. At this point, there is little incentive for new buyers to come into the market, with many stock indices having stretched deep into the overbought territory. There is also the “sell in May” phenomenon which may be limiting further upside momentum despite the lack of foundation for a further pullback at present.

The risk this week will be focused on whether sellers are able to gain further control to bring the index lower, with the 15,068 area acting as immediate support. A break below this area opens the door towards the 15,000 mark, where the 50-day is currently in confluence. If buyers are unable to hold down this level, then I would expect a further pullback towards the ascending trendline, between 14,910 – 14,850.

On the topside, momentum seems to be capped at the 20-day moving average for now, but a break above 15,265 could see buyers building momentum towards 15,415, where stronger resistance can be found.

DAX 30 Daily chart

| Change in | Longs | Shorts | OI |

| Daily | 7% | -5% | -2% |

| Weekly | -9% | 6% | 2% |

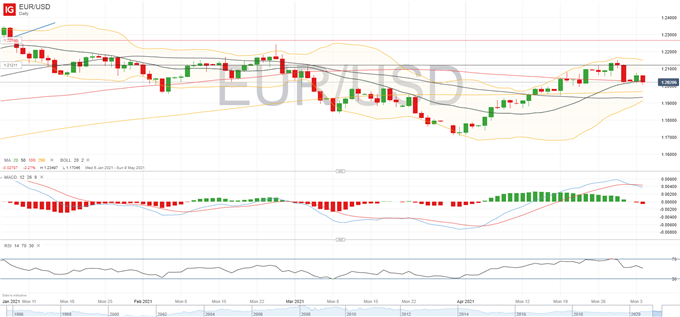

EUR/USD Levels

EUR/USD has been unable to hold above the 1.21 area given the recent strength in the US Dollar on the back of rising yields. The pair attempted to rebound in yesterday’s session but further selling pressure has seen yesterday’s gains reversed at the European open this morning, putting buyers at risk of losing the 1.20 mark.

Current price dropped below the 20- and 100-day moving averages, falling towards its lower range of the Bollinger Bands and with the RSI about to fall below the 50-line, which is likely to put further downside pressure on EUR/USD. If the pair is unable to hold above 1.20, watch out for the 200-day SMA at 1.1967 as the next area of support. On the topside, price would have to break above 1.2075 in order to consider further bullish potential.

EUR/USD Daily Chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin