MicroStrategy (MSTR) Talking Points:

- MicroStrategy has made a big push into Bitcoin, becoming one of the first companies to make such as splash in cryptocurrencies.

- Because MicroStrategy is publicly traded and Bitcoin is unavailable in equity markets (at least for now), MicroStrategy became one of the first ways that stock market participants could speculate on the price of Bitcoin.

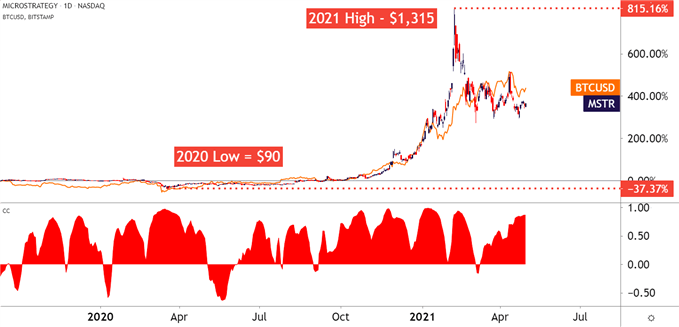

MicroStrategy (MSTR) makes Tesla’s investment in Bitcoin look like child’s play. In the summer of 2020, the company began to reposition its corporate treasury from cash to Bitcoin. As bitcoin boomed from late 2020 on, the stock price of MSTR rose from around $100 to a February peak of over $1,000. Retail traders clearly see the company as a speculative bet on Bitcoin, rather than a business analytics organization, a service that guided its early days. While MSTR’s price has settled to the $600s range, it remains tied to Bitcoin’s fate. The company holds over 90,000 Bitcoins at an average cost of $24,000. The company’s Q1 earnings report is scheduled for April 29th, when investors and markets may hear how its bitcoin investments have fared.

CEO Michael Saylor is often considered one of the big drivers of cryptocurrency adoption and innovation, and the company has even announced that they’ll compensate board members in Bitcoin, representing a big change that many crypto fans have been waiting for, as companies may begin to move payroll into alternative currencies.

But, perhaps most importantly for market participants, MicroStrategy became one of the first ways that equity market participants could speculate on the value of Bitcoin. This helps to explain the early-year flare that saw the stock test the $1,000 marker. That bullish trend has since calmed considerably, with the stock spending the past two weeks oscillating between values of $570 and $687. This still represents some pretty intense volatility albeit less than what was showing at the start of the year.

On the below chart, MicroStrategy has been compared to Bitcoin, with a correlation coefficient at the bottom of the chart to help illustrate just how tight this relationship has become.

Microstrategy (MSTR) Daily Price Chart March 2020 – Present (April 2021)

Chart created by James Stanley, Source: TradingView

Click Here to go to Meme Stock # 3

--- written by Izaac Brook, DailyFX Research Intern, James Stanley, Senior Strategist