Key Talking Points:

- Rising infection rates and possible monetary policy divergences see Silver spike higher

- XAG/USD rejected at key resistance

Silver prices are battling a key resistance after rising more than 2.5% in yesterday’s session. This was following the move in gold prices as the resurgence of Covid-19 cases in some parts of the world is dampening prospects of economic recovery, boosting demand for safe-haven assets. That said, there is still a broad demand for risk sentiment so the bullish push in silver may be short-lived.

The greatest risks to markets right now are the strong surge in virus cases in places like India and the possible shift in Central Bank monetary policy. Despite vaccination rates increasing at a promising level in many developed countries, there is still a shortage of doses in many emerging countries where infection rates are still out of control, posing a risk to broader economic recovery.

In the meantime, Central Banks are starting to show some divergence in their monetary policy views with the Bank of Canada saying yesterday that they may start tapering their current policies, with a rate hike being brought forward to 2022. And whilst the Fed continues to deny any policy changes until 2024, there will be big expectations at next week’s meeting to see if any new emphasis is given on a change of policy sooner than expected.

But the focus today will be on the ECB. Despite not expecting any policy changes, we have seen some members of the monetary policy committee diverge slightly from the widespread dovish stance. Council members Klaas Knot and Robert Holzmann have both called for bond-buying to be tapered later this year, suggesting a split at the ECB and a reason for investors to be extra vigilant at the post-meeting press conference held at 13.30 BST.

XAG/USD KEY LEVELS:

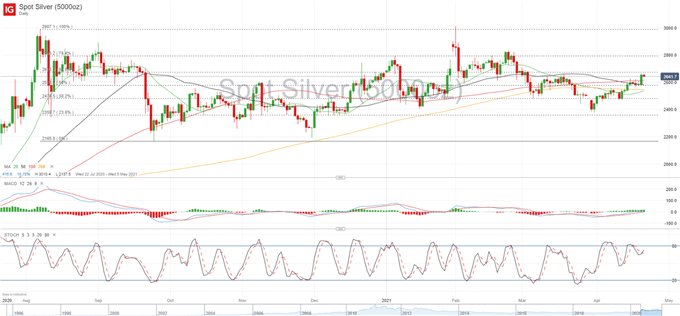

These risks to the broader market could be supportive for silver in the medium-term. The daily chart is showing the importance of Fibonacci levels in its price behavior over the last few months, so I would expect the 2664 – 2673 (61.8% Fibonacci retracement from 2987 to 2165) to offer increase resistance in the next few sessions. This area was also responsible for halting the attempted recovery back in March.

The good news is that yesterday’s push higher has put current price above the 100-day moving average, whilst the 50-day average is sitting on top of the 50% Fibonacci (2576), which is likely to offer a good area of support in the short term. We could see some sideways consolidation in the next few days between these two key Fibonacci levels, although momentum indicators are signaling that further buying pressure could likely arise.

SPOT SILVER Daily chart

Source: Refinitiv

Fibonacci Confluence on FX Pairs

Learn more about the stock market basics here or download our free trading guides.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin