GBP price, news and analysis:

- The recent strong rise in GBP/USD will likely pause for a while as the bulls regroup.

- The 1.40 level is the key one to watch, with a sustained break higher needed if the pair is to advance further short-term.

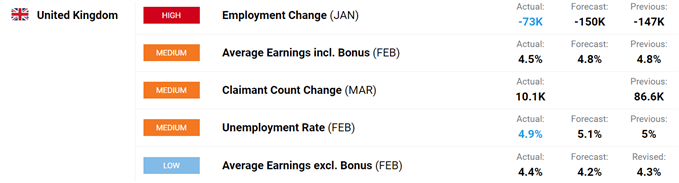

- Meanwhile, the latest UK employment data were better than forecast all round but that failed to give Sterling a boost.

GBP/USD facing 1.40 hurdle

GBP/USD looks set for a minor correction lower after the gains that have taken it from a low at 1.3670 on April 12 to 1.40 currently. Given the psychological importance of 1.40, bulls may well decide to take their profits near-term, weakening the pair, with a sustained break above the resistance at 1.40 needed if GBP/USD is to advance further.

As the chart below shows, there is also trendline resistance around current levels, although a weak USD could yet give the pair a boost.

GBP/USD Price Chart, Daily Timeframe (December 18, 2020 – April 20, 2021)

Source: IG (You can click on it for a larger image)

UK jobs data exceed expectations

In the meantime, the latest UK employment figures were better than expected all round but had little impact on the Pound. Employment fell again in January but by less than forecast, and the unemployment rate dipped to 4.9% in February from the previous 5.0% rather than rising to 5.1% as predicted.

Source: DailyFX calendar

These figures are too historic to have much of an impact on GBP given that it is reacting more currently to the perceived success of the UK’s coronavirus vaccine program. However, Wednesday’s UK inflation data for March could have more of an impact, with increases expected in all the major measures.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 4% | 4% | 4% |

--- Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex